A Sugar Land Texas Trustee's Deed is a legal document that transfers real property ownership from a borrower (trust or) to a trustee, who holds the property in trust for the benefit of a lender (beneficiary). This type of deed is commonly used in the foreclosure process when a borrower defaults on their mortgage and the lender initiates foreclosure proceedings to recoup the outstanding loan amount. In Sugar Land, Texas, there are different types of Trustee's Deeds that may be used depending on the specific circumstances of the foreclosure: 1. Trustee's Deed Upon Sale: This is the most common type of Trustee's Deed used in Sugar Land. It is executed by the trustee after the foreclosure sale, wherein the property is sold to the highest bidder at a public auction. The deed conveys the property from the trust or to the purchaser. 2. Trustee's Deed in Lieu of Foreclosure: In some cases, the borrower and the lender may agree to avoid the foreclosure process by executing a Trustee's Deed in Lieu of Foreclosure. This deed allows the borrower to voluntarily transfer the property to the lender, thus satisfying the debt. It provides a faster resolution and can help the borrower avoid some negative consequences of foreclosure. 3. Trustee's Deed Under Power of Sale: This type of Trustee's Deed is executed when the deed of trust or mortgage explicitly grants the trustee the power to sell the property without court involvement in the event of default. The trustee sells the property in accordance with the power of sale provision to satisfy the debt. 4. Trustee's Special Warranty Deed: Occasionally, a Trustee's Deed may include special warranty language. This means that the trustee guarantees the title against defects that occurred only during their period of ownership, usually from the foreclosure sale date. However, they do not warrant against any defects that may have existed before their ownership. In summary, a Sugar Land Texas Trustee's Deed is a legal instrument used in the foreclosure process that transfers property ownership from a borrower to a trustee for the benefit of a lender. It serves as a crucial document to facilitate the transfer of real estate, ensuring that the lender has a legal claim on the property.

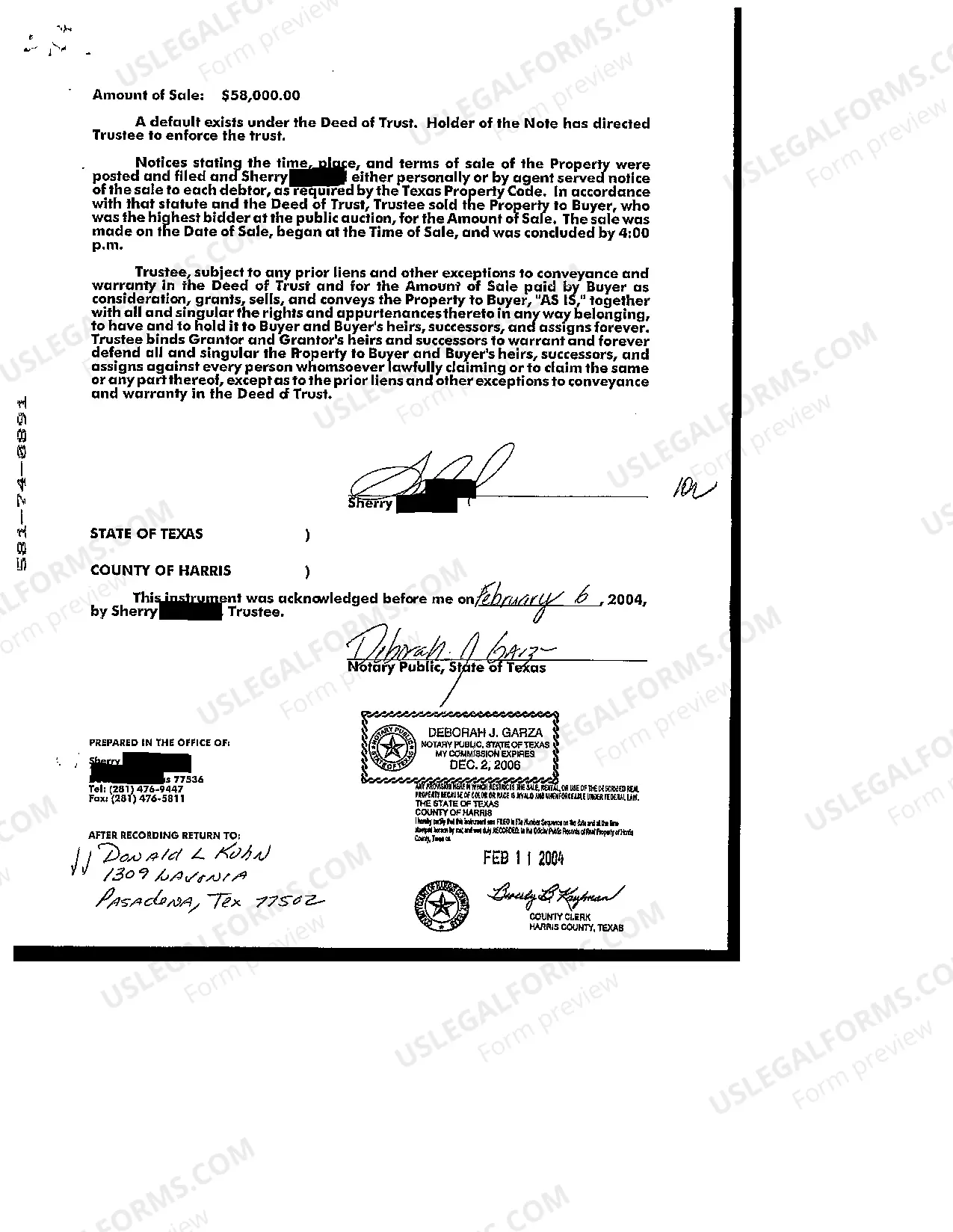

Sugar Land Texas Trustee's Deed

Description

How to fill out Sugar Land Texas Trustee's Deed?

Are you looking for a reliable and inexpensive legal forms provider to buy the Sugar Land Texas Trustee's Deed? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Sugar Land Texas Trustee's Deed conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Restart the search in case the template isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Sugar Land Texas Trustee's Deed in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online for good.