McAllen Texas Collateral Assignment of Note and Liens refers to a legal process where a borrower assigns collateral, usually property or assets, to secure a loan or debt. It acts as a safeguard for lenders, providing them with a legal claim over the pledged assets if the borrower fails to repay the amount owed. This type of agreement is commonly used in McAllen, Texas, and ensures the protection of both borrowers and lenders during financial transactions. There are two main types of Collateral Assignment of Note and Liens in McAllen, Texas: 1. Real Estate Collateral Assignment of Note and Liens: This type of collateral assignment involves utilizing real estate properties, such as residential or commercial buildings, land, or any other immovable asset, as security for a loan or debt. The borrower assigns the property's ownership, title, and rights to the lender until the loan is fully repaid. In case of default, the lender can take legal action to recover the debt by foreclosing on the property or selling it. 2. Personal Property Collateral Assignment of Note and Liens: Unlike real estate collateral, personal property assets, such as vehicles, equipment, inventory, or financial instruments, are used to secure the loan or debt. The borrower grants the lender a lien over the specified personal property, giving the lender the right to seize and sell the assets to recover the outstanding debt in case of default. In both types of Collateral Assignment of Note and Liens, a comprehensive legal agreement is drafted outlining the terms and conditions of the loan, the collateral being assigned, and the rights and responsibilities of both parties. This agreement must be recorded in the proper county records office to ensure a valid lien against the collateral. McAllen Texas Collateral Assignment of Note and Liens are crucial aspects of lending and borrowing processes, providing protection and security for both lenders and borrowers. Whether it involves real estate properties or personal assets, these agreements help mitigate risk and ensure fair dealings in the financial landscape of the McAllen, Texas area.

McAllen Texas Collateral Assignment of Note and Liens

State:

Texas

City:

McAllen

Control #:

TX-C126

Format:

PDF

Instant download

This form is available by subscription

Description

Collateral Assignment of Note and Liens

McAllen Texas Collateral Assignment of Note and Liens refers to a legal process where a borrower assigns collateral, usually property or assets, to secure a loan or debt. It acts as a safeguard for lenders, providing them with a legal claim over the pledged assets if the borrower fails to repay the amount owed. This type of agreement is commonly used in McAllen, Texas, and ensures the protection of both borrowers and lenders during financial transactions. There are two main types of Collateral Assignment of Note and Liens in McAllen, Texas: 1. Real Estate Collateral Assignment of Note and Liens: This type of collateral assignment involves utilizing real estate properties, such as residential or commercial buildings, land, or any other immovable asset, as security for a loan or debt. The borrower assigns the property's ownership, title, and rights to the lender until the loan is fully repaid. In case of default, the lender can take legal action to recover the debt by foreclosing on the property or selling it. 2. Personal Property Collateral Assignment of Note and Liens: Unlike real estate collateral, personal property assets, such as vehicles, equipment, inventory, or financial instruments, are used to secure the loan or debt. The borrower grants the lender a lien over the specified personal property, giving the lender the right to seize and sell the assets to recover the outstanding debt in case of default. In both types of Collateral Assignment of Note and Liens, a comprehensive legal agreement is drafted outlining the terms and conditions of the loan, the collateral being assigned, and the rights and responsibilities of both parties. This agreement must be recorded in the proper county records office to ensure a valid lien against the collateral. McAllen Texas Collateral Assignment of Note and Liens are crucial aspects of lending and borrowing processes, providing protection and security for both lenders and borrowers. Whether it involves real estate properties or personal assets, these agreements help mitigate risk and ensure fair dealings in the financial landscape of the McAllen, Texas area.

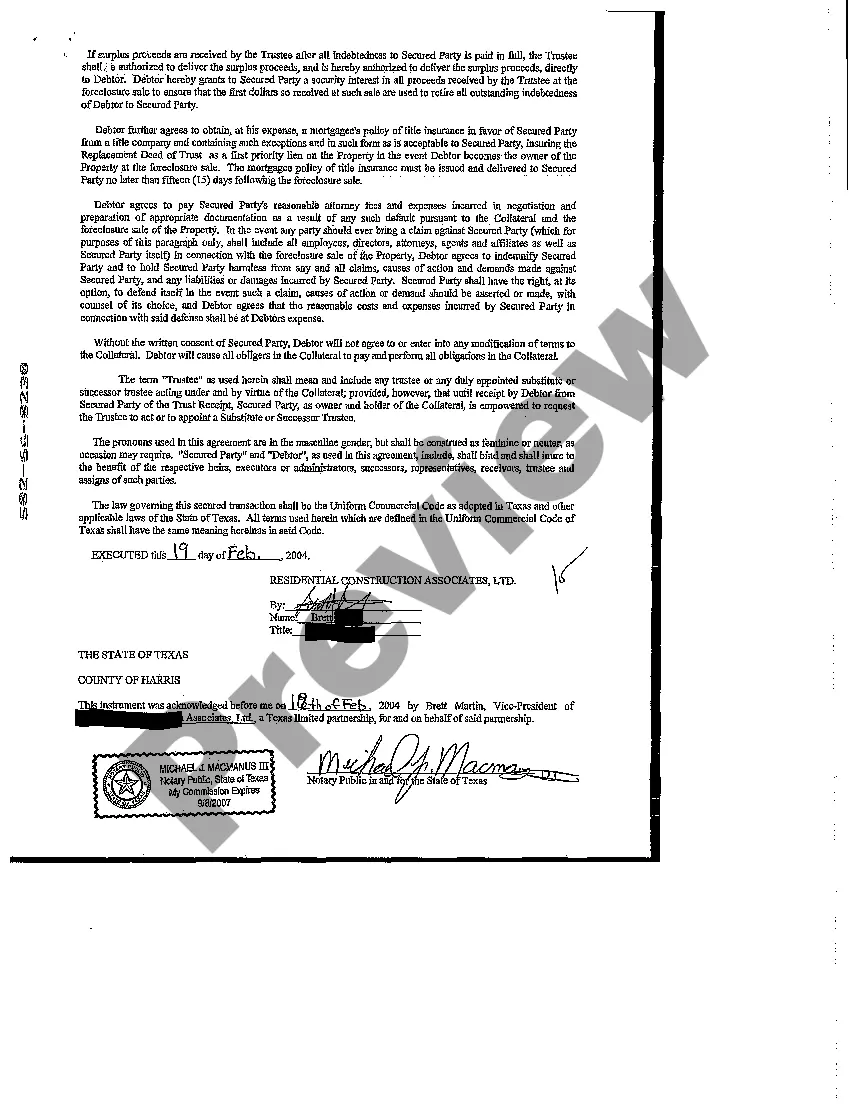

Free preview

How to fill out McAllen Texas Collateral Assignment Of Note And Liens?

If you’ve already used our service before, log in to your account and save the McAllen Texas Collateral Assignment of Note and Liens on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your McAllen Texas Collateral Assignment of Note and Liens. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!