Edinburg, Texas Collateral Assignment of Note and Liens involves a legal arrangement where a borrower transfers the collateral securing a loan to a lender as security for the repayment of the debt. This form of agreement provides the lender the right to assume control over the collateral if the borrower defaults on the loan. By entering into this contract, the borrower is essentially using the collateral (which may be real estate, equipment, or other assets) to back the loan, thereby reducing the lender's risk. There are various types of Collateral Assignment of Note and Liens prevalent in Edinburg, Texas. These can include: 1. Real Estate Collateral Assignment: If a borrower pledges real estate as collateral, this assignment empowers the lender to foreclose on the property in case of loan default. The lender gains the right to sell the property to recover the outstanding debt. 2. Equipment Collateral Assignment: A borrower may assign equipment, such as machinery, vehicles, or specialized tools, as collateral. In the event of default, the lender can seize and sell this equipment to recover the unpaid debt. 3. Accounts Receivable Collateral Assignment: This type of assignment involves using outstanding invoices or accounts receivable as collateral. The lender may then collect payment from the borrower's customers directly or demand the borrower to transfer these accounts receivable to the lender. 4. Intellectual Property Collateral Assignment: In some cases, a borrower may assign patents, trademarks, or copyrights as collateral. If the borrower defaults, the lender obtains the rights to these intellectual properties or can sell them to satisfy the debt. 5. Investment Collateral Assignment: Borrowers who possess stocks, bonds, or other investment instruments can pledge them as collateral. If the borrower fails to repay the loan, the lender can liquidate these investments to recover the amount owed. It is crucial to note that the terms and conditions of a Collateral Assignment of Note and Liens can vary depending on the specific agreement between the lender and borrower. The agreement should outline the scope of collateral, repayment terms, potential fees, and the lender's rights in the event of default. As with any legal arrangement, both parties should thoroughly review the agreement and consult with legal professionals to ensure compliance with Edinburg, Texas laws and regulations.

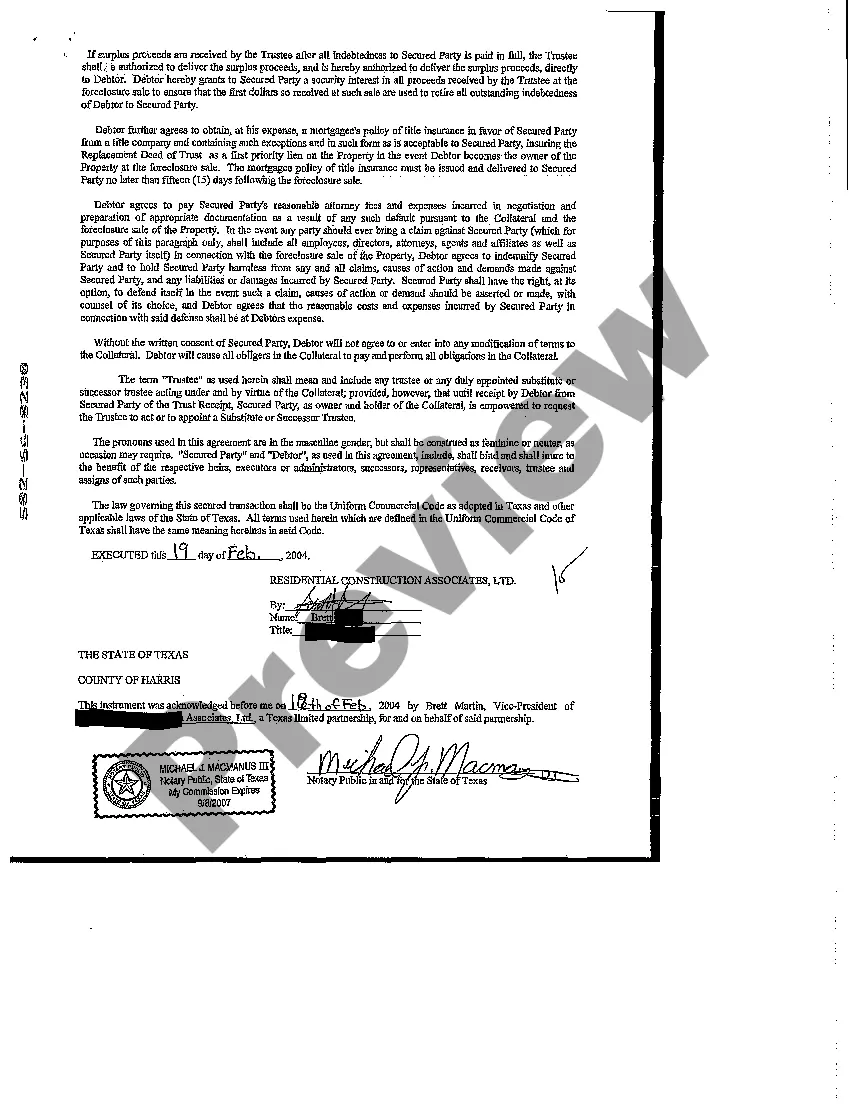

Edinburg Texas Collateral Assignment of Note and Liens

Description

How to fill out Edinburg Texas Collateral Assignment Of Note And Liens?

Make use of the US Legal Forms and obtain instant access to any form sample you want. Our beneficial platform with a huge number of templates makes it simple to find and get almost any document sample you will need. You are able to download, fill, and certify the Edinburg Texas Collateral Assignment of Note and Liens in a couple of minutes instead of surfing the Net for hours looking for the right template.

Utilizing our collection is an excellent way to increase the safety of your form submissions. Our experienced lawyers regularly check all the records to make certain that the templates are relevant for a particular state and compliant with new laws and polices.

How do you get the Edinburg Texas Collateral Assignment of Note and Liens? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the form you require. Ensure that it is the form you were looking for: check its name and description, and make use of the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the document. Choose the format to obtain the Edinburg Texas Collateral Assignment of Note and Liens and modify and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy document libraries on the web. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Edinburg Texas Collateral Assignment of Note and Liens.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!