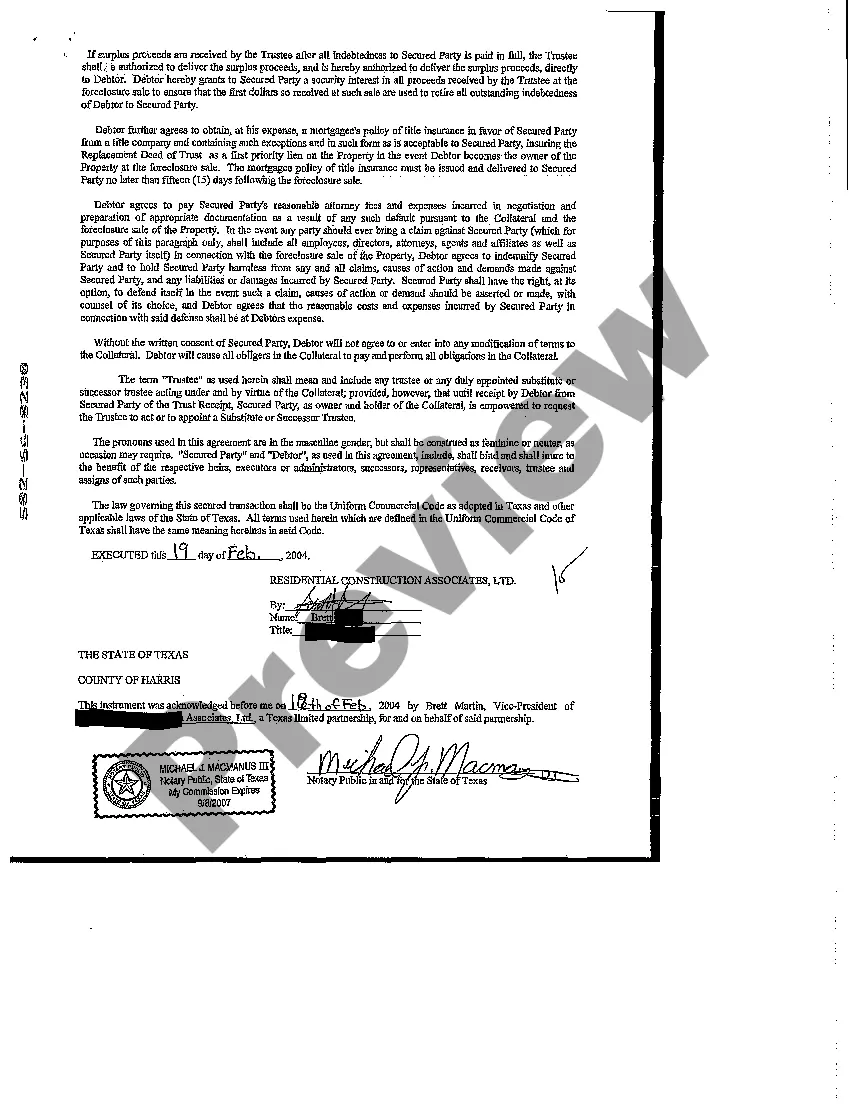

In Austin, Texas, the Collateral Assignment of Note and Liens is a legal concept that involves the transfer of the collateralized property rights by an individual or entity who owns a promissory note to a lender or a third party in exchange for a loan or security interest. This process allows the lender to have a priority claim on the collateral if the borrower defaults on the loan. There are different types of Collateral Assignment of Note and Liens that can be used in Austin, Texas: 1. Real Estate Collateral Assignment of Note and Liens: This type involves the assignment of a promissory note secured by a real estate property, allowing the lender to place a lien on the property as a security interest to protect their investment. 2. Equipment Collateral Assignment of Note and Liens: In this case, a promissory note secured by specific equipment or machinery is assigned to the lender, granting them a security interest in the equipment if the borrower defaults on the loan. 3. Accounts Receivable Collateral Assignment of Note and Liens: This type involves the assignment of a promissory note backed by accounts receivable, enabling the lender to claim the outstanding amounts owed by the borrower's customers in case of default. 4. Intellectual Property Collateral Assignment of Note and Liens: Here, the assignment of a promissory note secured by intellectual property such as patents, copyrights, or trademarks is executed, granting the lender a security interest over these intangible assets. These Collateral Assignment of Note and Liens agreements typically outline the terms and conditions of the loan, the responsibilities and obligations of both parties, and the rights of the lender in case of default. It is crucial for all parties involved to carefully review and comply with the legal requirements and execute the necessary legal documents to ensure the validity and enforceability of the Collateral Assignment of Note and Liens in Austin, Texas.

Austin Texas Collateral Assignment of Note and Liens

Description

How to fill out Austin Texas Collateral Assignment Of Note And Liens?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone without any law education to create such papers cfrom the ground up, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our service offers a huge library with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Austin Texas Collateral Assignment of Note and Liens or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Austin Texas Collateral Assignment of Note and Liens in minutes employing our trustworthy service. If you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are new to our platform, make sure to follow these steps before obtaining the Austin Texas Collateral Assignment of Note and Liens:

- Ensure the template you have found is suitable for your location since the rules of one state or county do not work for another state or county.

- Review the document and read a brief description (if provided) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start again and search for the suitable form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Austin Texas Collateral Assignment of Note and Liens once the payment is completed.

You’re all set! Now you can proceed to print out the document or complete it online. Should you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.