Carrollton Texas Rescission of Acceleration of Loan Maturity is a legal process that allows borrowers in Carrollton, Texas, to reset the terms of their loan agreements in the event of default. This process provides borrowers an opportunity to reinstate the loan, effectively canceling any acceleration of the loan maturity date. In Carrollton, Texas, there are two main types of Rescission of Acceleration of Loan Maturity: 1. Judicial Rescission: This type of Rescission of Acceleration of Loan Maturity is initiated through a lawsuit filed by the borrower against the lender. It involves the borrower seeking court intervention to review the circumstances of the acceleration of the loan maturity and potentially overturn the decision. Carrollton's borrowers may opt for this type if they believe the acceleration was unjustified or if there are valid defenses to the default. 2. Non-Judicial Rescission: This type of Rescission of Acceleration of Loan Maturity is an out-of-court process, often facilitated by a loan modification or loss mitigation specialist. The borrower and lender negotiate new terms to reinstate the loan, taking into consideration the borrower's financial situation and any potential changes in loan terms that may prevent future defaults. Non-judicial rescission typically involve direct communication between the borrower and the lender, aiming to achieve a mutually agreeable solution. Keywords: Carrollton Texas, Rescission of Acceleration of Loan Maturity, default, loan agreement, reset, terms, cancellation, acceleration, maturity date, judicial rescission, lawsuit, lender, court intervention, unjustified, valid defenses, non-judicial rescission, loan modification, loss mitigation, negotiation, financial situation, communication, mutually agreeable solution.

Carrollton Texas Rescission of Acceleration of Loan Maturity

Description

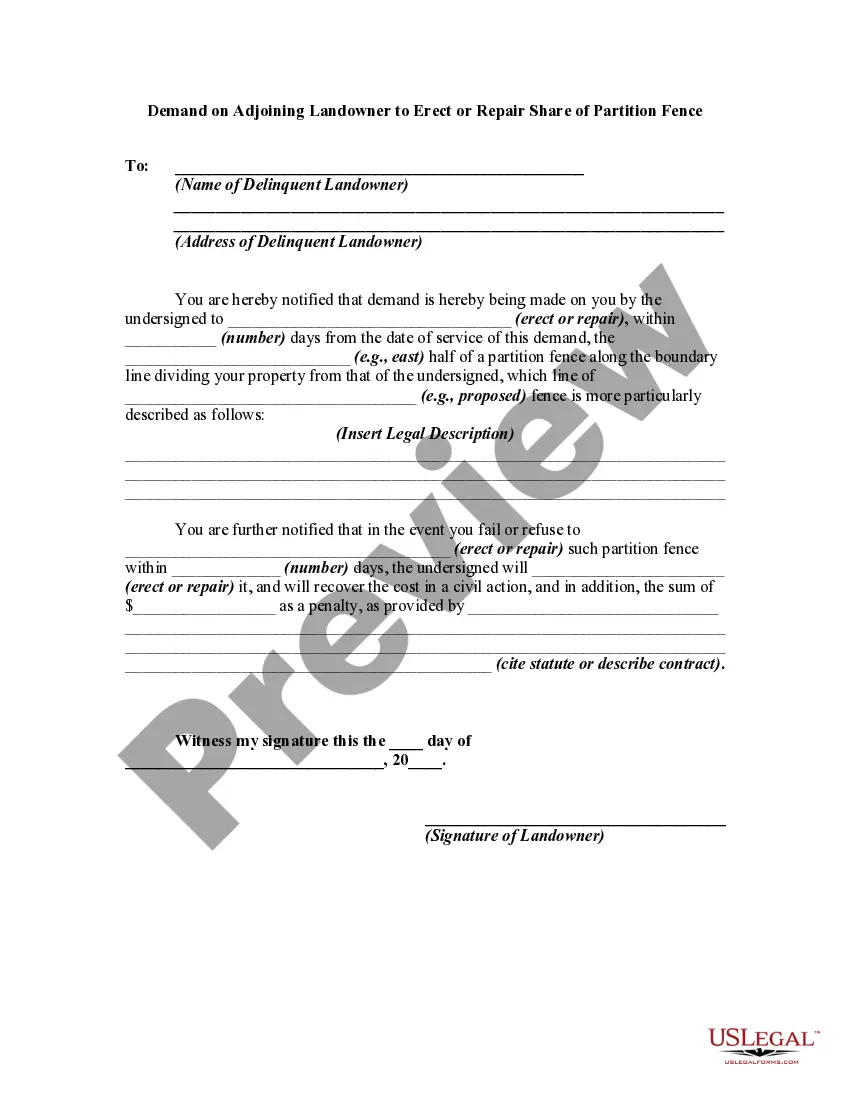

How to fill out Carrollton Texas Rescission Of Acceleration Of Loan Maturity?

Make use of the US Legal Forms and obtain instant access to any form sample you require. Our useful platform with a huge number of document templates makes it simple to find and obtain virtually any document sample you want. You can export, complete, and certify the Carrollton Texas Rescission of Acceleration of Loan Maturity in a few minutes instead of browsing the web for hours trying to find a proper template.

Using our collection is a great way to raise the safety of your record filing. Our experienced legal professionals regularly review all the records to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How can you obtain the Carrollton Texas Rescission of Acceleration of Loan Maturity? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Find the template you need. Make sure that it is the template you were seeking: examine its headline and description, and use the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the saving process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the file. Indicate the format to obtain the Carrollton Texas Rescission of Acceleration of Loan Maturity and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable template libraries on the internet. We are always happy to help you in any legal process, even if it is just downloading the Carrollton Texas Rescission of Acceleration of Loan Maturity.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!