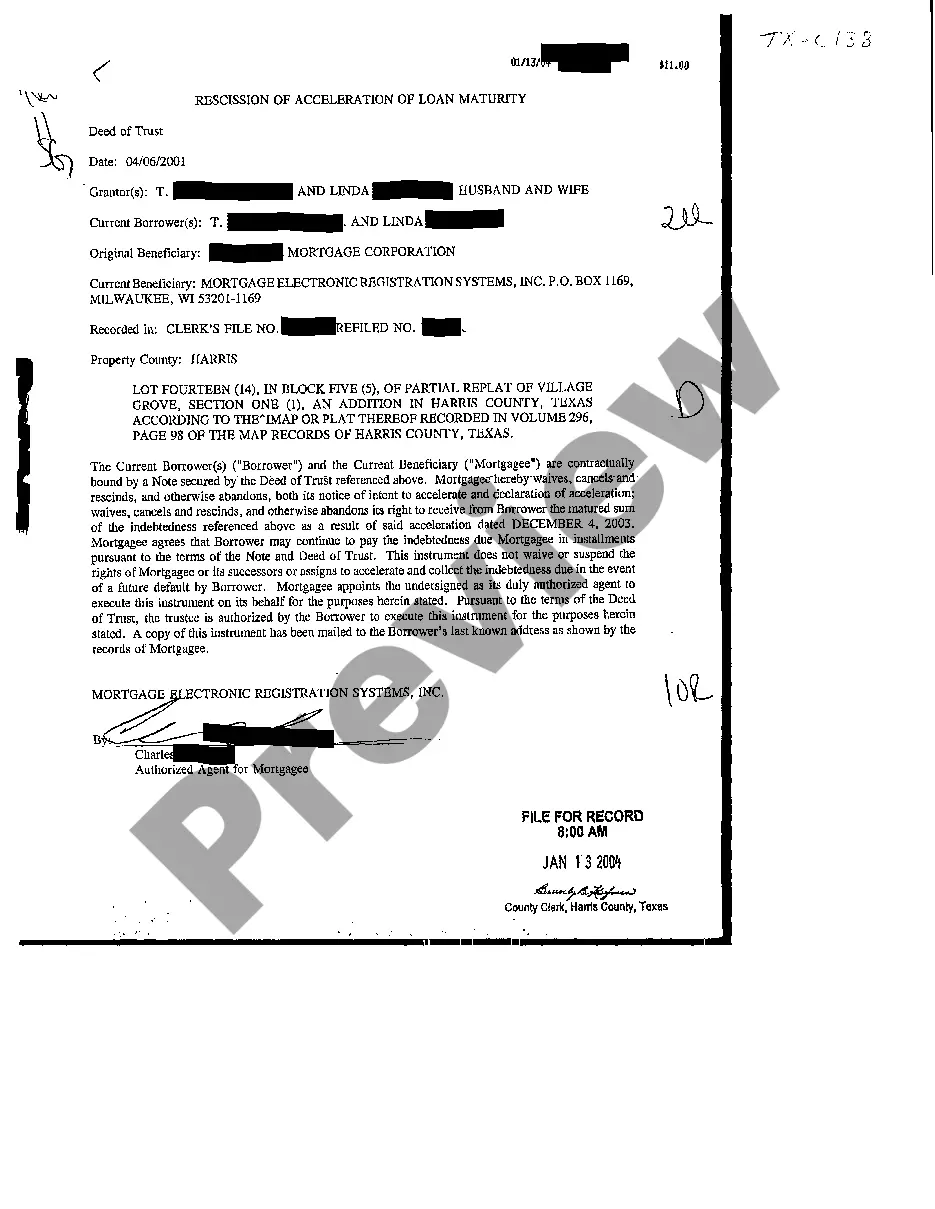

Brownsville Texas Rescission of Acceleration of Loan Maturity refers to the process by which a borrower in Brownsville, Texas can revoke or reverse the acceleration of their loan maturity. When a loan is accelerated, it means that the lender has called for the full repayment of the loan balance due to default or breach of the loan agreement. However, under certain circumstances, the borrower may have the right to rescind or cancel this acceleration, allowing them to continue making regular payments on the loan. The rescission process in Brownsville, Texas usually involves the borrower filing a formal request or notice with the lender, stating their intent to reverse the acceleration and resume regular loan payments. Depending on the specific situation, the borrower may need to provide supporting documentation or evidence demonstrating their ability to meet the loan obligations going forward. Keywords: Brownsville Texas, rescission of acceleration, loan maturity, borrower, lender, repayment, default, breach, loan agreement, regular payments, formal request, notice, resume, supporting documentation, loan obligations. Types of Brownsville Texas Rescission of Acceleration of Loan Maturity: 1. Legal Rescission: This type of rescission occurs when the borrower challenges the validity of the acceleration based on legal grounds, such as a breach of contract, predatory lending practices, or any other violation of state or federal law. Through legal action, the borrower seeks to have the acceleration revoked and return the loan to its original terms. 2. Financial Rescission: In some cases, a borrower may request rescission of acceleration based on their improved financial situation. This may involve providing evidence of increased income, the settlement of previous debts, or other financial improvements that demonstrate the borrower's ability to resume regular loan payments. If approved, the lender may agree to reverse the acceleration and allow the borrower to continue paying as scheduled. 3. Negotiated Rescission: Sometimes, a borrower and lender can come to an agreement through negotiation or mediation to rescind the acceleration. This typically occurs when there are extenuating circumstances that led to the acceleration, such as temporary financial hardship or unforeseen events. The borrower may propose revised payment terms or seek other concessions, and if both parties reach a mutually beneficial agreement, the acceleration is reversed. 4. Statutory Rescission: Certain state or federal laws may grant borrowers the right to rescind an acceleration of loan maturity in specific situations. These laws may provide a defined period within which the borrower can exercise their right to cancel the acceleration, usually within a set number of days from receiving notice. It is important for borrowers in Brownsville, Texas to familiarize themselves with applicable statutory rights and deadlines. 5. Voluntary Rescission: Occasionally, a lender may agree to voluntarily rescind an acceleration without any legal or financial pressures. This can happen if the lender determines that it is in their best interest to reinstate the original loan terms or if they want to maintain a positive relationship with the borrower. However, voluntary rescission is at the discretion of the lender and not guaranteed. It is crucial for borrowers facing an acceleration of loan maturity in Brownsville, Texas to consult with a legal professional or seek advice from a financial expert to fully understand their rights and options for rescission, as the process can vary depending on the specific circumstances and applicable laws.

Brownsville Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out Brownsville Texas Rescission Of Acceleration Of Loan Maturity?

Take advantage of the US Legal Forms and gain immediate access to any form template you desire.

Our advantageous platform, filled with a vast array of documents, makes it easy to locate and acquire nearly any form sample you wish.

You can download, fill out, and sign the Brownsville Texas Rescission of Acceleration of Loan Maturity in just a few minutes instead of spending hours online searching for the right template.

Utilizing our catalog is a fantastic method to enhance the security of your document submission.

Access the page with the form you need. Ensure that it is the form you were seeking: check its title and description, and use the Preview option when available. If not, use the Search field to locate the desired one.

Initiate the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your purchase using a credit card or PayPal.

- Our experienced attorneys routinely review all documents to ensure that the templates are suitable for a specific jurisdiction and comply with the latest laws and regulations.

- How can you procure the Brownsville Texas Rescission of Acceleration of Loan Maturity? If you already have a subscription, simply Log In to your account.

- The Download option will be activated on all the samples you view.

- Additionally, you can access all the previously saved documents in the My documents section.

- If you haven’t yet registered, follow the instructions below.

Form popularity

FAQ

In physics, a letter symbol often represents acceleration, typically denoted by 'a'. This letter indicates the rate at which an object changes its velocity. While this concept is separate from financial terms, knowing about acceleration can enrich your understanding of both fields.