Pasadena Texas Collateral Assignment of Note and Liens is a legal document that serves as a means to secure a loan or debt by pledging an asset as collateral. It is commonly used in financial transactions, particularly in the lending industry, where borrowers provide collateral to lenders as a form of security. This collateral can be in the form of real estate, vehicles, stocks, bonds, or any other valuable asset that holds monetary value. When a borrower in Pasadena, Texas enters into a Collateral Assignment of Note and Liens agreement, they are essentially giving the lender an interest in their asset until the debt is fully repaid. This interest is often in the form of a lien, which is a legal claim on the asset. In case the borrower fails to repay the loan or defaults on the debt, the lender can then exercise its rights to sell or seize the collateral to recover the outstanding amount. There are different types of Collateral Assignment of Note and Liens that may exist in Pasadena, Texas, including: 1. Real Estate Collateral Assignment: This type involves using real property, such as land, houses, or commercial buildings, as collateral. The lender will file a lien against the property, which remains in effect until the debt is satisfied. 2. Vehicle Collateral Assignment: Here, the borrower assigns the ownership rights of a vehicle to the lender as collateral. The lender may hold the vehicle's title until the loan is repaid, and in case of default, they can seize and sell the vehicle to recover their funds. 3. Stock or Bond Collateral Assignment: Investors or borrowers may pledge their stocks, bonds, or other investment securities as collateral. The lender places a lien on the securities, granting them a security interest until the debt is settled. 4. Equipment Collateral Assignment: In certain cases, borrowers may assign their business equipment, machinery, or other physical assets to the lender as collateral. If the borrower fails to repay the loan, the lender can take possession of the equipment and sell it to recoup the loan amount. It is imperative for both lenders and borrowers in Pasadena, Texas to ensure that the terms and conditions of the Collateral Assignment of Note and Liens agreement are clearly outlined and duly understood. Consulting with legal professionals or experts specializing in collateral assignments can provide valuable guidance throughout the process, ensuring compliance with local laws and maximizing protection for all parties involved.

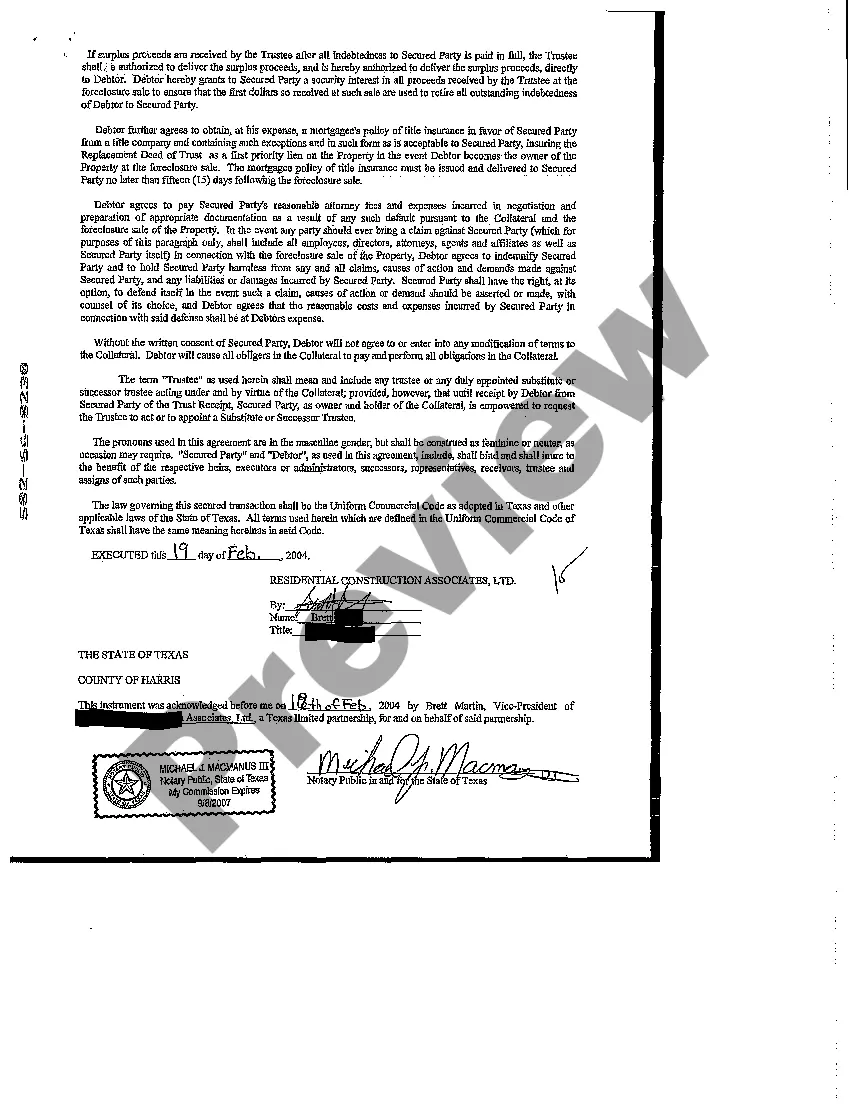

Pasadena Texas Collateral Assignment of Note and Liens

Description

How to fill out Pasadena Texas Collateral Assignment Of Note And Liens?

Make use of the US Legal Forms and get instant access to any form you want. Our beneficial website with a large number of documents simplifies the way to find and get almost any document sample you need. It is possible to download, complete, and certify the Pasadena Texas Collateral Assignment of Note and Liens in just a matter of minutes instead of browsing the web for many hours trying to find a proper template.

Using our library is a great way to raise the safety of your document filing. Our professional lawyers regularly review all the records to make certain that the templates are relevant for a particular region and compliant with new acts and polices.

How can you obtain the Pasadena Texas Collateral Assignment of Note and Liens? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you look at. In addition, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: examine its headline and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Indicate the format to obtain the Pasadena Texas Collateral Assignment of Note and Liens and edit and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy document libraries on the internet. We are always ready to help you in any legal process, even if it is just downloading the Pasadena Texas Collateral Assignment of Note and Liens.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!