Edinburg, Texas Notice of Lien: A Comprehensive Guide In Edinburg, Texas, a Notice of Lien refers to a legal document filed to assert a creditor's claim against a property or assets to secure the repayment of a debt or obligation owed by the property owner. This notice is an important tool used to protect the rights and interests of creditors, ensuring that they have the opportunity to be paid before the property is transferred or sold. There are several types of liens that may be filed in Edinburg, Texas, depending on the specific circumstances and nature of the debt involved. The most common types include: 1. Mechanic's Lien: Often filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for the improvement or construction of a property. This lien enables the claimant to seek reimbursement for unpaid bills or seek the sale of the property to satisfy the debt. 2. Tax Lien: This type of lien is filed by the government or taxing authorities when a property owner fails to pay their property taxes. A tax lien gives the government the right to collect the outstanding taxes by selling the property. 3. Judgment Lien: A judgment lien is obtained when a party wins a lawsuit against another party, and the court awards them a monetary judgment. By filing a judgment lien, the creditor secures the right to collect the awarded sum from the debtor's property or assets. 4. HOA Lien: Homeowner associations (Has) often file liens against a property owner for unpaid dues, fines, or assessments. These liens provide the HOA with the ability to enforce payment and potentially foreclose on the property. 5. Child Support Lien: A child support lien can be filed by the Texas Attorney General's Office against a delinquent parent who fails to fulfill their obligation regarding child support payments. This lien ensures that the debt owed is repaid by seizing the parent's property or assets. It is crucial for creditors and property owners in Edinburg, Texas, to understand the Notice of Lien process thoroughly. Filing a valid and timely notice is essential to protect one's rights and interests. Failure to address a notice of lien can lead to severe consequences, such as property foreclosure or forced sale to satisfy the debt. If served with a Notice of Lien, property owners should seek legal advice promptly to understand their rights and possible courses of action. Alternatively, creditors should ensure that their claims comply with the requirements set forth by Texas law and are properly filed within the designated timeframes. In conclusion, an Edinburg, Texas Notice of Lien is a legally significant document filed against a property to secure the repayment of a debt. Different types of liens, such as mechanic's liens, tax liens, judgment liens, HOA liens, and child support liens, exist in Edinburg, each serving a specific purpose. Both creditors and property owners should be aware of the Notice of Lien process and seek professional guidance when dealing with this matter.

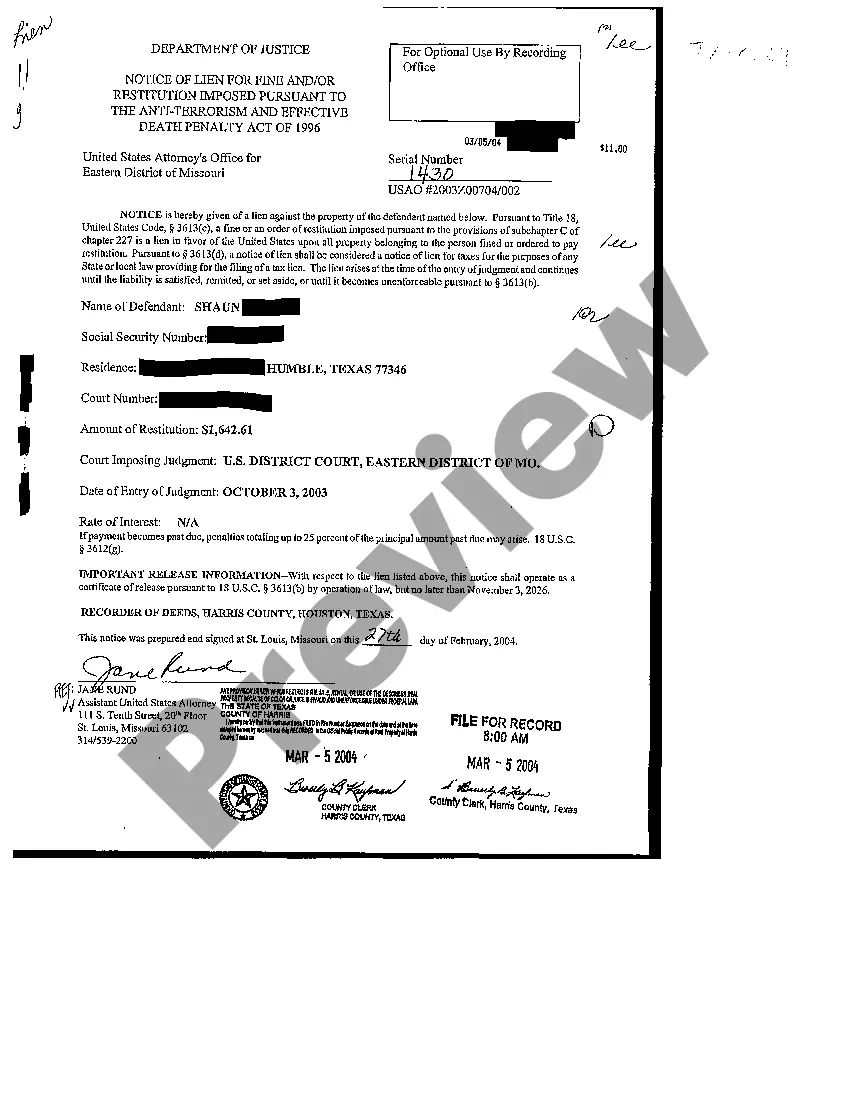

Edinburg Texas Notice of Lien

Description

How to fill out Edinburg Texas Notice Of Lien?

Do you need a trustworthy and affordable legal forms supplier to get the Edinburg Texas Notice of Lien? US Legal Forms is your go-to option.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and county.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Edinburg Texas Notice of Lien conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Restart the search in case the form isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Edinburg Texas Notice of Lien in any available format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal paperwork online for good.