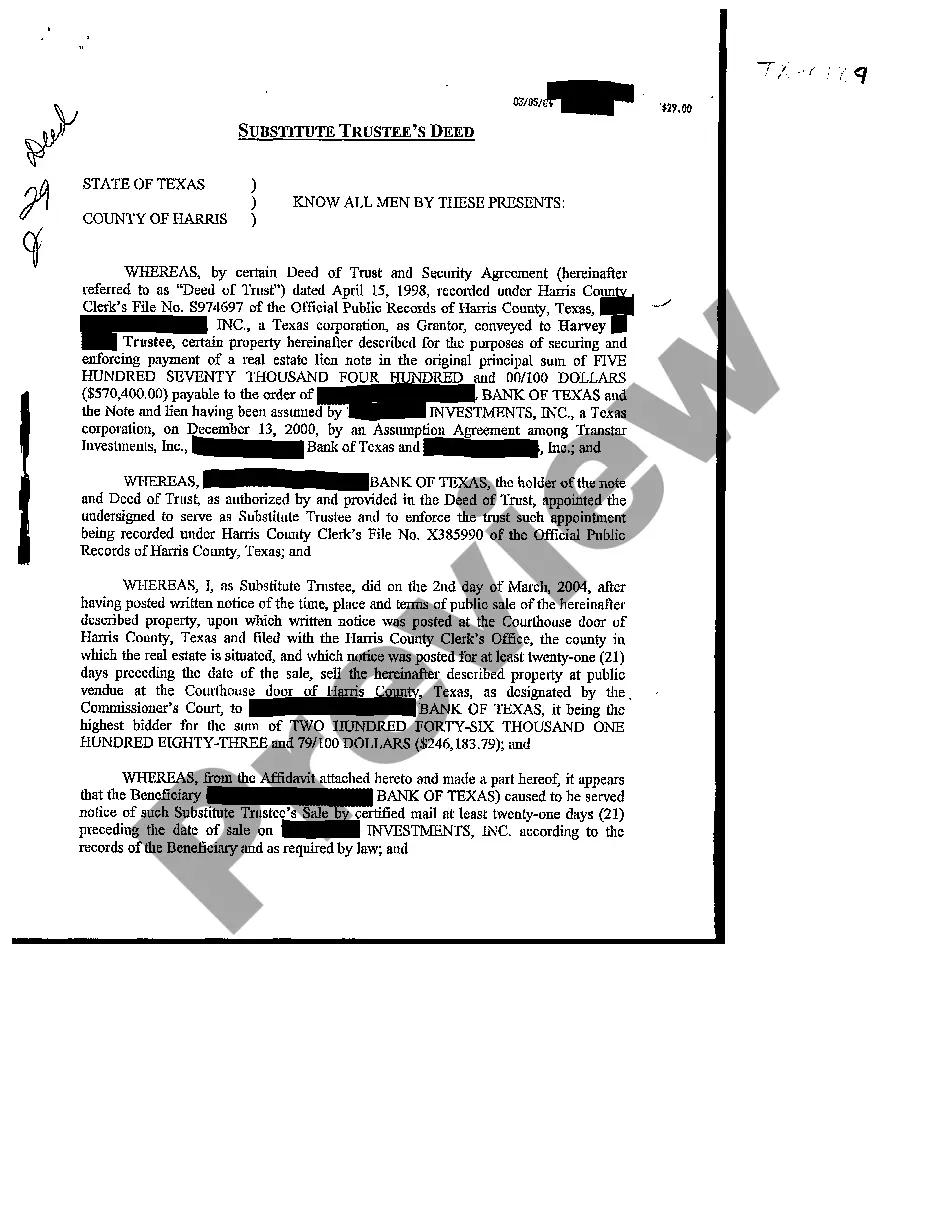

Pearland Texas Substitute Trustee's Deed

Description

How to fill out Texas Substitute Trustee's Deed?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements along with various real-world scenarios.

All the forms are systematically organized by category of use and jurisdictional regions, making it simple to find the Pearland Texas Substitute Trustee's Deed in no time.

By leveraging the US Legal Forms library, you can effortlessly maintain organized paperwork that adheres to legal standards and have vital document templates readily available for any requirement!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your needs and aligns with your local jurisdiction standards.

- Search for an additional template, if necessary.

- If you spot any discrepancies, utilize the Search tab above to pinpoint the correct document. If it meets your criteria, proceed to the following step.

- Purchase the document.

Form popularity

FAQ

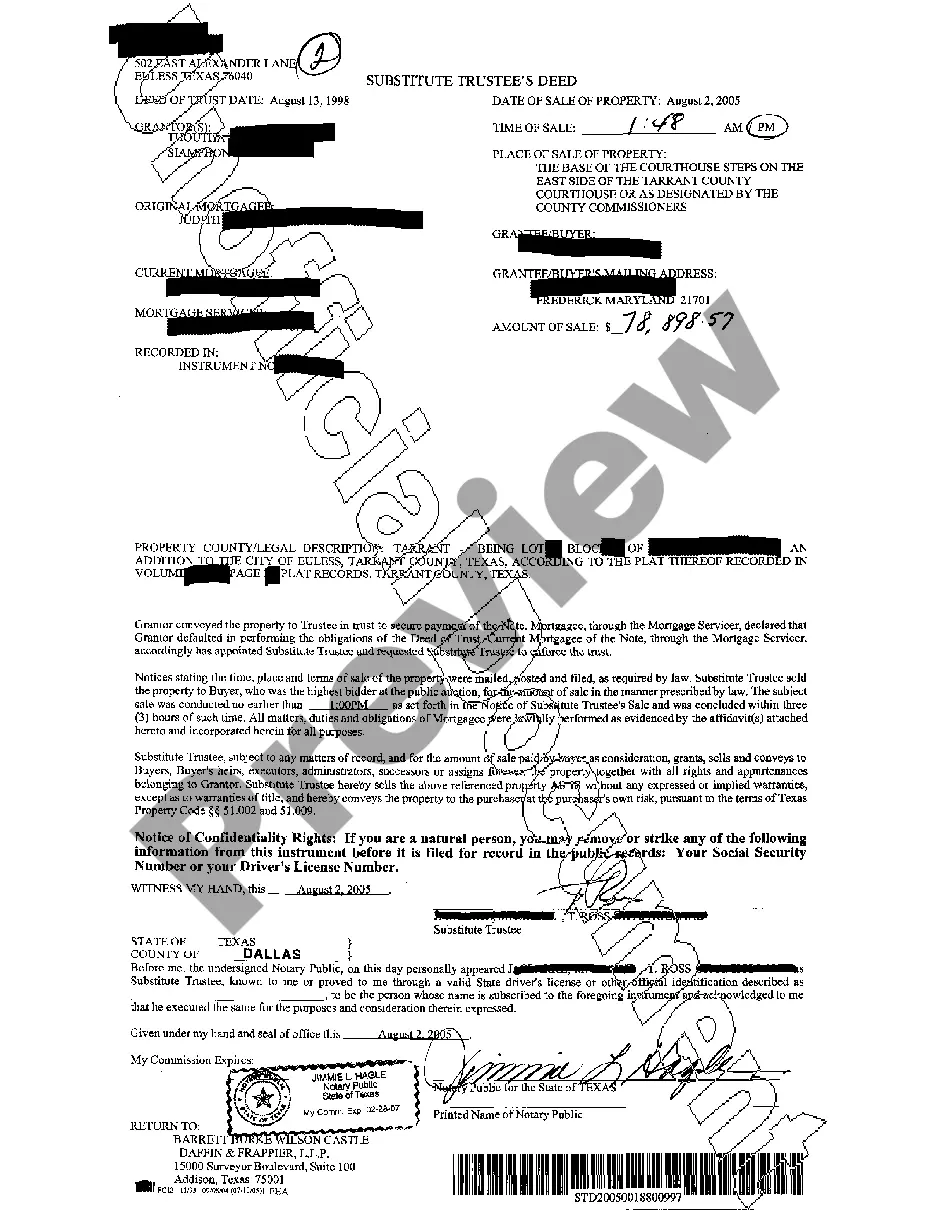

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

The trustee named in a Texas deed of trust can be any individual person who has the legal capacity to hold and transfer property. Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas.

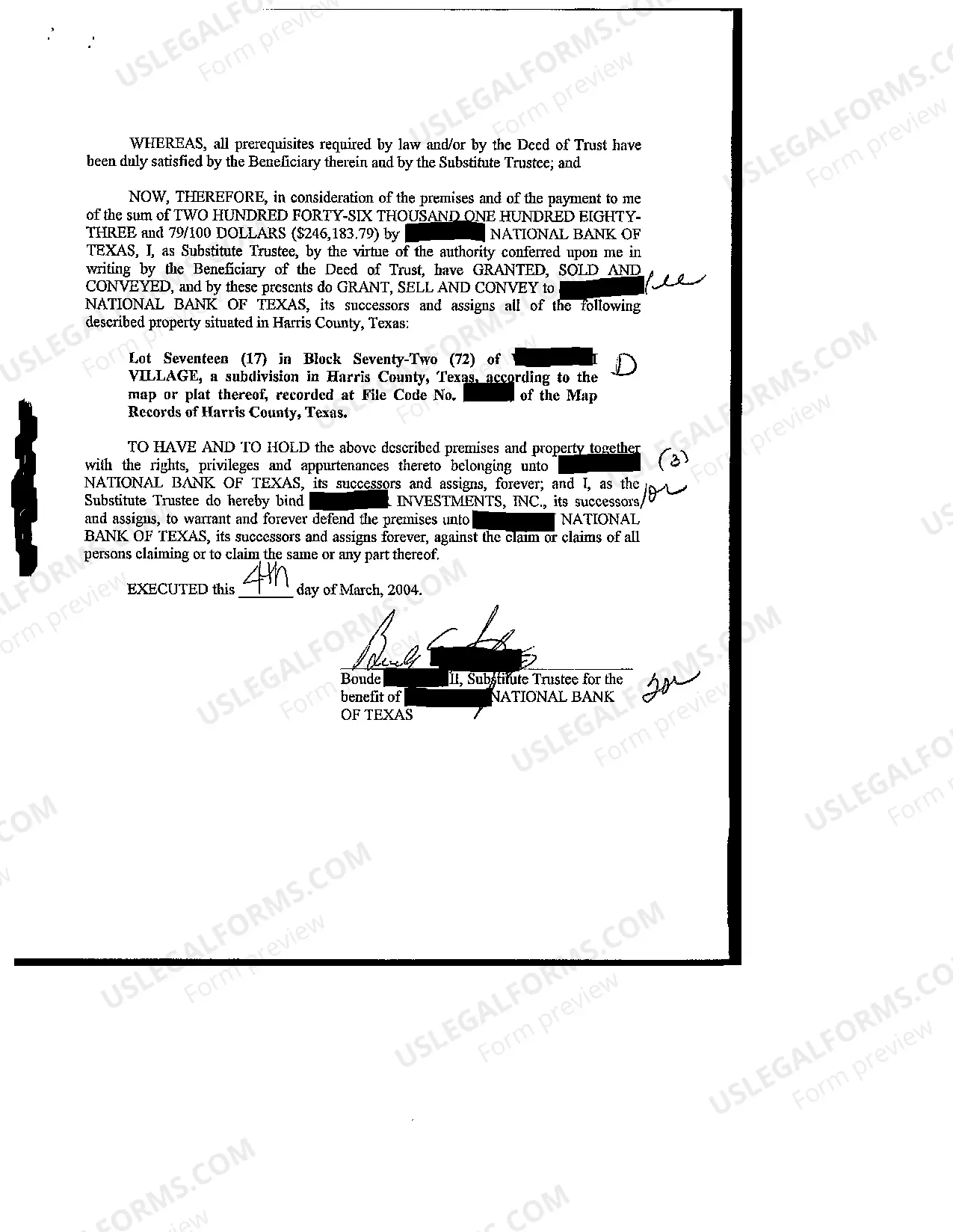

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

In simple terms, anyone who has the capacity to hold property can be a trustee. It is possible to be both a beneficiary and a trustee, although this may not always be appropriate. A trust may have just professional trustees, just lay trustees or a combination of the two.

When you set up a living trust as the grantor, you designate both trustees and beneficiaries. You can designate the same person as both a beneficiary and a trustee, and you can even name yourself as a trustee and beneficiary.

A substitution of trustee under a trust deed is a legal document that allows the mortgage lender to change the person or business entity that will carry out the private trustee's foreclosure sale.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

A substitution of trustee simply names a new person to take over that position, as well as a secondary trustee if necessary. A substitution of trustee and full reconveyance serves two purposes: It enables a lender (such as a mortgage company) to appoint a new trustee. It allows the new trustee to release the lien.