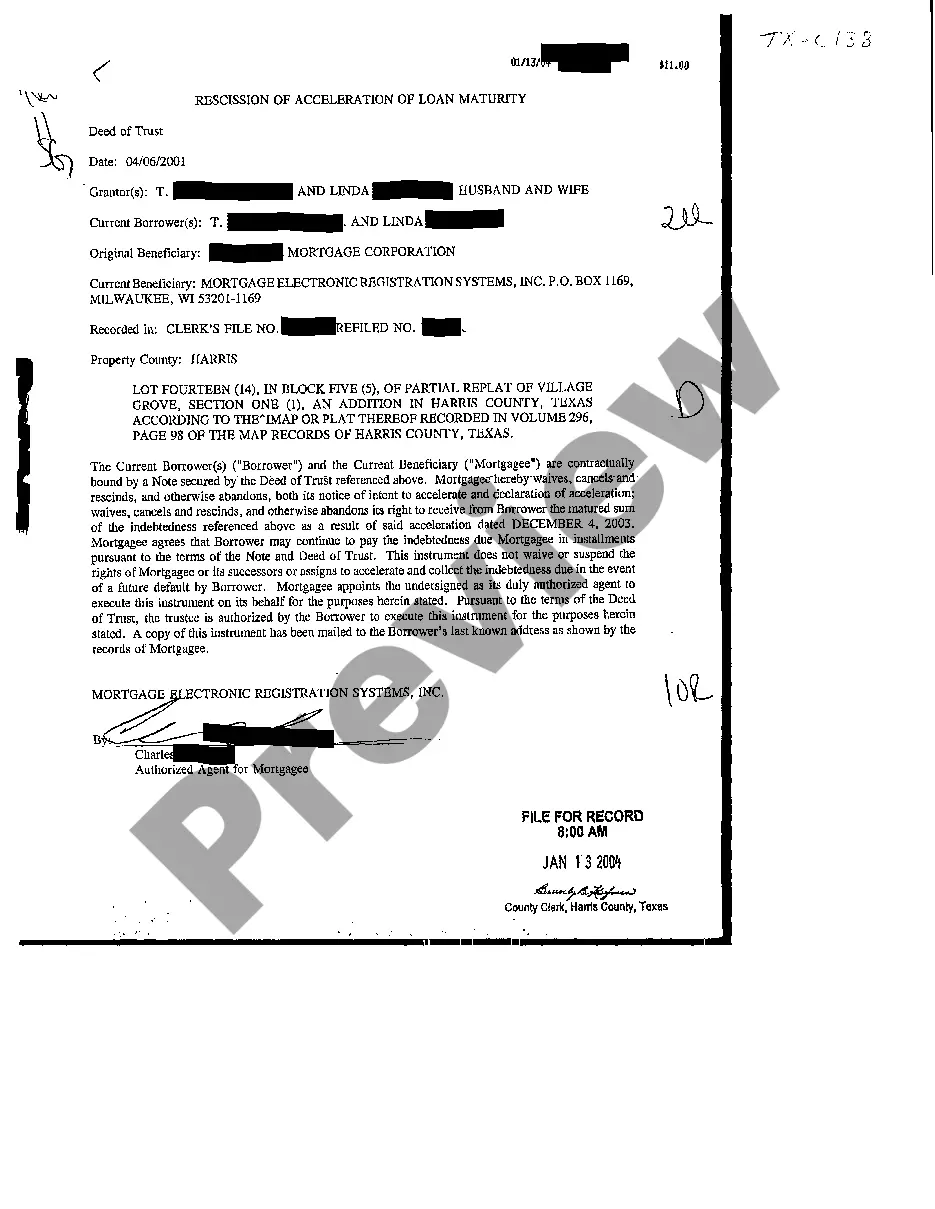

Title: Dallas Texas Rescission of Acceleration of Loan Maturity: Understanding Its Process and Types Introduction: In the realm of real estate and finance, loans and their maturity play a crucial role. One aspect to be familiar with is the process of Rescission of Acceleration of Loan Maturity. This article aims to provide a detailed description of what it entails, its significance, and shed light on different types that exist in Dallas, Texas. Understanding Rescission of Acceleration of Loan Maturity: Rescission of Acceleration of Loan Maturity refers to a legal process in which the acceleration clause of a loan agreement is revoked, restoring the original repayment schedule. This rescission allows borrowers to regain control over their loan terms by eliminating the immediate necessity to pay the remaining loan balance in full upon default. Types of Dallas Texas Rescission of Acceleration of Loan Maturity: 1. Judicial Rescission: — This type involves the borrower filing a lawsuit in the appropriate court, seeking a rescission judgment against the lender. The court analyzes the circumstances of the acceleration and determines if it was unjust or a violation of the loan agreement. 2. Voluntary Agreement: — In some cases, the borrower and lender may engage in negotiations or mediation aimed at reaching a voluntary agreement to rescind the acceleration clause. This often involves discussions about loan modifications, repayment plans, or loan refinancing to alleviate the default situation. 3. Statutory Rescission: — Under certain circumstances, state-specific laws in Texas may allow for rescission of loan acceleration. Such legal provisions might grant borrowers the right to request the reversal of acceleration if specific criteria are met, such as demonstrating evidence of rectification or mitigating circumstances that led to the default. Process of Rescission of Acceleration of Loan Maturity: To initiate the process of Rescission of Acceleration of Loan Maturity in Dallas, Texas, borrowers generally need to follow these steps: 1. Review Loan Agreement: — Carefully examine the loan agreement, paying close attention to the terms, conditions, and clauses related to acceleration, default, and any provision for rescission. 2. Consultation with Legal Counsel: — Seek the advice of an experienced real estate or finance attorney who specializes in loan and mortgage-related matters. They can assess your specific situation, evaluate the validity of the acceleration, and guide you through the rescission process. 3. Gather Supporting Evidence: — Collect all relevant documentation supporting your claim for rescission. This may include communication records, financial records, loan payment history, and any evidence that suggests unjust acceleration or non-compliance by the lender. 4. Initiate Legal Proceedings (if applicable): — If the chosen course of action is judicial rescission, your attorney will file the necessary lawsuit, outlining the grounds for rescinding the acceleration clause. The court will evaluate the case based on evidence presented by both parties. 5. Negotiate or Mediate: — In cases of voluntary agreement, your attorney will represent you in negotiations or medications with the lender. These discussions aim to find a mutually acceptable solution that involves the rescission of the acceleration clause and sets new terms for the loan. Conclusion: Dallas Texas Rescission of Acceleration of Loan Maturity encompasses various methods through which borrowers can reverse the acceleration clause in their loan agreements. By understanding the types and process involved, borrowers can navigate the complexities of loan defaults and exercise their rights to regain control over their loan terms in Dallas, Texas.

Dallas Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out Dallas Texas Rescission Of Acceleration Of Loan Maturity?

Are you looking for a reliable and affordable legal forms provider to get the Dallas Texas Rescission of Acceleration of Loan Maturity? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Dallas Texas Rescission of Acceleration of Loan Maturity conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Dallas Texas Rescission of Acceleration of Loan Maturity in any provided file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal papers online for good.

Form popularity

FAQ

Delayed or Missed Payments ? Repeated missed payments may force the lender to effectuate an acceleration clause. Thankfully, making full mortgage payments before can reverse the process.

Foreclosure Procedures Depending on state law and the circumstances, once the loan is accelerated and if you don't reinstate or take other steps to stop the process, the lender will either: file a lawsuit in court to foreclose (a judicial foreclosure), or.

The good news is, borrowers are generally able to avoid acceleration by working out a loan modification or repayment plan with their lender to make up delinquent payments. This is called a mortgage reinstatement.

The Notice of Acceleration is just one name for a document from your lender which advises you that ALL of your mortgage payments, including past missed payments, will be due within the next 30 to 90 days.

The notice of acceleration cuts off the borrower's right to cure the default after the 20-day notice of default period expires. If the borrower fails to cure the default, the foreclosure sale proceeds unless the borrower pays: The full (accelerated) amount of the loan.

For mortgages that have an acceleration clause (most do), that means that, after breaching your contract by missing payments, your lender can demand that you either pay off the entire balance of your mortgage or be foreclosed upon.

An acceleration clause allows the lender to require payment before the standard terms of the loan expire. Acceleration clauses are typically contingent on on-time payments. Acceleration clauses are most common in mortgage loans and help to mitigate the risk of default for the lender.

An acceleration clause is often part of a loan contract, and it allows a lender to require you to immediately repay all of your outstanding loan balance if you don't meet certain conditions. A lender may take advantage of this clause if you miss too many payments or breach the contract in some other way.

Interesting Questions

More info

0085 of the Texas Government Code: The parties hereby waive their right to trial by jury in the above-captioned matter. Plaintiff shall bear the costs of this action.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.