Title: Understanding Sugar Land Texas Collateral Assignment of Note and Liens for Secured Transactions Introduction: In Sugar Land, Texas, the Collateral Assignment of Note and Liens is an important legal instrument used to secure loans or financial obligations. This document allows lenders or creditors to gain an interest in certain assets, ensuring repayment in case of default. This article will provide a detailed description of the Sugar Land Texas Collateral Assignment of Note and Liens, outlining the purpose, process, and types available. 1. The Purpose of Sugar Land Texas Collateral Assignment of Note and Liens: The primary purpose of Collateral Assignment of Note and Liens is to protect lenders and creditors by establishing a security interest in specific assets of the borrower or obliged. This ensures that in the event of non-payment or default, the creditor has the right to seize and liquidate the collateral to recover the outstanding debt. 2. The Process of Sugar Land Texas Collateral Assignment of Note and Liens: a. Identification of Collateral: The Collateral Assignment of Note and Liens requires a comprehensive description of the assets provided as collateral. This can include real estate properties, equipment, vehicles, securities, intellectual property rights, or any other valuable asset acceptable to the parties involved. b. Creation of Security Interest: The document establishes a security interest in the identified collateral, granting the creditor certain rights, including the ability to take possession and sell off the assets in case of default. c. Filing with the Appropriate Authorities: To protect the lender's interest, the Collateral Assignment of Note and Liens may need to be recorded or filed with the appropriate state or local authorities, depending on the nature of the collateral involved. 3. Types of Sugar Land Texas Collateral Assignment of Note and Liens: a. Real Estate Collateral Assignments: This type of collateral assignment is used when real property, such as land or buildings, is offered as security for a loan or debt obligation. b. Chattel Collateral Assignments: Chattels refer to movable assets, excluding real estate. Chattel collateral assignments secure loan obligations with assets like vehicles, equipment, inventory, or accounts receivable. c. Intellectual Property Collateral Assignments: Intellectual property, including patents, trademarks, and copyrights, can be assigned as collateral to secure loans in certain cases, for instance, in technology-based businesses. d. Accounts Receivable Collateral Assignments: Businesses can assign their accounts receivable as collateral, enabling the lender to have a claim on the future receivables generated by the borrower's customers. e. Securities Collateral Assignments: These assignments involve pledging stocks, bonds, or other investment securities as collateral to secure loans. Conclusion: The Sugar Land Texas Collateral Assignment of Note and Liens is a vital legal instrument that enables lenders to secure their loans or financial obligations effectively. By establishing a security interest in specific assets, creditors have a means to recover outstanding debts in the event of borrower default. Understanding the process and types of collateral assignments available in Sugar Land, Texas, provides both lenders and borrowers with necessary insights in navigating secured transactions successfully.

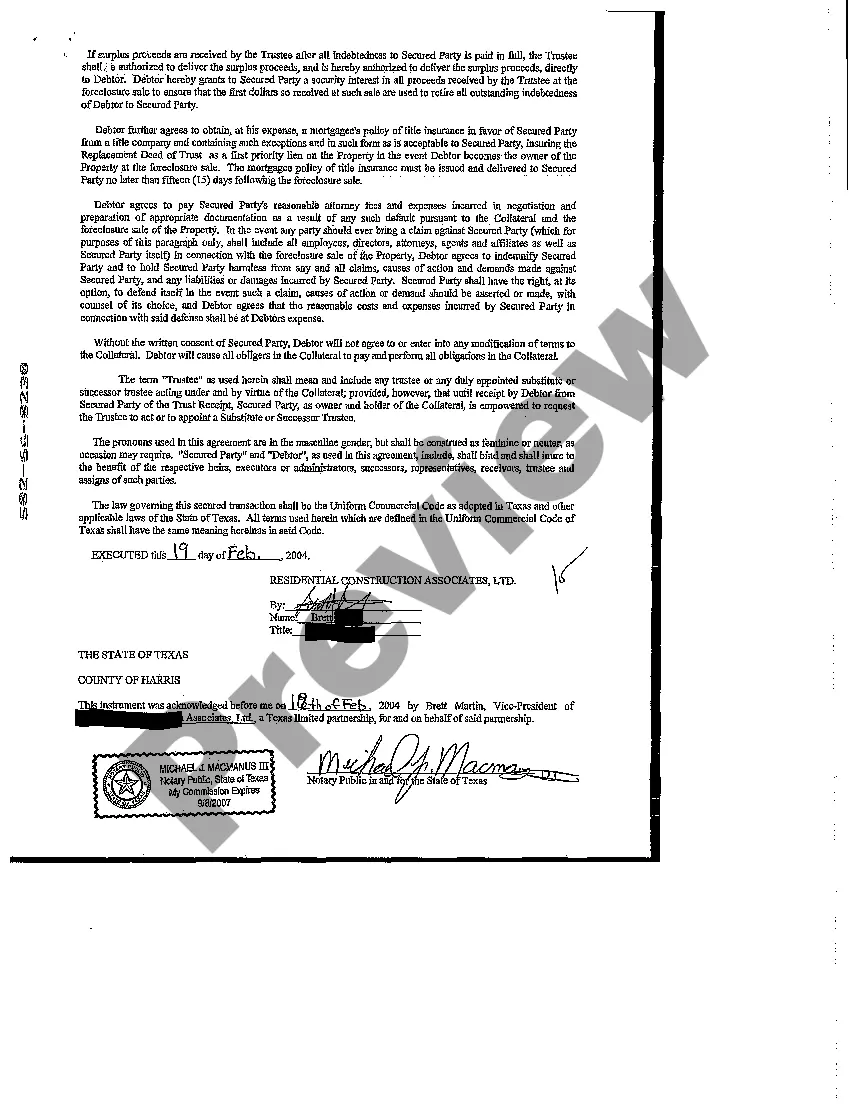

Sugar Land Texas Collateral Assignment of Note and Liens

Description

How to fill out Sugar Land Texas Collateral Assignment Of Note And Liens?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Sugar Land Texas Collateral Assignment of Note and Liens becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Sugar Land Texas Collateral Assignment of Note and Liens takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Sugar Land Texas Collateral Assignment of Note and Liens. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!