The San Antonio Texas Collateral Assignment of Note and Liens is a legal agreement that involves the transfer of security interests in a promissory note and the creation of liens to secure repayment of a debt. It is a document designed to provide protection to lenders and creditors by ensuring that they have a means to recover their funds in case of default. In essence, this agreement allows a borrower to assign their rights in a promissory note to a lender or creditor as collateral for a loan. This means that if the borrower fails to repay the loan, the lender or creditor can claim ownership of the promissory note and potentially liquidate it to recover the outstanding debt. There are different types of San Antonio Texas Collateral Assignment of Note and Liens that may be used depending on the specific circumstances. Some common types include: 1. Real Estate Collateral Assignment: This type of collateral assignment is used when the promissory note is secured by a real estate property. The lender or creditor will have a lien on the property, which could allow them to foreclose on it in the event of default. 2. Personal Property Collateral Assignment: This type of collateral assignment is used when the promissory note is secured by personal property such as vehicles, equipment, or other assets. The lender or creditor will have a lien on the specific property, allowing them to seize and sell it if the borrower fails to repay the loan. 3. Accounts Receivable Collateral Assignment: This type of collateral assignment involves the assignment of the borrower's accounts receivable as collateral for the debt. The lender or creditor will have a lien on the receivables, enabling them to collect the payments directly from the borrowers' customers if necessary. The San Antonio Texas Collateral Assignment of Note and Liens is a crucial legal instrument that helps protect the rights and interests of lenders and creditors. By establishing security interests and liens, it provides them with a means to recover their funds in case of default, enhancing their overall risk management and financial stability.

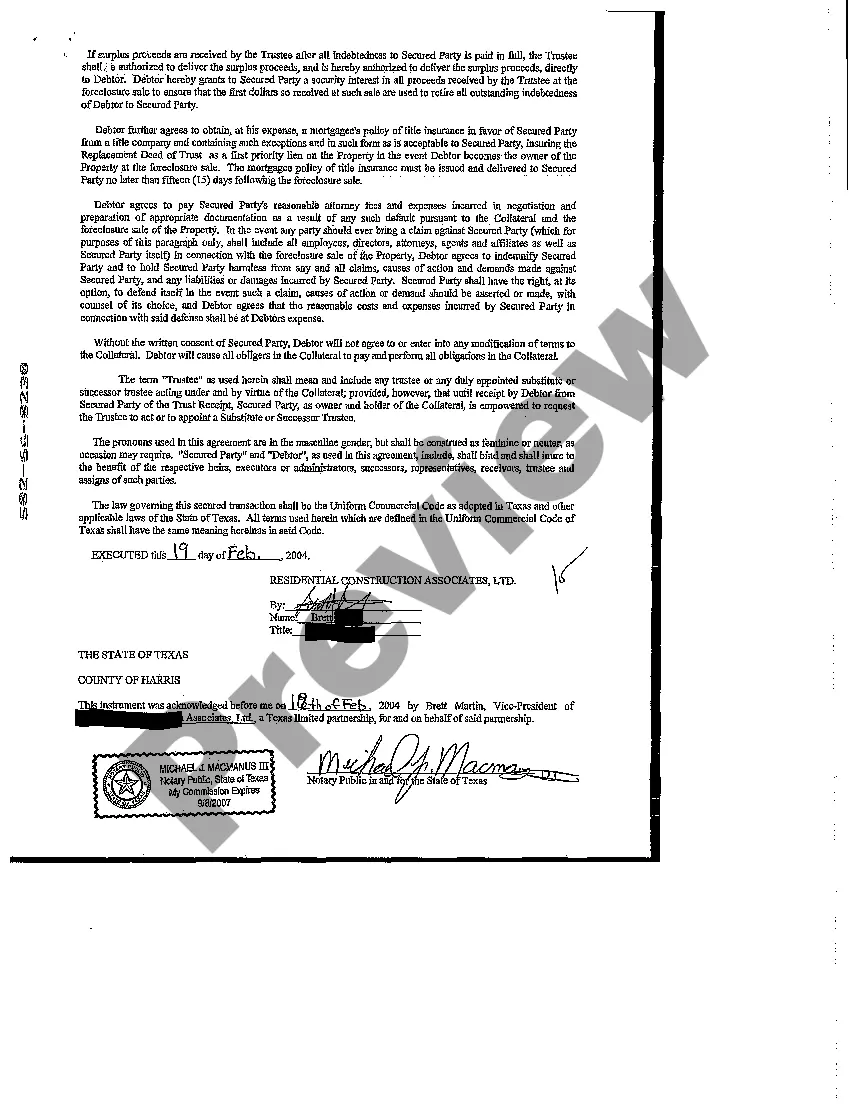

San Antonio Texas Collateral Assignment of Note and Liens

Description

How to fill out San Antonio Texas Collateral Assignment Of Note And Liens?

Benefit from the US Legal Forms and obtain immediate access to any form template you need. Our beneficial platform with thousands of document templates makes it easy to find and get virtually any document sample you will need. You can save, complete, and sign the San Antonio Texas Collateral Assignment of Note and Liens in just a couple of minutes instead of surfing the Net for many hours looking for an appropriate template.

Utilizing our library is an excellent strategy to improve the safety of your record filing. Our experienced legal professionals on a regular basis check all the records to ensure that the forms are relevant for a particular state and compliant with new laws and polices.

How do you get the San Antonio Texas Collateral Assignment of Note and Liens? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instruction listed below:

- Open the page with the form you require. Make certain that it is the template you were seeking: examine its name and description, and take take advantage of the Preview option if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the saving process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Save the document. Pick the format to get the San Antonio Texas Collateral Assignment of Note and Liens and revise and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy document libraries on the web. We are always happy to help you in any legal procedure, even if it is just downloading the San Antonio Texas Collateral Assignment of Note and Liens.

Feel free to make the most of our service and make your document experience as efficient as possible!