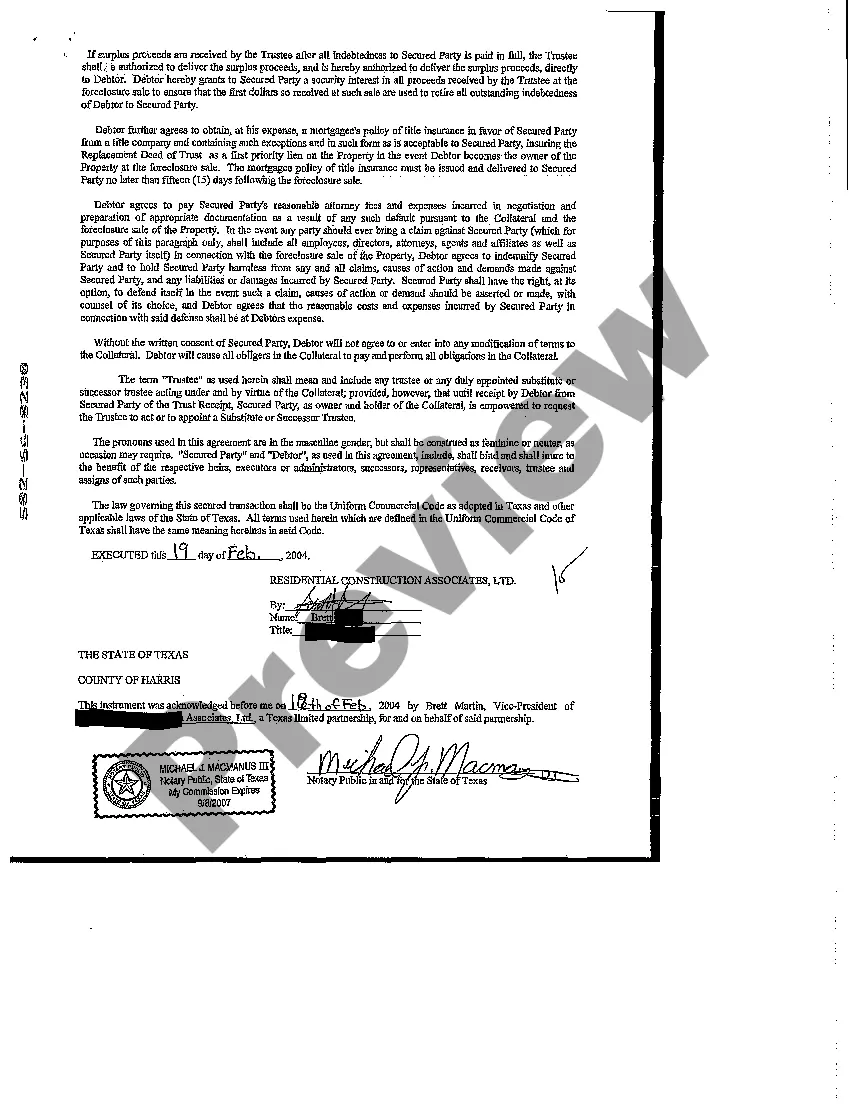

Irving Texas Collateral Assignment of Note and Liens is a legal process that involves assigning a collateral or security interest in the form of a note and lien for an asset or property in Irving, Texas. This assignment is used as a safeguard by lenders or creditors to secure their interests and ensure repayment in case of default or non-payment by the borrower. The collateral assignment of note and liens in Irving, Texas can be categorized into different types based on the nature of the asset or property involved. Some common types include: 1. Real Estate Collateral Assignment: This type of assignment is commonly used when securing a loan for real estate properties in Irving, Texas. Lenders may require borrowers to assign a lien on the property as collateral, allowing them to foreclose and sell the property to recover their dues in case of default. 2. Business Collateral Assignment: Businesses in Irving, Texas often use this type of assignment to secure loans or credit lines. It involves assigning notes and liens on business assets such as equipment, inventory, or accounts receivable. Lenders can then claim ownership or sell these assets to recover their funds during default situations. 3. Intellectual Property Collateral Assignment: Companies or individuals in Irving, Texas who possess valuable intellectual property rights, such as patents, trademarks, or copyrights, can utilize this type of collateral assignment. By assigning these intangible assets as collateral, lenders can have a claim on the intellectual property in case the borrower fails to repay the loan. 4. Securities Collateral Assignment: Investments such as stocks, bonds, or mutual funds can be assigned as collateral in Irving, Texas. This type of assignment allows lenders to claim ownership or sell these securities to recover their funds if the borrower defaults on their obligations. In summary, Irving Texas Collateral Assignment of Note and Liens is a legal mechanism used to secure loans or credit lines by assigning a collateral or security interest in the form of a note and lien. Different types of collateral assignments exist, such as real estate, business assets, intellectual property, and securities, each catering to specific circumstances and assets.

Irving Texas Collateral Assignment of Note and Liens

Description

How to fill out Irving Texas Collateral Assignment Of Note And Liens?

Utilize the US Legal Forms and gain immediate access to any form sample you require.

Our user-friendly platform with a wide array of document templates streamlines the method to discover and obtain nearly any document sample you need.

You can save, fill out, and authenticate the Irving Texas Collateral Assignment of Note and Liens in just a few minutes instead of spending hours online searching for an appropriate template.

Using our collection is an excellent tactic to enhance the security of your document submissions.

Open the page with the form you need. Make sure it is the form you were looking for: check its title and description, and utilize the Preview feature if available. Otherwise, use the Search bar to find the necessary one.

Initiate the downloading process. Click Buy Now and select the pricing plan you prefer. Then create an account and complete your order using a credit card or PayPal.

- Our experienced attorneys frequently review all documents to ensure that the forms are suitable for a specific region and adhere to updated laws and regulations.

- How can you acquire the Irving Texas Collateral Assignment of Note and Liens.

- If you already have a subscription, simply Log In to your account. The Download button will be activated on all the samples you examine.

- Furthermore, you can access all the previously saved documents in the My documents section.

- If you do not have an account yet, follow the instructions below:

Form popularity

FAQ

Collateral assignments refer to the legal process where a borrower assigns their rights in a collateral asset to a lender as security for a debt. In the context of the Irving Texas Collateral Assignment of Note and Liens, this means that if the borrower defaults, the lender has the right to claim the asset. Understanding this process is crucial for borrowers and lenders alike, as it clarifies the rights and obligations surrounding secured loans. For those looking to navigate this intricate process, US Legal Forms provides resources and templates to help you create effective collateral assignment documents.

Filling out a collateral assignment form involves providing essential details about the collateral and the parties involved. You must include information such as the description of the collateral, its location, and the specifics of the obligations being secured. Using platforms like uslegalforms can simplify this process, ensuring that your collateral assignment aligns well with the Irving Texas Collateral Assignment of Note and Liens requirements.

A lien is a legal claim against a property to secure payment of a debt. In the context of an Irving Texas Collateral Assignment of Note and Liens, an assignment refers to the transfer of that lien to another party. This process ensures that the new holder assumes rights to collect on the debt attached to the property. Understanding these definitions helps you navigate financial agreements and protect your interests.

Collateral Assignment of Mortgage means the collateral assignment of mortgage made by the Borrower in favor of the Administrative Agent which encumbers the Borrower's right, title and interest in the Interim Mortgage.

You grant the lender a security interest in your property, and it means they have a lien. The lien secures the loan, so that if you don't pay, the lender can take the property. The property you pledge to secure a loan is called collateral.

Collateral assignment is the transfer of the rights to the rental payments from and a security interest (lien ) in a leased asset by the asset's owner and lessor to lenders ? the lease funders ? to secure the funding upon payment of the consideration by the funder to the lessor, typically structured on a nonrecourse

It can also be used if the buyer is assigning its rights under a stock purchase agreement or any other kind of acquisition agreement. The collateral assignment assigns the rights of the buyer under the asset purchase agreement to a lender as security for a loan from the lender to the buyer.

Collateral Assignment of Notes means the Collateral Assignment of Notes dated the date hereof executed by the Borrowers in favor of the Agent, covering such Borrower's right, title and interest in all promissory notes payable to such Borrowers.

Assignment of Notes and Liens means a Collateral Assignment of Notes and Liens and Security Agreement duly executed by Borrower assigning to Lender and granting Lender a first priority security interest in certain Mortgage Paper relating to a Mortgage Loan, in recordable form, and all like intervening instruments that

Collateral property is placed on hold in an arrangement so that the owner of the mortgage (the lender or investor) could sell and recoup their investment should the borrower ever default on the loan.