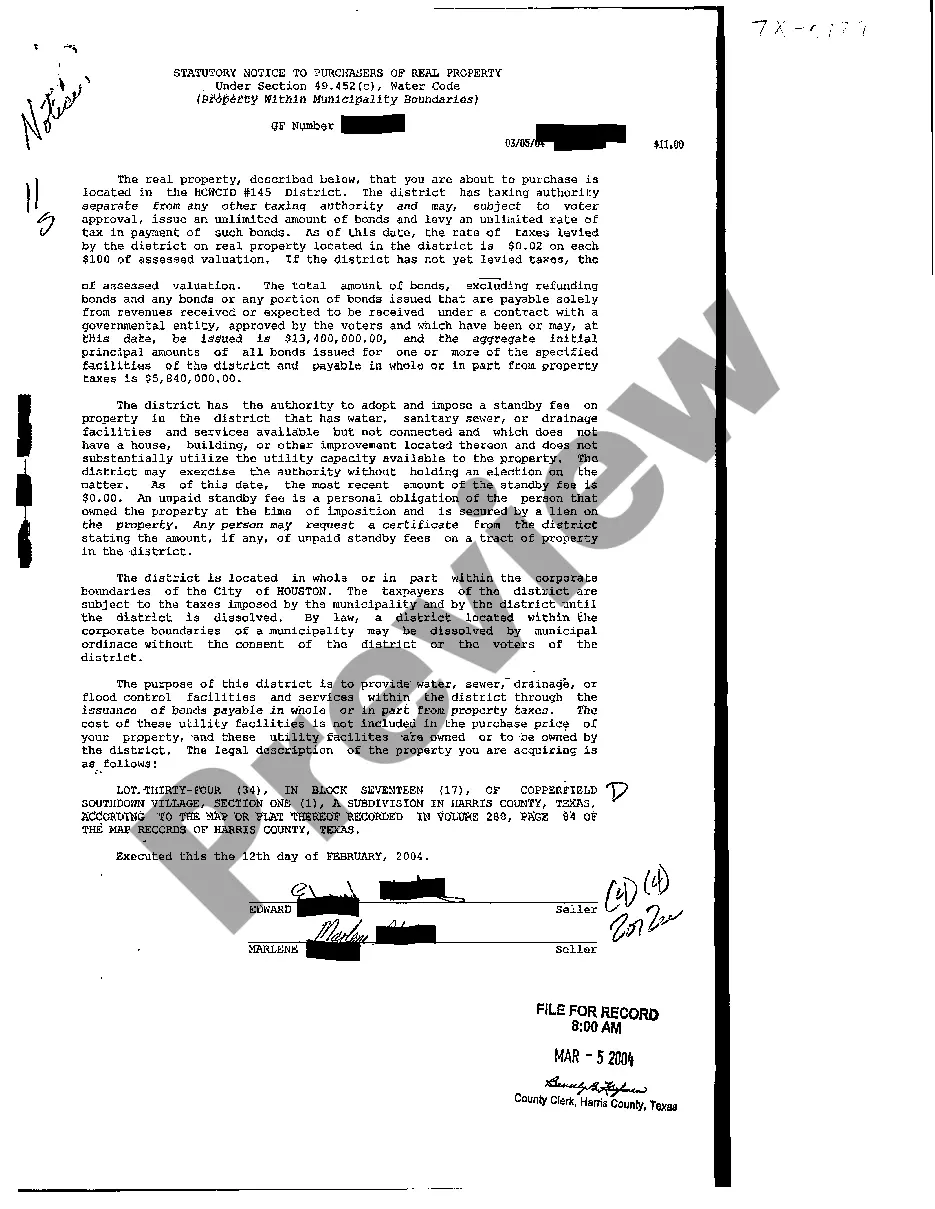

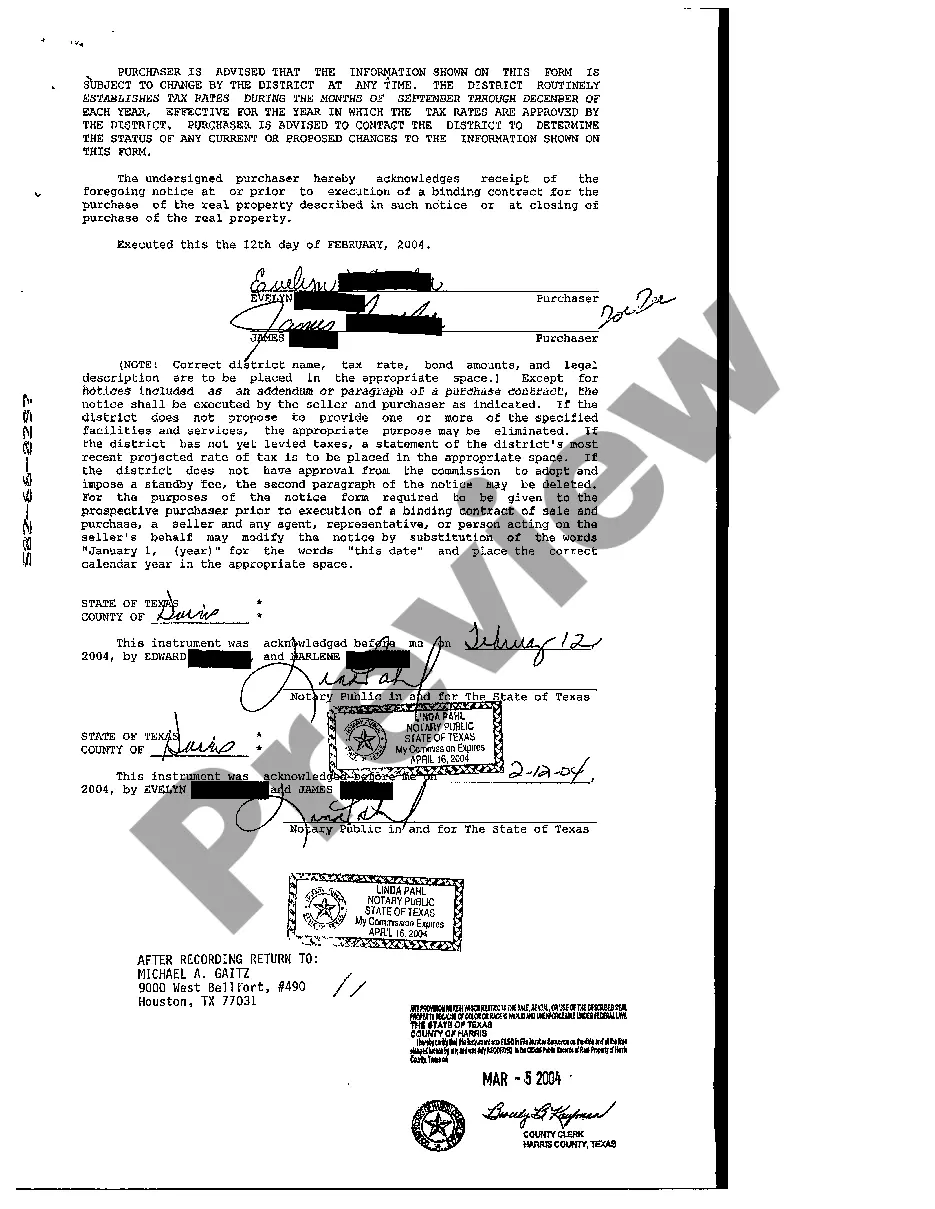

The Round Rock Texas Statutory Notice to Purchasers of Real Property is a legal obligation that provides important information to potential buyers about their rights and responsibilities when entering into a real estate transaction in Round Rock, Texas. This notice serves as a disclosure document mandated by state law and gives purchasers certain protections and disclosures they should be aware of before finalizing a property purchase. The Round Rock Texas Statutory Notice to Purchasers of Real Property covers various key aspects of the transaction process, including property condition, potential environmental hazards, property taxes, zoning regulations, and potential legal disputes. By including relevant keywords, this description becomes more useful for readers looking to understand the specific areas covered by the notice. Different types of Round Rock Texas Statutory Notice to Purchasers of Real Property may include: 1. Property Condition Notice: This type of notice informs purchasers about the current condition of the property they intend to acquire. It may highlight any structural issues, repairs needed, or existing damages that may affect the property's value or pose safety concerns. 2. Environmental Hazard Notice: This notice provides information on any known hazardous materials or conditions on or near the property that may have an impact on health or potential liability. It may detail the presence of lead-based paint, asbestos, or radon gas, along with any required disclosures or precautions. 3. Property Tax Notice: This type of notice is specific to Round Rock, Texas, and informs purchasers about the property tax obligations and assessed value associated with the property. It may include details on tax rates, exemptions, and any pending tax liens or assessments. 4. Zoning and Land Use Notice: This notice alerts purchasers to the zoning regulations, land use restrictions, and any planned developments/enhancements in the vicinity of the property. It ensures that buyers are aware of any restrictions or changes that might affect their intended use of the property. 5. Legal Dispute Notice: This type of notice informs purchasers if there are any ongoing legal disputes or pending lawsuits related to the property they are considering buying. It ensures transparency, allowing buyers to make informed decisions about the potential risks associated with the property. In conclusion, the Round Rock Texas Statutory Notice to Purchasers of Real Property is a comprehensive disclosure document that covers various critical aspects of a real estate transaction. It is essential for buyers to review and understand these notices thoroughly to make informed decisions and mitigate potential risks associated with the property purchase.

Round Rock Texas Statutory Notice to Purchases of Real Property

Description

How to fill out Round Rock Texas Statutory Notice To Purchases Of Real Property?

Regardless of social or professional standing, finishing legal documents is a regrettable obligation in today's work environment.

Too frequently, it's nearly impossible for someone lacking legal training to generate this type of paperwork from scratch, primarily due to the intricate terminology and legal subtleties that accompany it.

This is where US Legal Forms proves invaluable.

- Our service provides a vast collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal context.

- US Legal Forms also acts as a tremendous resource for associates or legal advisors seeking to enhance their efficiency using our DIY forms.

- Regardless of whether you require the Round Rock Texas Statutory Notice to Purchases of Real Property or another document valid in your jurisdiction, everything is readily available through US Legal Forms.

- Here’s the process to obtain the Round Rock Texas Statutory Notice to Purchases of Real Property in minutes using our reliable service.

- If you are already an existing customer, feel free to Log In to your account to access the required form.

Form popularity

FAQ

Why must brokerages display information about the Texas real estate recovery trust account? The real estate recovery trust account is one of the ways Texas protects consumers in the event of misdeeds by license holders.

The general purpose of recording statutes is to permit (rather than require) the recordation of any instrument which affects the title to or possession of real property, and to penalize the person who fails to take advantage of recording.

What is the IABS? Texas law requires all brokers and sales agents to provide written notice regarding information about brokerage services at the first substantive communication with prospective buyers, tenants, sellers, and landlords concerning specific real property.

Birth certificates and marriage licenses are recordable documents. A recordable document is one that is recorded with some type of entity whether it be the Secretary of State's Office, a court of law, a county clerk, or the Bureau of Vital Statistics. Certified copies may be obtained by contacting such entities.

5.008. SELLER'S DISCLOSURE OF PROPERTY CONDITION.

There are three basic types of recording statutes: race, race-notice, and notice. A race statute protects a subsequent purchaser who records their conveyance first, regardless of whether the subsequent purchaser had notice of any prior conveyances.

The Consumer Protection Notice must be hyperlinked in a readily noticeable location on the homepage of your business website. For real estate brokers, sales agents, and inspectors, the text for the link must be either: Texas Real Estate Commission Consumer Protection Notice in at least 10-point font.

STANDARD ? Because Texas has a ?notice? recordation statute, an examiner should not presume that the order of filing or recording of competing instruments establishes priority of right or that unrecorded instruments are subordinate. Common Law Rule ? First in time is first in right.

For a deed to be recorded (or registered), the grantor's signa- ture must be properly acknowl- edged or witnessed (Texas Prop- erty Code, Section 12.001b). An acknowledgment is a statutory procedure whereby persons signing a document declare their action before a qualified person, usually a notary public.

THIS NOTICE IS A DISCLOSURE OF SELLER'S KNOWLEDGE OF THE CONDITION OF THE PROPERTY AS OF THE DATE SIGNED BY SELLER AND IS NOT A SUBSTITUTE FOR ANY INSPECTIONS OR WARRANTIES THE PURCHASER MAY WISH TO OBTAIN. IT IS NOT A WARRANTY OF ANY KIND BY SELLER OR SELLER'S AGENTS.