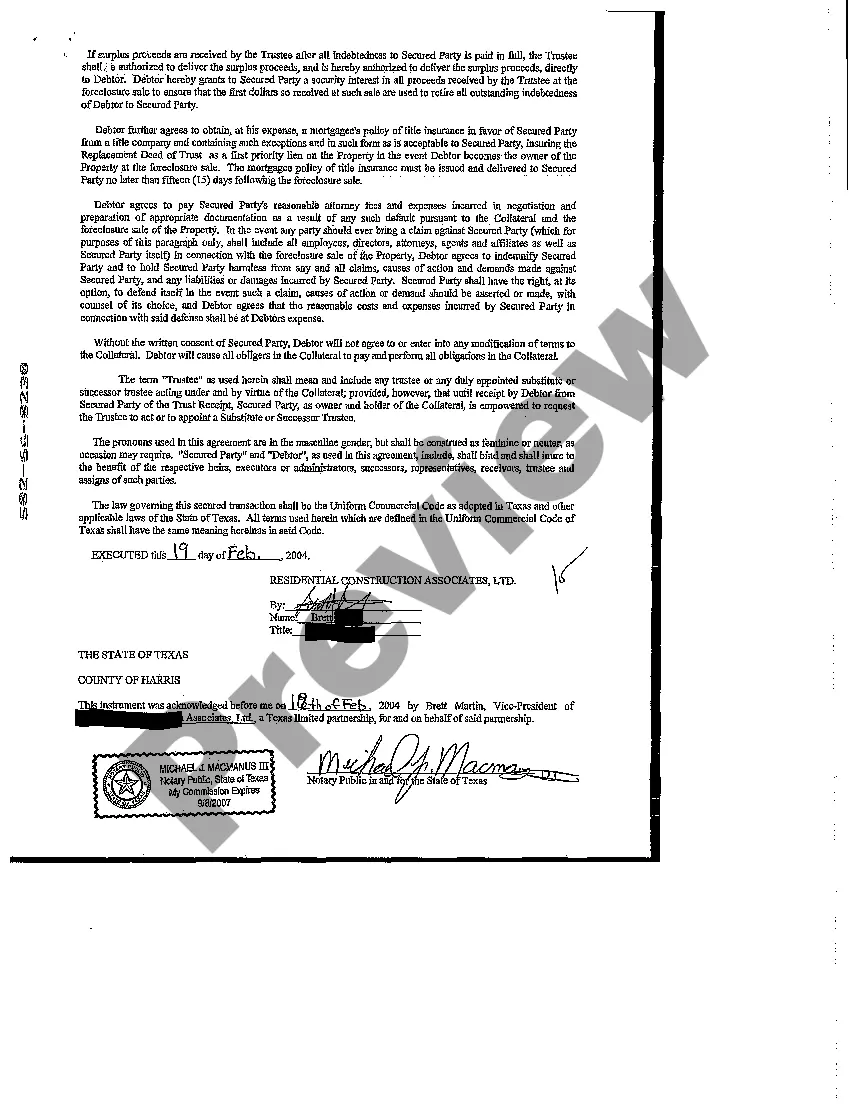

A collateral assignment of note and liens in Wichita Falls, Texas refers to a legal document that occurs when a borrower uses their property or assets as collateral to secure a loan or debt. This arrangement typically involves two parties: the borrower, who pledges the collateral, and the lender, who accepts the collateral as security for the debt. The collateral assignment of note and liens serves as a protection mechanism for the lender in case the borrower fails to repay the loan. By having a lien on the collateral, the lender gains the right to seize and sell it to recover the outstanding debt amount. In Wichita Falls, Texas, there are various types of collateral assignment of note and liens that individuals or businesses might encounter: 1. Real Estate Collateral Assignment: This type of collateral assignment involves using real property, such as land, homes, or buildings, as security for a loan. If the borrower defaults on the loan, the lender can foreclose on the property to recover the debt. 2. Motor Vehicle Collateral Assignment: Borrowers may assign their motor vehicles, such as cars, trucks, or motorcycles, as collateral for a loan. In case of default, the lender can repossess the vehicle to satisfy the debt. 3. Equipment and Machinery Collateral Assignment: Businesses often use their equipment, machinery, or even inventory as collateral when obtaining financing. If the borrower defaults, the lender can seize and sell the assets to recoup the outstanding loan amount. 4. Accounts Receivable Collateral Assignment: Companies looking for working capital might assign their accounts receivable as collateral. In this case, if the borrower fails to repay the loan, the lender can collect the outstanding invoices directly from the borrower's customers. It is essential to mention that the specific terms and conditions of a collateral assignment of note and liens can vary depending on the loan agreement and the parties involved. Additionally, the laws and regulations governing such assignments might also differ in Wichita Falls, Texas. Understanding the intricacies of the collateral assignment of note and liens is crucial for both borrowers and lenders in Wichita Falls, Texas. It ensures that the rights and obligations of each party are clearly defined, providing security and protection in financial transactions.

Wichita Falls Texas Collateral Assignment of Note and Liens

Description

How to fill out Wichita Falls Texas Collateral Assignment Of Note And Liens?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Wichita Falls Texas Collateral Assignment of Note and Liens or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Wichita Falls Texas Collateral Assignment of Note and Liens adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Wichita Falls Texas Collateral Assignment of Note and Liens would work for you, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

Assignment of Notes and Liens means a Collateral Assignment of Notes and Liens and Security Agreement duly executed by Borrower assigning to Lender and granting Lender a first priority security interest in certain Mortgage Paper relating to a Mortgage Loan, in recordable form, and all like intervening instruments that

Collateral Assignment of Deeds of Trust means that agreement executed by Borrower in favor of Lender in which Borrower collaterally assigns to Lender all of the Borrower's rights, title and interest in and to those deeds of trust which secure repayment of the Pledged Accounts.

A life insurance policy with a cash value of $75,000 and a death benefit of $500,000 may help convince them to provide the loan to you. Using collateral assignment of the policy, you allow the insurance company to pay the lender should you default on the loan, or you die before you repay it.

Collateral assignment is the transfer of the rights to the rental payments from and a security interest (lien ) in a leased asset by the asset's owner and lessor to lenders ? the lease funders ? to secure the funding upon payment of the consideration by the funder to the lessor, typically structured on a nonrecourse

Collateral is an item of value, such as property or assets, that is pledged by an individual (borrower) in order to guaranty a loan. Upon default, the collateral becomes subject to seizure by the lender and may be sold to satisfy the debt.

It can also be used if the buyer is assigning its rights under a stock purchase agreement or any other kind of acquisition agreement. The collateral assignment assigns the rights of the buyer under the asset purchase agreement to a lender as security for a loan from the lender to the buyer.

How does collateral assignment work? A collateral assignment of life insurance directs your insurance provider to use your death benefit to pay off an existing loan if you die while in debt. After the lender is paid, any remaining funds go to your policy's beneficiaries.

With a deed of trust, the borrower promises the lender to repay the loan. The loan is secured on real property which the borrower has pledged as security (collateral) for the loan.

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.