Beaumont Texas Collateral Assignment of Note and Liens is a legal document used in the state of Texas to secure a loan with personal property as collateral. This assignment allows lenders to protect their interests by obtaining a lien on the borrower's assets, ensuring repayment in the event of default or non-payment. In a Beaumont Texas Collateral Assignment of Note and Liens, the borrower (also known as the assignor) transfers ownership rights of a specific asset, such as real estate, vehicles, equipment, or securities, to the lender (also known as the assignee). This transfer of ownership serves as security for the loan, giving the lender the ability to seize and sell the collateral if the borrower fails to meet their repayment obligations. There are several types of collateral assignments and liens that can be used in Beaumont, Texas: 1. Real Estate Collateral Assignment: This type of collateral assignment involves using real property, such as a house or land, as security for the loan. The lender gains a lien on the property and can foreclose on it if the borrower defaults. 2. Vehicle Collateral Assignment: In this case, the borrower assigns their ownership rights of a vehicle to the lender as collateral. If the borrower fails to repay the loan, the lender can repossess and sell the vehicle. 3. Equipment Collateral Assignment: This type of lien involves using machinery, appliances, or other equipment as collateral. If the borrower defaults, the lender can seize and sell the equipment to recover the outstanding debt. 4. Securities Collateral Assignment: Securities, such as stocks, bonds, or other investment instruments, can be used as collateral for a loan. If the borrower defaults, the lender has the right to sell the securities to satisfy the debt. It is important to note that each type of collateral assignment and lien has specific requirements and regulations that must be followed in Beaumont, Texas. The terms and conditions, including the rights and responsibilities of both the borrower and lender, are outlined in the Collateral Assignment of Note and Liens agreement. Overall, Beaumont Texas Collateral Assignment of Note and Liens plays a crucial role in securing loans and protecting lenders' interests in the event of default. By using personal property as collateral, lenders mitigate their risks and increase the chances of recouping their investment.

Beaumont Texas Collateral Assignment of Note and Liens

State:

Texas

City:

Beaumont

Control #:

TX-C126

Format:

PDF

Instant download

This form is available by subscription

Description

Collateral Assignment of Note and Liens

Beaumont Texas Collateral Assignment of Note and Liens is a legal document used in the state of Texas to secure a loan with personal property as collateral. This assignment allows lenders to protect their interests by obtaining a lien on the borrower's assets, ensuring repayment in the event of default or non-payment. In a Beaumont Texas Collateral Assignment of Note and Liens, the borrower (also known as the assignor) transfers ownership rights of a specific asset, such as real estate, vehicles, equipment, or securities, to the lender (also known as the assignee). This transfer of ownership serves as security for the loan, giving the lender the ability to seize and sell the collateral if the borrower fails to meet their repayment obligations. There are several types of collateral assignments and liens that can be used in Beaumont, Texas: 1. Real Estate Collateral Assignment: This type of collateral assignment involves using real property, such as a house or land, as security for the loan. The lender gains a lien on the property and can foreclose on it if the borrower defaults. 2. Vehicle Collateral Assignment: In this case, the borrower assigns their ownership rights of a vehicle to the lender as collateral. If the borrower fails to repay the loan, the lender can repossess and sell the vehicle. 3. Equipment Collateral Assignment: This type of lien involves using machinery, appliances, or other equipment as collateral. If the borrower defaults, the lender can seize and sell the equipment to recover the outstanding debt. 4. Securities Collateral Assignment: Securities, such as stocks, bonds, or other investment instruments, can be used as collateral for a loan. If the borrower defaults, the lender has the right to sell the securities to satisfy the debt. It is important to note that each type of collateral assignment and lien has specific requirements and regulations that must be followed in Beaumont, Texas. The terms and conditions, including the rights and responsibilities of both the borrower and lender, are outlined in the Collateral Assignment of Note and Liens agreement. Overall, Beaumont Texas Collateral Assignment of Note and Liens plays a crucial role in securing loans and protecting lenders' interests in the event of default. By using personal property as collateral, lenders mitigate their risks and increase the chances of recouping their investment.

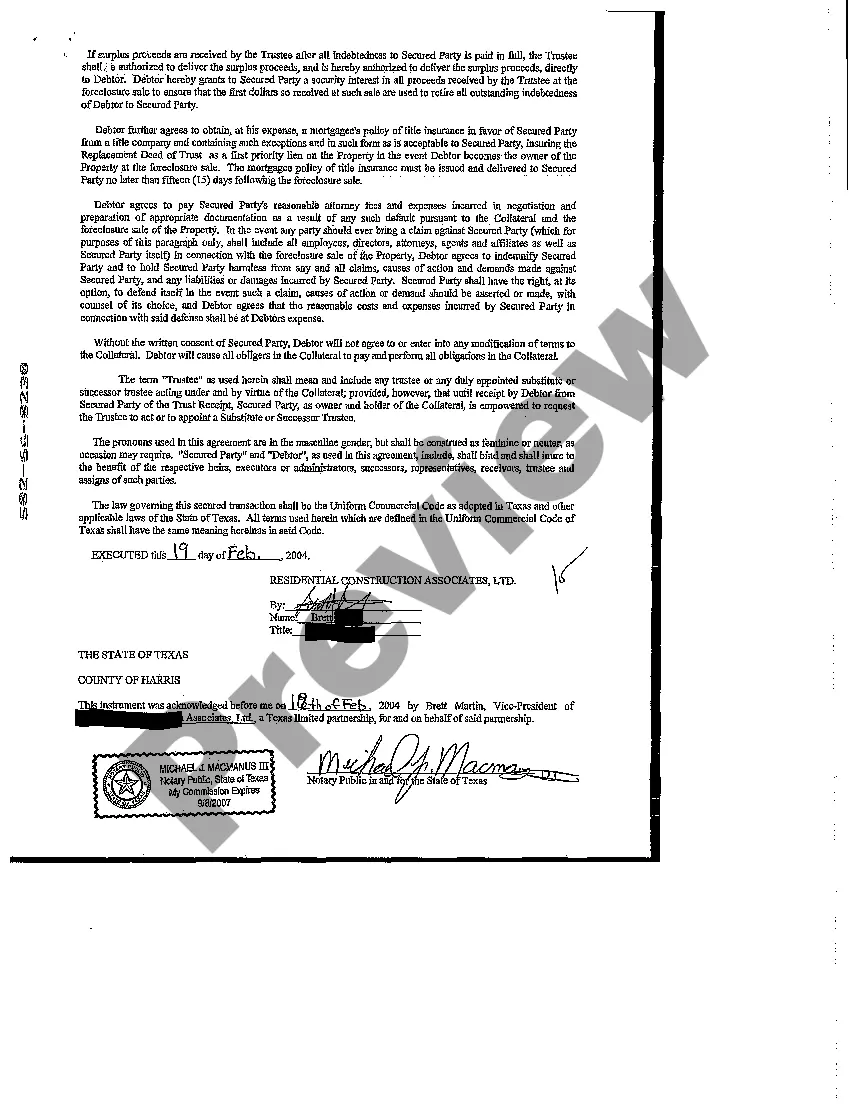

Free preview

How to fill out Beaumont Texas Collateral Assignment Of Note And Liens?

If you’ve already used our service before, log in to your account and download the Beaumont Texas Collateral Assignment of Note and Liens on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Beaumont Texas Collateral Assignment of Note and Liens. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!