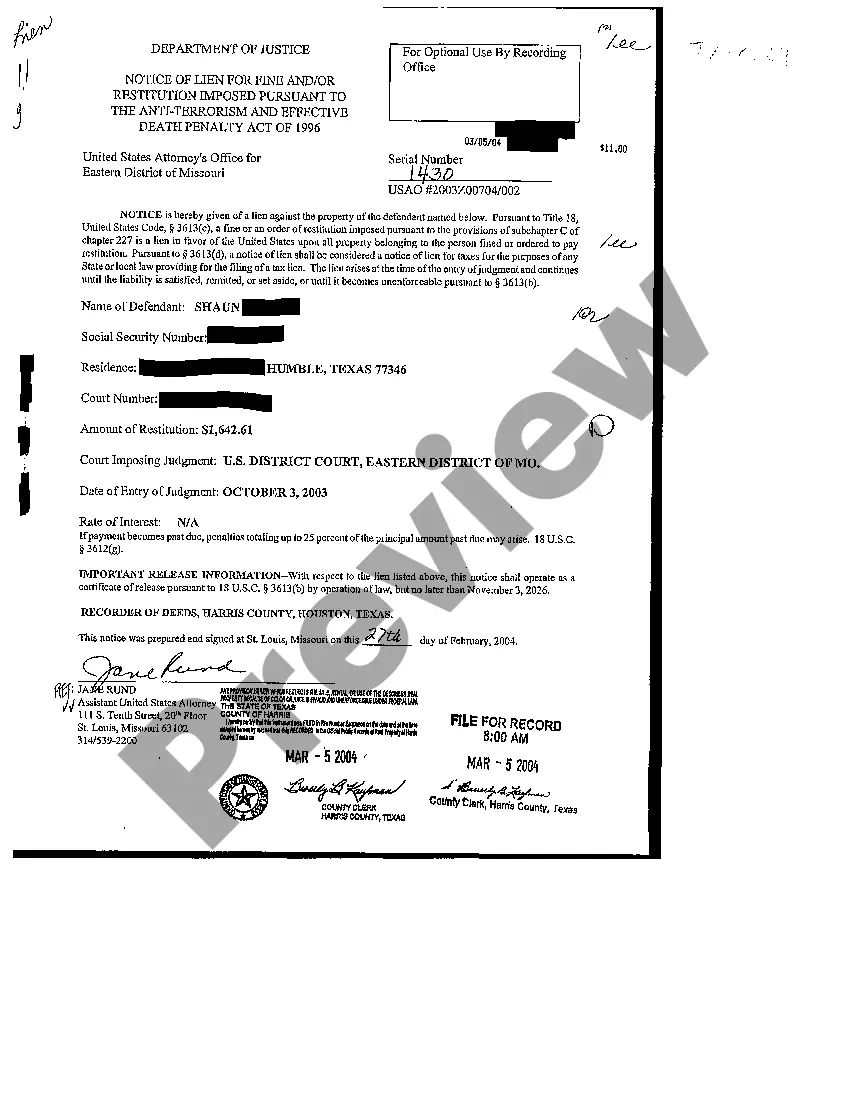

A Brownsville Texas Notice of Lien is a legal document that serves as a public notice, indicating a claim or encumbrance on a property or personal asset. It is typically filed by a party who is owed money or has a legal right to claim the property's value as security against a debt or obligation. In Brownsville, Texas, there are different types of Notices of Lien, each serving a specific purpose. Here are some of the most common types: 1. Mechanic's Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for construction or improvement projects. If they haven't received payment, they can file a mechanic's lien against the property to ensure they get paid. 2. Tax Lien: These liens are issued by taxing authorities, such as the Internal Revenue Service (IRS) or the Texas Comptroller's Office. When someone fails to pay their taxes, a tax lien is placed on their property, giving the government a legal claim to the property's value until the taxes are paid. 3. Judgment Lien: If a court awards someone a monetary judgment against another party and the judgment remains unpaid, the creditor can file a judgment lien. This type of lien gives the creditor the ability to collect the outstanding debt from the debtor's property. 4. HOA Lien: Homeowners' associations (Has) can file a lien against a property if the homeowner fails to pay their association fees, fines, or assessments. This lien allows the HOA to recover the unpaid dues by selling the property. 5. Child Support Lien: When an individual falls behind on their child support payments, the custodial parent or the state's child support agency can file a child support lien against their property. This lien ensures that the owed child support is paid before the property can be sold or transferred. 6. Mortgage Lien: Once a mortgage is obtained to purchase a property, the lender places a mortgage lien on the property. This lien gives the lender the right to foreclose on the property if the borrower fails to meet their mortgage obligations. It's important to note that Notices of Lien in Brownsville, Texas, are public records, readily accessible to anyone interested in purchasing the property or conducting due diligence. These liens act as warnings to potential buyers or lenders about existing claims or encumbrances on the property. Therefore, it is crucial for property owners and potential buyers to thoroughly investigate and resolve any outstanding liens to ensure a clear title and protect their interests.

Brownsville Texas Notice of Lien

Category:

State:

Texas

City:

Brownsville

Control #:

TX-C124

Format:

PDF

Instant download

This form is available by subscription

Description

Notice of Lien

A Brownsville Texas Notice of Lien is a legal document that serves as a public notice, indicating a claim or encumbrance on a property or personal asset. It is typically filed by a party who is owed money or has a legal right to claim the property's value as security against a debt or obligation. In Brownsville, Texas, there are different types of Notices of Lien, each serving a specific purpose. Here are some of the most common types: 1. Mechanic's Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for construction or improvement projects. If they haven't received payment, they can file a mechanic's lien against the property to ensure they get paid. 2. Tax Lien: These liens are issued by taxing authorities, such as the Internal Revenue Service (IRS) or the Texas Comptroller's Office. When someone fails to pay their taxes, a tax lien is placed on their property, giving the government a legal claim to the property's value until the taxes are paid. 3. Judgment Lien: If a court awards someone a monetary judgment against another party and the judgment remains unpaid, the creditor can file a judgment lien. This type of lien gives the creditor the ability to collect the outstanding debt from the debtor's property. 4. HOA Lien: Homeowners' associations (Has) can file a lien against a property if the homeowner fails to pay their association fees, fines, or assessments. This lien allows the HOA to recover the unpaid dues by selling the property. 5. Child Support Lien: When an individual falls behind on their child support payments, the custodial parent or the state's child support agency can file a child support lien against their property. This lien ensures that the owed child support is paid before the property can be sold or transferred. 6. Mortgage Lien: Once a mortgage is obtained to purchase a property, the lender places a mortgage lien on the property. This lien gives the lender the right to foreclose on the property if the borrower fails to meet their mortgage obligations. It's important to note that Notices of Lien in Brownsville, Texas, are public records, readily accessible to anyone interested in purchasing the property or conducting due diligence. These liens act as warnings to potential buyers or lenders about existing claims or encumbrances on the property. Therefore, it is crucial for property owners and potential buyers to thoroughly investigate and resolve any outstanding liens to ensure a clear title and protect their interests.

How to fill out Brownsville Texas Notice Of Lien?

If you’ve already used our service before, log in to your account and save the Brownsville Texas Notice of Lien on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Brownsville Texas Notice of Lien. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!