Austin Texas Rescission of Acceleration of Loan Maturity refers to a legal process by which the acceleration clause in a loan agreement is rescinded or cancelled in the state of Texas, specifically in the city of Austin. The acceleration clause is a provision commonly found in loan agreements that allows the lender to demand immediate payment of the entire outstanding loan balance if the borrower fails to meet certain obligations, such as defaulting on payments or violating other loan terms. The rescission of acceleration of loan maturity serves as a safeguard for borrowers who may be struggling to meet their loan obligations but wish to avoid the immediate payment of the entire loan balance. By rescinding the acceleration clause, borrowers in Austin, Texas, have the opportunity to negotiate new payment terms or explore alternatives to satisfaction of the loan without facing the threat of immediate default. It is important to note that there may be different types of Austin Texas Rescission of Acceleration of Loan Maturity, which can vary based on specific circumstances and the agreement between the borrower and the lender. These types may include: 1. Judicial Rescission: This type of rescission occurs through a legal process initiated by the borrower in a court of law. The borrower files a lawsuit seeking the rescission of the acceleration clause and presents evidence or arguments to support their position. The court then makes a determination based on applicable laws and regulations. 2. Voluntary Rescission: In this case, the borrower and the lender mutually agree to cancel the acceleration clause. The borrower may propose alternative payment terms or provide reassurances of their ability to fulfill the loan obligations in a timely manner. Both parties negotiate and reach an agreement to rescind the acceleration clause. 3. Rescission through Loan Modification: Here, the borrower and the lender modify the terms of the loan agreement, which may include removing or altering the acceleration clause. This type of rescission typically occurs when the borrower is experiencing financial hardship and approaches the lender to discuss options for restructuring the loan. Overall, the Austin Texas Rescission of Acceleration of Loan Maturity provides borrowers in Austin, Texas, with the opportunity to address loan repayment challenges without being faced with immediate default. It allows for negotiation, legal intervention, or loan modification to find a viable solution that benefits both the borrower and lender.

Austin Texas Rescission of Acceleration of Loan Maturity

Description

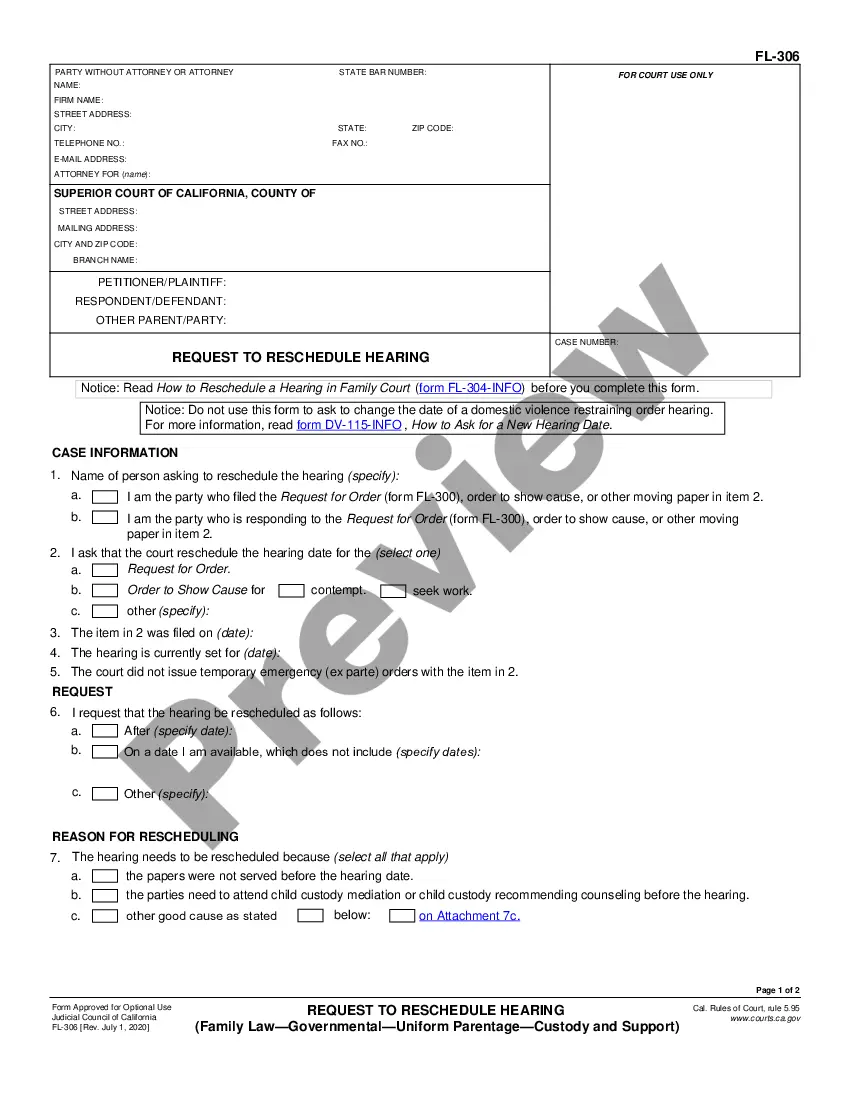

How to fill out Austin Texas Rescission Of Acceleration Of Loan Maturity?

We consistently endeavor to diminish or avert legal complications when handling intricate legal or financial matters.

To achieve this, we seek attorney services that are generally quite expensive.

Nevertheless, not all legal issues exhibit the same level of complexity.

The majority of them can be managed independently.

Take advantage of US Legal Forms whenever you need to acquire and download the Austin Texas Rescission of Acceleration of Loan Maturity or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorneys to incorporation articles and dissolution petitions.

- Our collection empowers you to manage your affairs without relying on legal representation.

- We offer access to legal document templates that are not always accessible to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Texas law requires that the lender/servicer must send the borrower a notice of default and intent to accelerate by certified mail that provides at least 20 days to cure the default before notice of sale can be given.

The good news is, borrowers are generally able to avoid acceleration by working out a loan modification or repayment plan with their lender to make up delinquent payments. This is called a mortgage reinstatement.

An accelerated clause is a term in a loan agreement that requires the borrower to pay off the loan immediately under certain conditions. An accelerated clause is typically invoked when the borrower materially breaches the loan agreement.

After the loan is accelerated, the borrower can no longer pay off the loan in installments; the loan changes from an installment contract to a debt that's due in a single, lump-sum payment.

The Notice of Acceleration is just one name for a document from your lender which advises you that ALL of your mortgage payments, including past missed payments, will be due within the next 30 to 90 days.

Upon acceleration, the entire unpaid balance becomes due and the six-year period begins to run on the entire unpaid balance of the mortgage debt. Depending on the terms of the mortgage, acceleration may be automatic, or at the option of the mortgagee.

The Notice of Acceleration is just one name for a document from your lender which advises you that ALL of your mortgage payments, including past missed payments, will be due within the next 30 to 90 days.

An acceleration clause allows the lender to require payment before the standard terms of the loan expire. Acceleration clauses are typically contingent on on-time payments. Acceleration clauses are most common in mortgage loans and help to mitigate the risk of default for the lender.

What Are Foreclosure Acceleration Clauses? Foreclosure proceedings are possible because most mortgage loan documentation contains an acceleration clause. This clause gives the lender the right to collect the entire amount due on the loan if the borrower fails to make the monthly mortgage payments.

After the loan is accelerated, the borrower can no longer pay off the loan in installments; the loan changes from an installment contract to a debt that's due in a single, lump-sum payment.