Title: Understanding the Grand Prairie Texas Substitute Trustee's Notice of Sale Keywords: Grand Prairie Texas, Substitute Trustee's Notice of Sale, foreclosure, mortgage, property, auction, legal action, borrower, trustee, lender, public notice, default, sale date, redeem, satisfaction, debt Introduction: The Grand Prairie Texas Substitute Trustee's Notice of Sale serves as a crucial legal document that notifies borrowers, lenders, and interested parties about an impending foreclosure auction or sale in Grand Prairie, Texas. This notice contains vital information about the property, the impending sale, and the steps that can be taken by the borrower to prevent or resolve the foreclosure process. Types of Grand Prairie Texas Substitute Trustee's Notice of Sale: 1. Initial Notice of Default: When a borrower fails to make timely mortgage payments, the lender, also known as the trustee, may issue a Notice of Default. This notice informs the borrower that they are in default on their mortgage and provides a specified period, typically 30 days, to cure the default by paying the overdue amounts. 2. Substitute Trustee's Notice of Sale: If the borrower fails to rectify the default within the specified timeframe, the trustee proceeds to issue a Substitute Trustee's Notice of Sale. This notice declares the lender's intent to sell the property through a public auction to recover the debt owed by the borrower. Content of the Substitute Trustee's Notice of Sale: 1. Identification Details: The notice specifies the names of the lender, borrower, and trustee, along with their contact information. It also mentions the legal description and street address of the property being foreclosed. 2. Default Details: The notice highlights the borrower's default, mentioning the outstanding amount, overdue payments, penalties, interest, and any additional fees that have accrued during the default period. 3. Sale Date and Time: A crucial aspect of the notice is the announcement of the sale date, time, and location, which is typically held on the county courthouse steps or an assigned venue. This date signifies when the property will be auctioned to the highest bidder. 4. Redemption Period: In some cases, Texas law grants a redemption period, enabling the borrower to redeem or repurchase the property after the sale by paying off the debt owed, interest, and associated costs within a specific timeframe. 5. Right to Contest: The notice informs the borrower of their right to contest the foreclosure by filing a legal action within a specified period to halt or postpone the sale. This legal action is typically initiated in a state court. 6. Satisfaction of Debt: If the borrower successfully cures the default or pays off the debt before the sale, the notice provides instructions to satisfy the debt and prevent the property from going to auction. Conclusion: In essence, the Grand Prairie Texas Substitute Trustee's Notice of Sale is a critical document that initiates the foreclosure process and informs the borrower and concerned parties about the upcoming auction. Understanding the contents and implications of this notice can help the borrower take appropriate actions to prevent the loss of their property or find alternative resolutions.

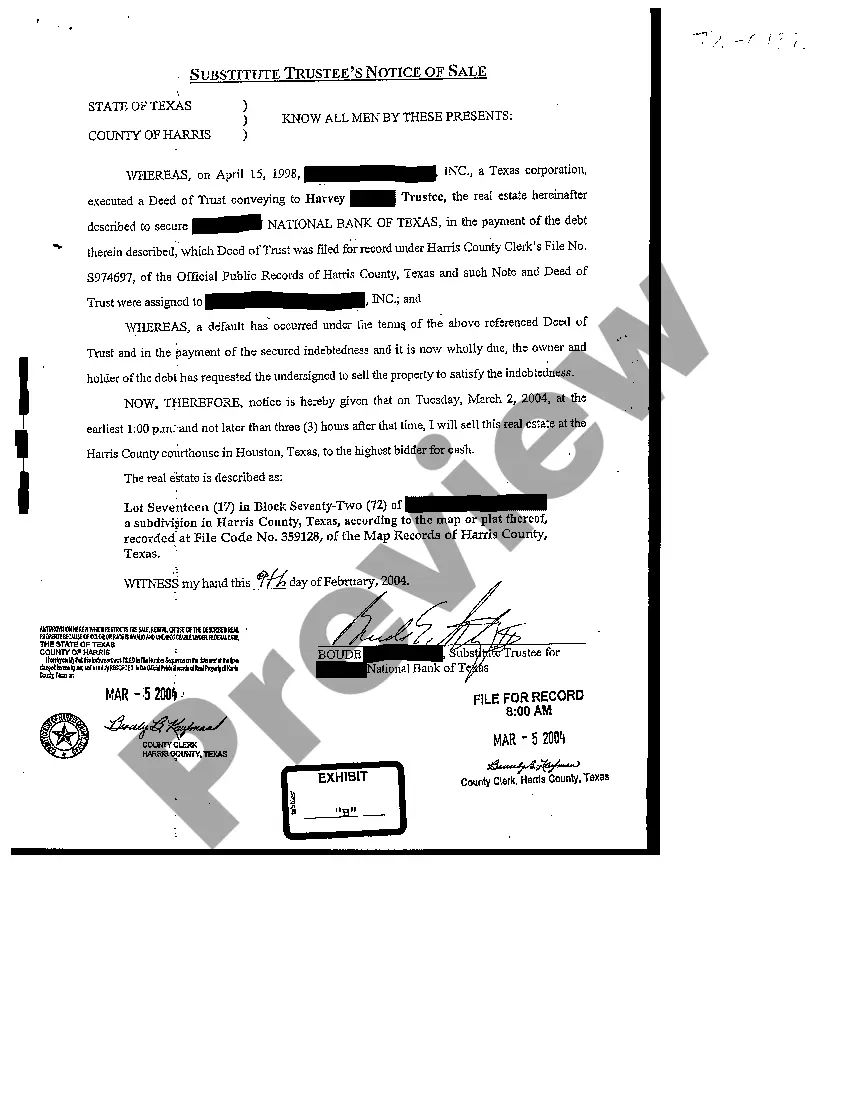

Grand Prairie Texas Substitute Trustee's Notice of Sale

Description

How to fill out Grand Prairie Texas Substitute Trustee's Notice Of Sale?

If you are searching for a relevant form, it’s impossible to find a more convenient place than the US Legal Forms website – one of the most considerable libraries on the internet. With this library, you can get thousands of templates for organization and personal purposes by types and regions, or keywords. With the high-quality search function, getting the latest Grand Prairie Texas Substitute Trustee's Notice of Sale is as easy as 1-2-3. Additionally, the relevance of every file is proved by a group of skilled lawyers that regularly check the templates on our platform and revise them according to the latest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Grand Prairie Texas Substitute Trustee's Notice of Sale is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the form you require. Look at its explanation and utilize the Preview feature (if available) to see its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the appropriate document.

- Affirm your selection. Select the Buy now button. Following that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Choose the file format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Grand Prairie Texas Substitute Trustee's Notice of Sale.

Every single form you save in your user profile does not have an expiry date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you want to have an extra version for enhancing or printing, you may return and download it again at any moment.

Make use of the US Legal Forms professional collection to get access to the Grand Prairie Texas Substitute Trustee's Notice of Sale you were seeking and thousands of other professional and state-specific samples on a single platform!