A Dallas Texas Collateral Assignment of Note and Liens is a legal agreement that serves as a security measure for lenders in commercial or personal loans. This document is used to protect the lender's interest and ensure repayment in the event the borrower defaults on the loan. Collateral refers to assets or properties that are pledged to secure the loan. In Dallas, Texas, there are different types of Collateral Assignment of Note and Liens that can be created, namely: 1. Real Estate Collateral Assignment: This type of collateral assignment involves using real estate properties as security for the loan. The borrower agrees to assign rights to the lender against the property in case of default. 2. Equipment Collateral Assignment: In this type, the borrower assigns specific equipment or machinery to secure the loan. The lender may have the right to claim or sell the equipment if the borrower defaults. 3. Intellectual Property Collateral Assignment: Intellectual property, such as patents, copyrights, or trademarks, can be assigned as collateral. This provides additional security for the loan, giving the lender the right to seize or sell these assets in case of non-payment. 4. Accounts Receivable Collateral Assignment: A borrower may assign their accounts receivable, such as unpaid invoices or customer payments, to secure the loan. The lender can have access to these funds if the borrower fails to repay the loan. 5. Investment Collateral Assignment: This type involves assigning investment instruments like stocks, bonds, or mutual funds as collateral. The lender may possess the rights to sell or liquidate these investments if the borrower fails to meet their obligations. A Dallas Texas Collateral Assignment of Note and Liens is an essential legal tool used to protect lenders from financial risks. It creates a legally binding agreement between the borrower and the lender that establishes the rights and obligations of both parties. By providing additional security, lenders can have peace of mind knowing they have recourse if the borrower defaults on their loan.

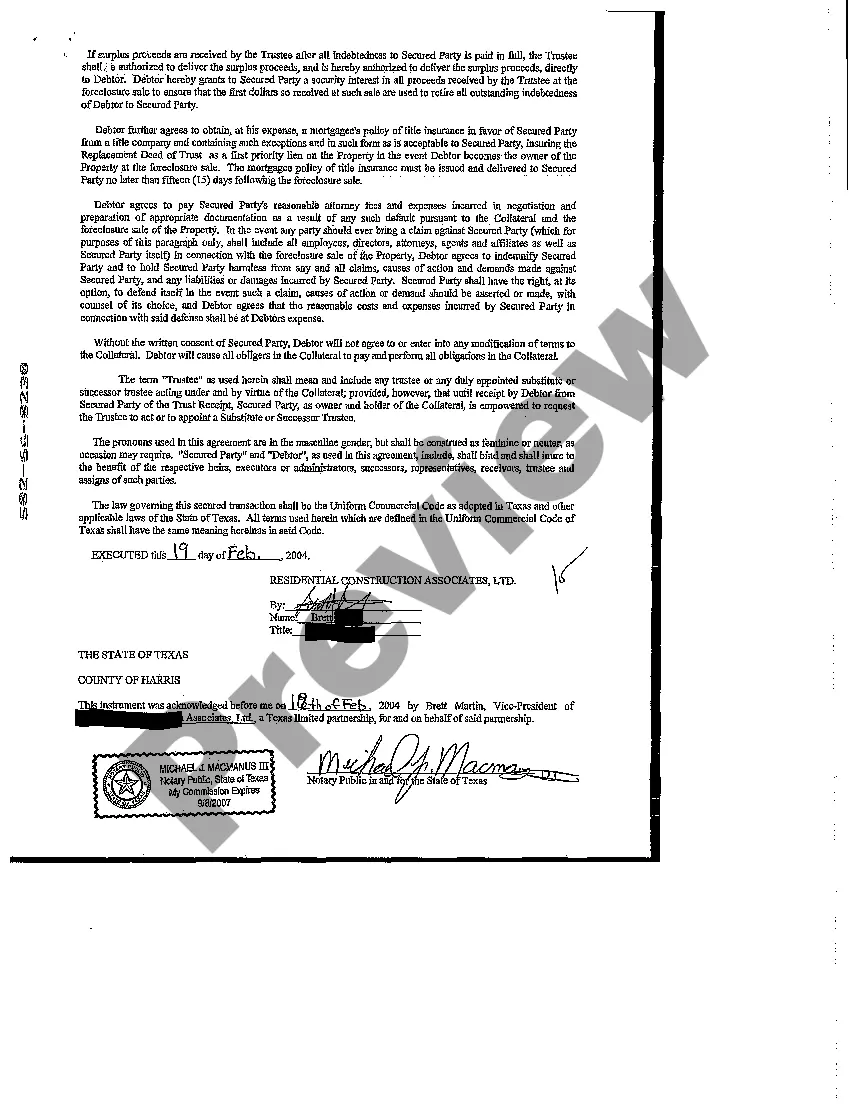

Dallas Texas Collateral Assignment of Note and Liens

Description

How to fill out Dallas Texas Collateral Assignment Of Note And Liens?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal solutions that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Dallas Texas Collateral Assignment of Note and Liens or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Dallas Texas Collateral Assignment of Note and Liens adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Dallas Texas Collateral Assignment of Note and Liens is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!