College Station Texas Notice of Lien: Explained In College Station, Texas, a Notice of Lien holds great significance and serves as a legal tool used to claim a property's interest or financial security. This official document serves as a public notice that a creditor has a legal right to the property being identified in the notice. It is crucial to understand the purpose, types, and implications of the College Station Texas Notice of Lien. A Notice of Lien signifies that a creditor has a valid claim on a property due to a debt or an unpaid obligation. By filing this document with the appropriate authorities, the creditor ensures that their interest in the property is recognized, preventing the property owner from selling or transferring ownership without satisfying the debt. The Notice of Lien asserts the creditor's right to be paid before any other interests, except for those with higher priority, such as property taxes or mortgages. There are various types of College Station Texas Notice of Lien, specific to different situations where debts may arise. Some common types include: 1. Mechanic's Lien: This kind of lien is typically filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for a construction or renovation project but haven't received proper compensation. It allows them to claim a stake in the property until the outstanding debts are settled. 2. Tax Lien: Governed by the Internal Revenue Service (IRS) or local tax authorities, a tax lien is imposed on properties when the owner fails to pay their taxes promptly. The government uses this lien to ensure that they receive the owed tax amount. 3. Judgment Lien: A judgment lien is issued by a court due to a judgment against a person or entity for a debt they owe. Once the judgment is obtained, the creditor can file a Notice of Lien against the debtor's property, creating a legal claim. 4. HOA Lien: In homeowner association (HOA) communities, if a homeowner fails to pay their HOA fees or fines, the association can file an HOA lien against the property. This lien protects the HOA's interest while they pursue collection efforts and can ultimately lead to foreclosure if the debts remain unpaid. It is essential to note that once a Notice of Lien is filed and officially recorded, it becomes public record, accessible to anyone interested in the property's history or title. Additionally, it can negatively impact the property owner's creditworthiness, making it challenging to secure loans or sell the property without resolving the underlying debt. Property owners should take careful measures to avoid receiving a Notice of Lien, such as fulfilling their financial obligations promptly and seeking legal advice if any disputes arise. Should a property owner receive a Notice of Lien, it is crucial to address the debt as soon as possible to prevent further complications. Understanding the intricacies of a College Station Texas Notice of Lien empowers property owners to navigate potential financial risks and take appropriate actions to protect their rights and property interests.

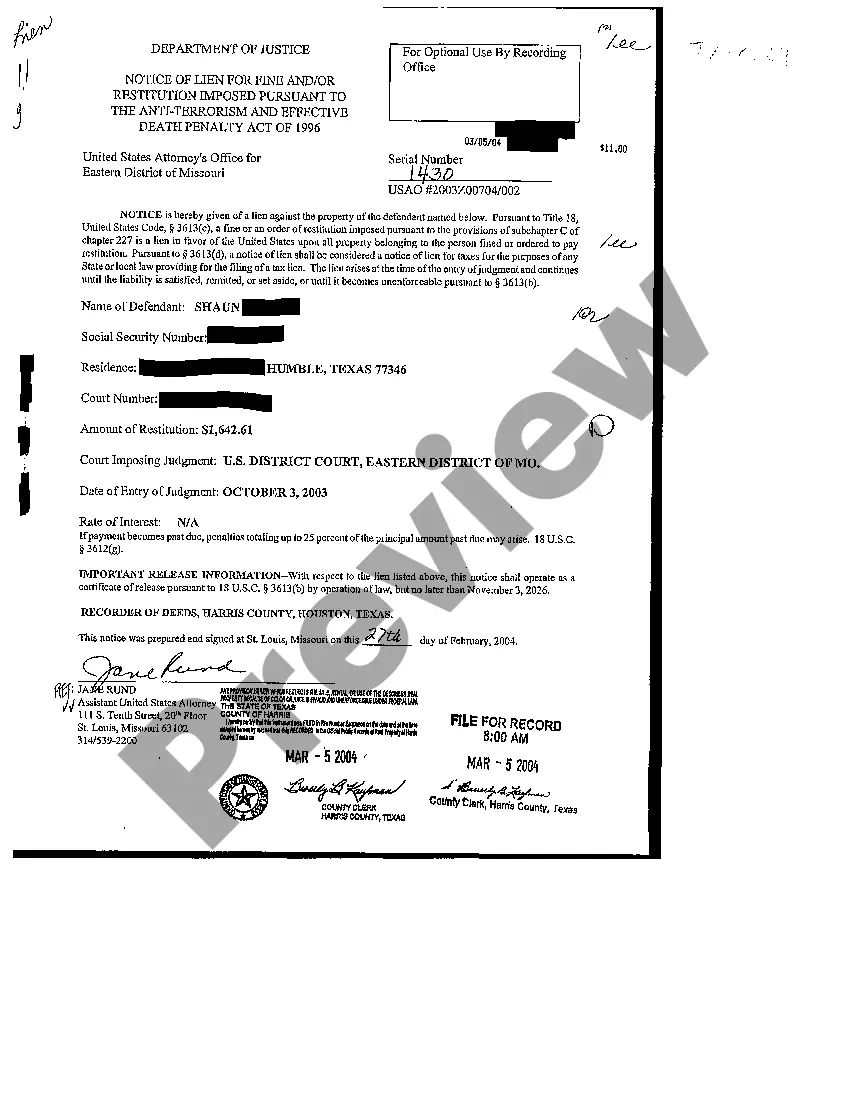

College Station Texas Notice of Lien

Description

How to fill out College Station Texas Notice Of Lien?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the College Station Texas Notice of Lien becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the College Station Texas Notice of Lien takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the College Station Texas Notice of Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!