Title: Exploring the Waco Texas Notice of Lien: Types and Detailed Overview Introduction: The Waco Texas Notice of Lien is a legal document used to assert a creditor's right to claim ownership or property rights over a specific asset in order to secure payment for outstanding debts. This crucial instrument gives individuals or businesses the ability to protect their financial interests when someone owes them money. In Waco, Texas, several types of notice of liens can be filed, each addressing specific circumstances. In this article, we will delve into the comprehensive details of Waco Texas Notice of Lien, exploring its various types and shedding light on their significance. 1. Mechanic's Lien: One common type of Waco Texas Notice of Lien is the Mechanic's Lien. Generally filed by contractors, subcontractors, or suppliers who provided labor or materials to improve, construct, or repair a property, this lien ensures that the associated debts are paid. Serving as a legal claim, it gives the lien holder the right to foreclose on the property if the debt is not settled satisfactorily. 2. Property Tax Lien: Property Tax Liens are imposed by the local tax authorities when property owners fail to pay their property taxes. Through this notice, the government secures the debt by placing a lien on the property. This ensures the collection of overdue taxes and may also result in penalties, interest, or even foreclosure if the debt remains unpaid. 3. Judgment Lien: A Judgment Lien is filed by a winning party (plaintiff) in a court judgment against the losing party (defendant) to ensure the monetary judgment is satisfied. When a judgment is issued, a lien is placed on the defendant's property, preventing its sale or transfer without first satisfying the outstanding judgment debt. 4. IRS Tax Lien: The Internal Revenue Service (IRS) may issue a tax lien on a property if an individual or business fails to pay their federal taxes. This notice is filed to protect the government's claim on the property and assists in collecting unpaid taxes. An IRS Tax Lien has a significant impact on the individual's credit score, making it difficult to secure loans or sell the property. Conclusion: The Waco Texas Notice of Lien is a critical legal tool for protecting creditors' financial interests in various situations. Mechanic's liens enable contractors to receive payment for construction work, property tax liens ensure payment of overdue taxes, judgment liens secure court-ordered debt, and IRS tax liens aid the government in collecting unpaid taxes. Understanding these different types of liens helps individuals navigate the legal nuances surrounding debt collection and asset protection in Waco, Texas.

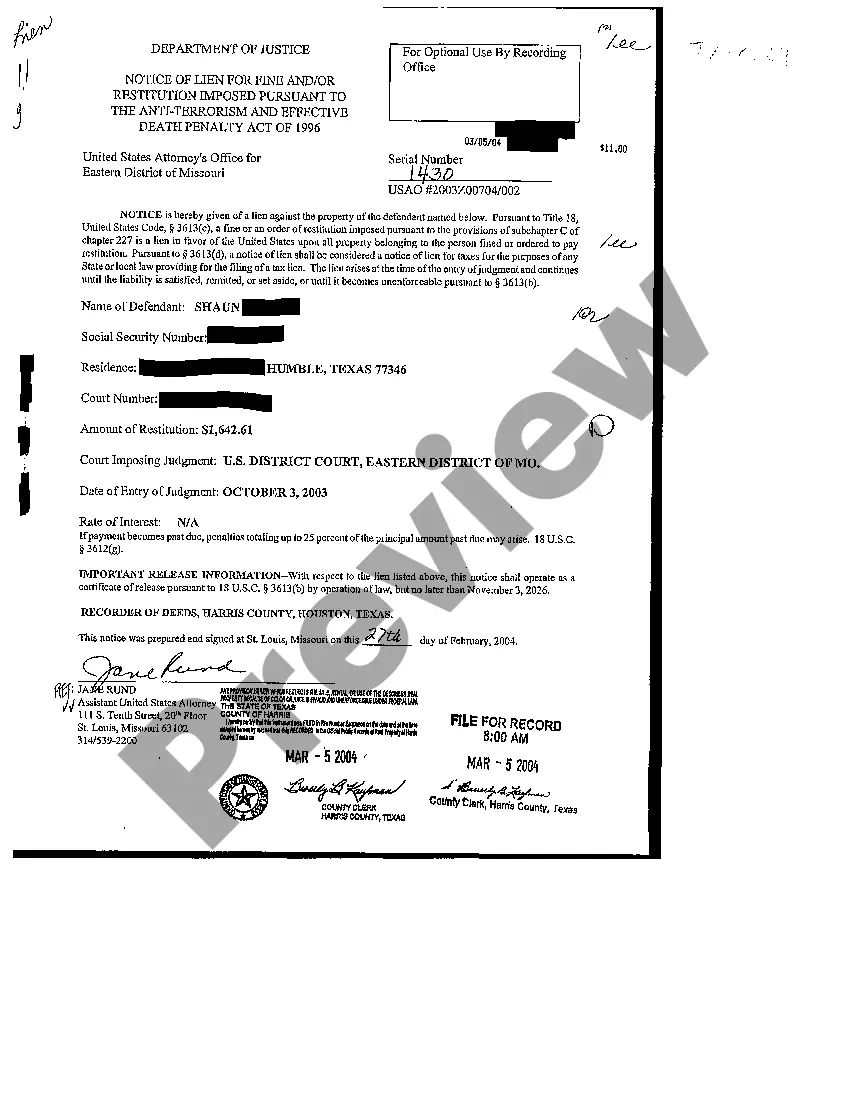

Waco Texas Notice of Lien

Description

How to fill out Waco Texas Notice Of Lien?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person without any legal background to create this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you want the Waco Texas Notice of Lien or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Waco Texas Notice of Lien in minutes employing our reliable platform. If you are already a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are a novice to our library, make sure to follow these steps prior to downloading the Waco Texas Notice of Lien:

- Be sure the form you have found is specific to your area considering that the rules of one state or area do not work for another state or area.

- Preview the form and read a quick outline (if provided) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Pick the payment method and proceed to download the Waco Texas Notice of Lien once the payment is done.

You’re good to go! Now you can go ahead and print the form or fill it out online. In case you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.