Tarrant Texas Notice of Lien serves as an important legal document filed by creditors to stake a claim on a debtor's property or assets. In simple terms, a notice of lien signifies that the debtor owes a debt, and if left unpaid, the creditor has the right to seize or sell the debtor's property to satisfy the owed amount. This article aims to provide a comprehensive understanding of Tarrant Texas Notice of Lien, its purpose, and the different types of liens applicable in Tarrant County, Texas. A Notice of Lien is typically filed with the Tarrant County clerk's office, in accordance with the Texas Property Code, to formally notify the public of a creditor's interest in a specific property or personal assets owned by a debtor. This legal notice enables the creditor to establish a priority claim against the debtor's property, making it difficult for the debtor to sell or transfer ownership of the assets without first addressing the outstanding debt. There are several types of Tarrant Texas Notice of Liens, each serving a distinct purpose. Some common types include: 1. Mechanic's Lien: Contractors, subcontractors, laborers, or materials suppliers can file a mechanic's lien when a property owner fails to compensate them for work or supplies provided. This lien acts as security to ensure payment for services rendered. 2. Tax Lien: Filed by the Internal Revenue Service (IRS) or the Texas State Comptroller's Office, a tax lien is a claim against a debtor's property for unpaid federal or state taxes. This type of lien has priority over most other liens and can significantly affect the debtor's ability to sell or refinance the property. 3. Judgment Lien: A judgment lien is obtained by a creditor after winning a lawsuit against a debtor. Once obtained, the creditor can place a lien on the debtor's property, bank accounts, or other assets to satisfy the court-ordered judgment. 4. HOA Lien: Homeowners Associations (Has) within Tarrant County can file a lien against a homeowner's property for unpaid fees, including assessments, fines, or late charges. This lien ensures that the HOA has a legal claim on the property until the outstanding dues are paid. 5. Property Tax Lien: If a homeowner fails to pay property taxes, the county tax assessor can file a lien against the property. Property tax liens take precedence over most other liens and can result in foreclosure if left unresolved. It is crucial to note that each type of Tarrant Texas Notice of Lien has specific filing requirements and timelines. Failure to comply with these requirements may result in the lien being deemed invalid or losing its priority status. Therefore, it is highly recommended for both creditors and debtors to seek legal advice and understand the applicable laws pertaining to liens in Tarrant County, Texas. In conclusion, Tarrant Texas Notice of Lien is a legally binding document used by creditors to assert their claims on a debtor's property or assets. Various types of liens, including mechanic's liens, tax liens, judgment liens, HOA liens, and property tax liens, exist in Tarrant County. These liens ensure that the debt is addressed and provide necessary protection to creditors while impacting the debtor's ability to deal with the affected property. Understanding the specific requirements and implications of each type of lien is crucial for all parties involved in order to navigate the lien process effectively.

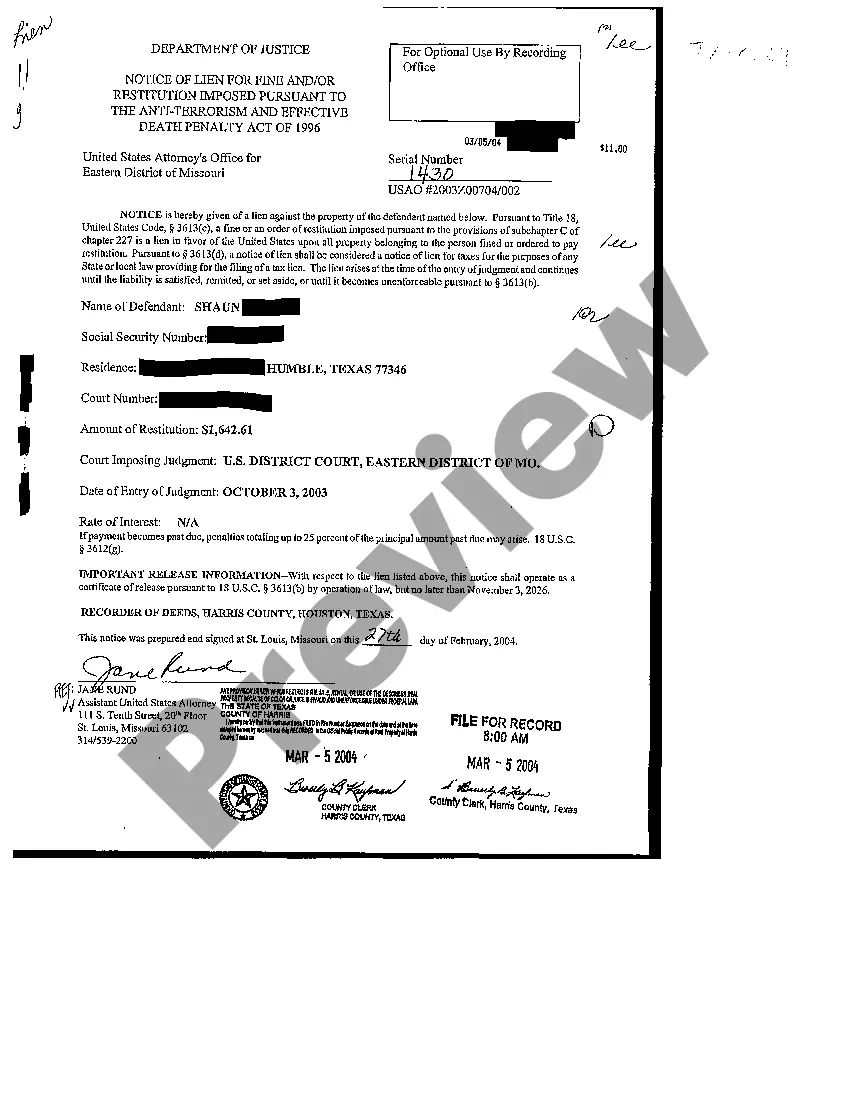

Tarrant Texas Notice of Lien

Description

How to fill out Tarrant Texas Notice Of Lien?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Tarrant Texas Notice of Lien becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Tarrant Texas Notice of Lien takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Tarrant Texas Notice of Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!