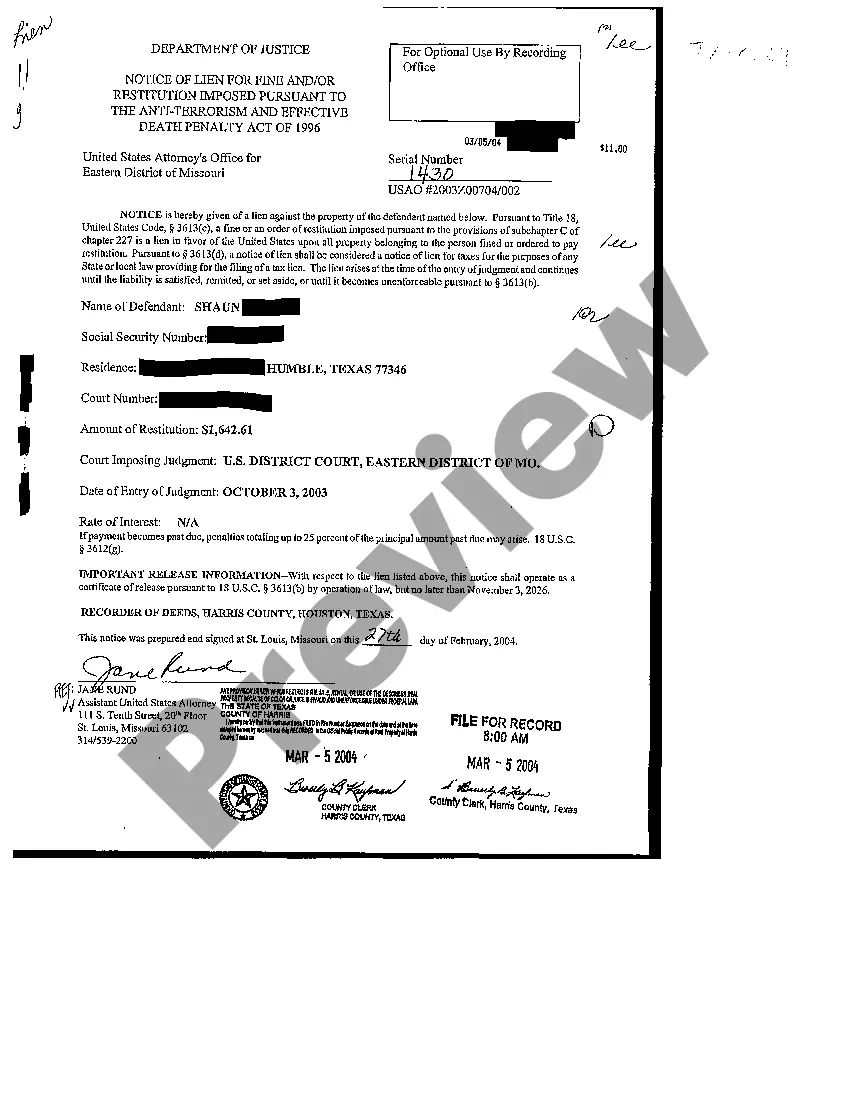

The Plano Texas Notice of Lien is a legal document that serves as a formal notice to inform parties that a lien has been placed on a property in Plano, Texas. A lien is a claim made by a creditor against a property to secure payment for a debt or obligation owed by the property owner. This notice acts as a public record and is typically filed with the county clerk's office where the property is located. It ensures that all interested parties, including potential buyers or lenders, are aware of the existing lien on the property. There are different types of Plano Texas Notice of Liens, each serving a specific purpose: 1. Mechanic's Lien: This type of lien is commonly filed by contractors, subcontractors, or suppliers who have not been paid for labor, materials, or services provided to improve the property. It allows these parties to seek payment by asserting a claim against the property's value. 2. Property Tax Lien: When property owners fail to pay their property taxes, the local taxing authority can place a lien on the property. This type of lien ensures that the outstanding taxes are eventually paid, either through the sale of the property or via other legal means. 3. Judgment Lien: If a creditor wins a lawsuit against a property owner and is awarded a monetary judgment, they can file a judgment lien to secure the debt. This lien ensures that the creditor has a legal claim to the property if the debtor fails to satisfy the judgment. 4. IRS Tax Lien: In cases where a property owner has unpaid federal taxes, the Internal Revenue Service (IRS) can file a tax lien against the property. This lien ensures that the government has a claim to the property's value in order to collect the unpaid taxes. 5. HOA Lien: Homeowners' associations (Has) can file a lien against a property if the owner fails to pay outstanding dues or fees. This lien secures the HOA's right to collect the unpaid amounts before the property can be sold or transferred. It's important for both property owners and potential investors/buyers to be aware of any Plano Texas Notice of Liens filed against a property. These liens can significantly affect the property's marketability and may need to be satisfied or released before any transfer of ownership can occur.

Plano Texas Notice of Lien

Description

How to fill out Plano Texas Notice Of Lien?

Do you need a trustworthy and affordable legal forms supplier to get the Plano Texas Notice of Lien? US Legal Forms is your go-to solution.

Whether you require a basic agreement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Plano Texas Notice of Lien conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Start the search over if the template isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Plano Texas Notice of Lien in any provided format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online for good.