Irving, Texas Notice of Lien: An Overview In Irving, Texas, a Notice of Lien is a legally significant document filed by individuals or organizations to secure an outstanding debt or claim against a property. This notice serves as a notification to all interested parties, such as property owners, potential buyers, or lenders, that there is a pending obligation tied to the property. Keywords: Irving Texas, Notice of Lien, outstanding debt, claim, property, notification, obligation. The Notice of Lien in Irving, Texas can be issued for various reasons, each having its own specific purpose and legal implications. Here are a few types of Notice of Lien commonly used within the city: 1. Construction Lien: Construction projects often involve multiple parties such as contractors, subcontractors, suppliers, and vendors. If any of these entities remain unpaid for their services or materials provided, they can file a Construction Lien. This type of lien helps protect the rights of those who have contributed to the project's development. 2. Mechanic's Lien: Mechanic's Lien, similar to a Construction Lien, is specifically filed by a mechanic or repair service provider who has not received payment for services rendered. This lien protects their right to seek compensation by establishing a claim on the property that benefited from the respective repairs. 3. Tax Lien: The city of Irving, Texas may file a Tax Lien on a property if the owner has failed to meet their tax obligations. This lien secures the outstanding tax debt and allows the city to collect the owed taxes by eventually enforcing the sale of the property. 4. Homeowners Association (HOA) Lien: In cases where homeowners fail to pay their dues or assessments to a homeowners' association, an HOA Lien may be filed against their property. This lien ensures that the homeowner is held responsible for their financial obligations to the association. 5. Judgment Lien: A Judgment Lien can be issued when a party wins a lawsuit against another party and is awarded monetary damages. By filing this lien, the victorious party can claim the debt owed to them from the losing party by attaching it to their property. 6. Spousal Support Lien: For individuals who are obligated to pay spousal support (alimony) or marital support, a Spousal Support Lien can be filed against their property if they fail to meet their obligations. This lien serves to ensure that the recipient of support receives the appropriate payments. It is important to note that each type of Notice of Lien has its own specific legal procedures, requirements, and time limits. Consequently, it is advisable to consult an attorney or relevant legal authority to fully understand the process and implications involved in filing or addressing a Notice of Lien in Irving, Texas.

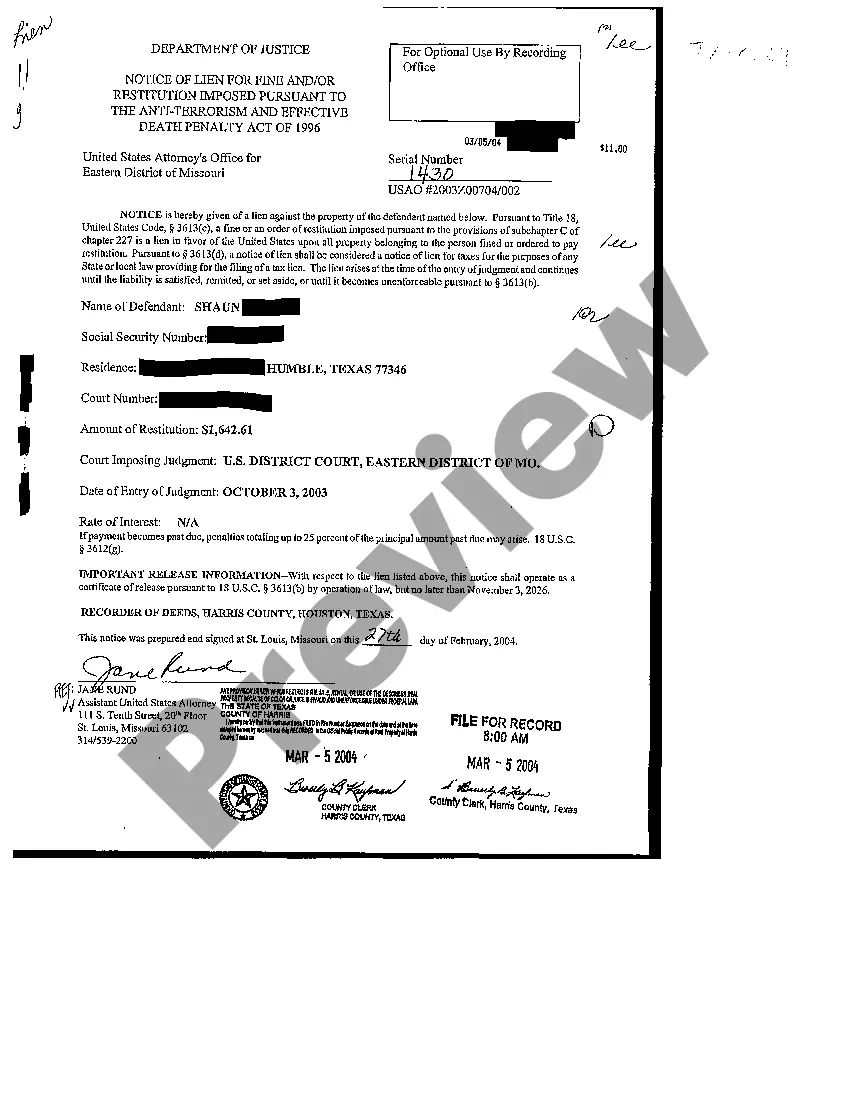

Irving Texas Notice of Lien

Description

How to fill out Irving Texas Notice Of Lien?

Do you need a reliable and inexpensive legal forms provider to buy the Irving Texas Notice of Lien? US Legal Forms is your go-to option.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Irving Texas Notice of Lien conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Start the search over in case the form isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Irving Texas Notice of Lien in any provided format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal papers online once and for all.