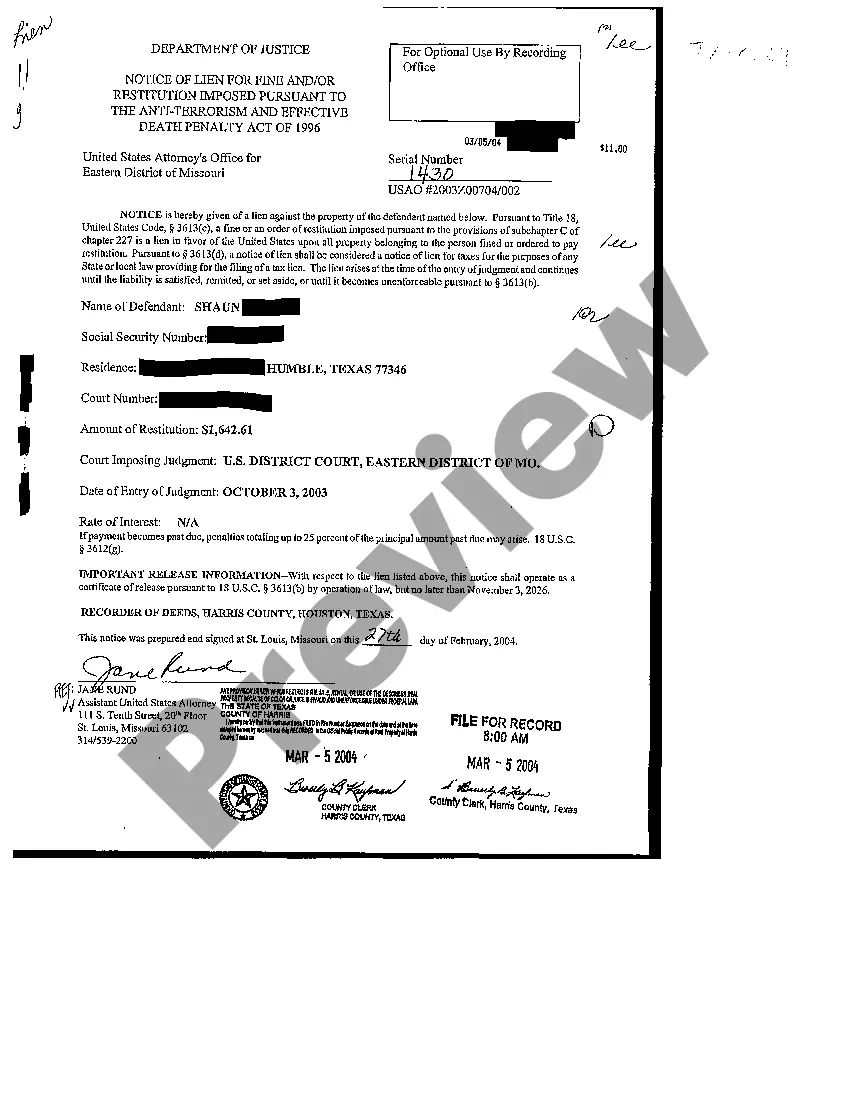

Killeen Texas Notice of Lien: Exploring its Types and Purpose Keywords: Killeen Texas, Notice of Lien, types, purpose, legal document, property ownership, financial claims, material suppliers, contractors, banks, construction projects, obligations, real estate, mechanics lien, statutory lien. Introduction: In Killeen, Texas, a Notice of Lien is a crucial legal document that serves as a means of protecting the rights and interests of various parties involved in property ownership, construction, and financial transactions. This article aims to delve into the different types of Killeen Texas Notice of Lien, shedding light on their significance and purpose. 1. Mechanic's Lien: One of the most common types of Killeen Texas Notice of Lien is the Mechanic's Lien. This lien is typically filed by contractors, subcontractors, or material suppliers who have provided labor, services, or materials for construction projects but have not received proper payment. A Mechanic's Lien allows them to assert a legal claim against the property, seeking payment for their contributions. 2. Statutory Lien: A Statutory Lien, also known as a General Lien, encompasses a broader scope compared to Mechanic's Liens. This type of lien grants creditors such as banks or financial institutions rights to levy a claim against a property to secure payment for a debt owed by the property owner. A Statutory Lien may not be limited to construction-related obligations but can also include other financial claims. 3. Property Tax Lien: A Property Tax Lien is another notable type of Killeen Texas Notice of Lien. In cases where property owners have neglected or refused to pay property taxes, the local county government can impose a tax lien on the property. This lien acts as a legal claim that allows the government to recover the unpaid taxes by potentially selling the property through a tax lien foreclosure process. 4. Judgment Lien: A Judgment Lien stems from a court judgment against an individual or entity that owes a debt. When the judgment is related to unpaid debts, the winning party may file a Judgment Lien against the debtor's property, including real estate owned in Killeen, Texas. This Notice of Lien allows for the satisfaction of the debt through the forced sale of the property. Purpose and Importance: The Killeen Texas Notice of Lien serves several essential purposes. Firstly, it offers protection to contractors, material suppliers, and laborers by ensuring they receive due compensation for their work and materials in construction projects. This incentivizes timely payment and fair treatment within the industry. Secondly, it provides a mechanism for financial institutions to secure repayment for debts or loans advanced to property owners. This helps maintain the integrity of financial systems and encourages responsible borrowing and lending practices. Lastly, Notice of Liens aids in ensuring property owners fulfill their financial obligations, including property taxes, preventing delinquencies and promoting community development. Conclusion: Understanding the various types of Killeen Texas Notice of Lien is crucial for all parties involved in property ownership, construction projects, and financial transactions. Whether it's a Mechanic's Lien, Statutory Lien, Property Tax Lien, or Judgment Lien, each serves an important purpose in safeguarding the rights, interests, and financial obligations of the stakeholders involved. It is advisable to seek professional legal advice to navigate the complexities and implications associated with these Notice of Liens.

Killeen Texas Notice of Lien

Description

How to fill out Killeen Texas Notice Of Lien?

Do you need a reliable and inexpensive legal forms provider to get the Killeen Texas Notice of Lien? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Killeen Texas Notice of Lien conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Killeen Texas Notice of Lien in any provided format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.