Title: Understanding League City Texas Rescission of Acceleration of Loan Maturity Description: In League City, Texas, the Rescission of Acceleration of Loan Maturity is an essential concept for borrowers and lenders to comprehend. This legal provision allows borrowers to roll back the acceleration of loan maturity, providing them with an opportunity to rectify default conditions and potentially avoid foreclosure. Keyword-rich Description: 1. Definition of Rescission of Acceleration of Loan Maturity: The Rescission of Acceleration of Loan Maturity in League City, Texas refers to a legal mechanism that allows borrowers to reverse the acceleration of their loan, restoring the original maturity date. It gives eligible individuals the chance to rectify default conditions and maintain their loan agreement. 2. Importance of Rescission of Acceleration of Loan Maturity: Understanding the process of Rescission of Acceleration of Loan Maturity is crucial for borrowers facing default. By triggering this provision, individuals can potentially avoid foreclosure, restoring their loan agreement and preserving their financial stability. 3. Eligibility for Rescission of Acceleration of Loan Maturity: To qualify for Rescission of Acceleration of Loan Maturity in League City, Texas, borrowers must meet specific criteria, including prompt and full payment of all outstanding delinquent amounts, adherence to the predetermined repayment terms, and compliance with any loan modification guidelines provided by the lender. 4. Potential Consequences of Non-compliance: Failure to meet the requirements of Rescission of Acceleration of Loan Maturity can have severe consequences. Lenders may proceed with foreclosure proceedings, resulting in the loss of the property and potential damage to the borrower's credit score. Types of League City Texas Rescission of Acceleration of Loan Maturity: 1. Standard Rescission of Acceleration of Loan Maturity: This type refers to the typical provision offered by lenders in League City, Texas, allowing borrowers to roll back the acceleration of the loan maturity date upon fulfilling the necessary conditions within a specified timeline. 2. Court-Ordered Rescission of Acceleration of Loan Maturity: In some cases, borrowers may seek legal intervention or file a lawsuit to obtain a court-ordered rescission of the acceleration of loan maturity. The decision rests with the court, based on specific circumstances presented by the borrower and lender. 3. Negotiated Rescission of Acceleration of Loan Maturity: Under certain circumstances, borrowers and lenders may negotiate alternative solutions to rescind the acceleration of loan maturity. This may involve modifying the loan agreement, settling outstanding dues, or agreeing to a revised repayment plan. By understanding the concepts and types of League City Texas Rescission of Acceleration of Loan Maturity, borrowers can take informed actions in addressing default situations and potentially preserving their financial stability and property ownership.

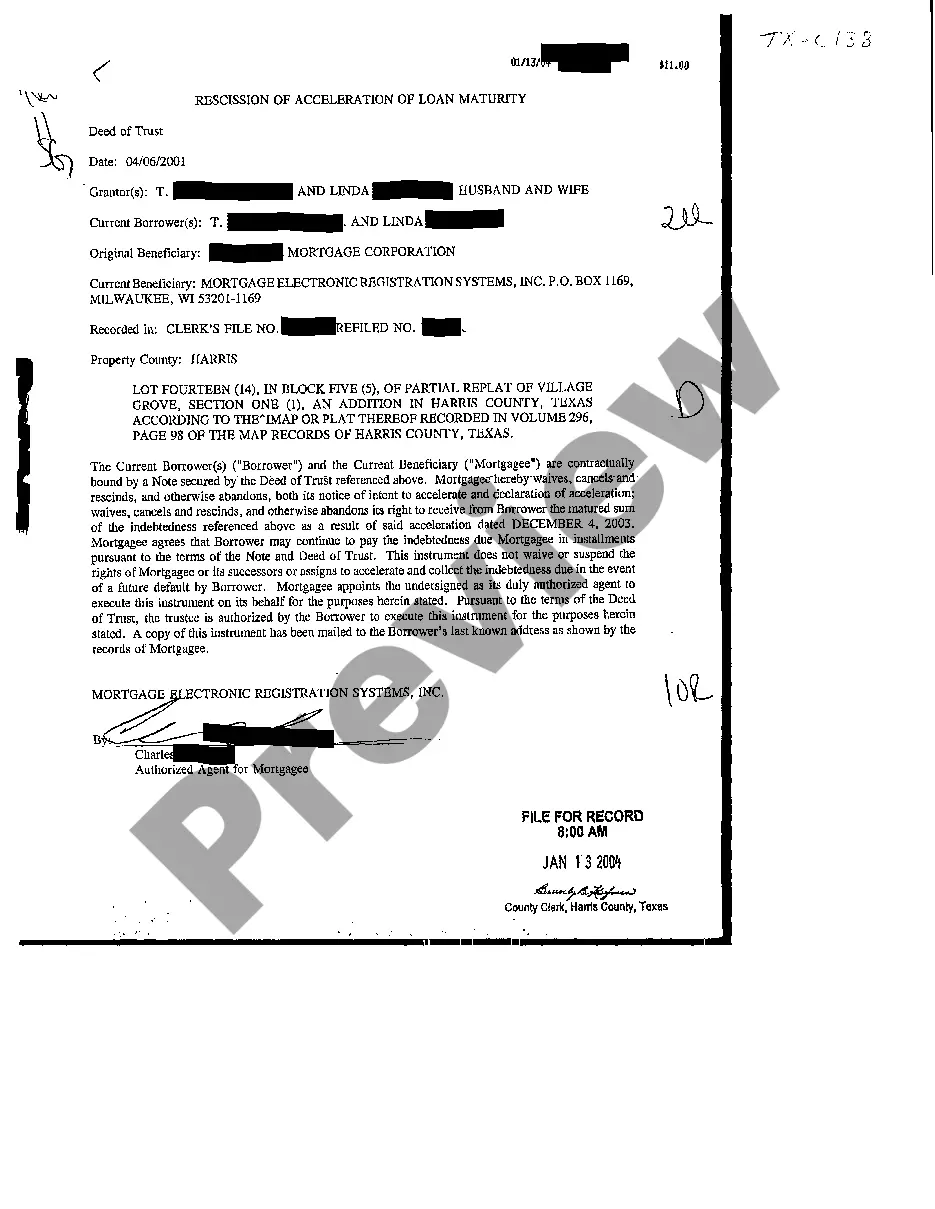

League City Texas Rescission of Acceleration of Loan Maturity

State:

Texas

City:

League City

Control #:

TX-C138

Format:

PDF

Instant download

This form is available by subscription

Description

Rescission of Acceleration of Loan Maturity

Title: Understanding League City Texas Rescission of Acceleration of Loan Maturity Description: In League City, Texas, the Rescission of Acceleration of Loan Maturity is an essential concept for borrowers and lenders to comprehend. This legal provision allows borrowers to roll back the acceleration of loan maturity, providing them with an opportunity to rectify default conditions and potentially avoid foreclosure. Keyword-rich Description: 1. Definition of Rescission of Acceleration of Loan Maturity: The Rescission of Acceleration of Loan Maturity in League City, Texas refers to a legal mechanism that allows borrowers to reverse the acceleration of their loan, restoring the original maturity date. It gives eligible individuals the chance to rectify default conditions and maintain their loan agreement. 2. Importance of Rescission of Acceleration of Loan Maturity: Understanding the process of Rescission of Acceleration of Loan Maturity is crucial for borrowers facing default. By triggering this provision, individuals can potentially avoid foreclosure, restoring their loan agreement and preserving their financial stability. 3. Eligibility for Rescission of Acceleration of Loan Maturity: To qualify for Rescission of Acceleration of Loan Maturity in League City, Texas, borrowers must meet specific criteria, including prompt and full payment of all outstanding delinquent amounts, adherence to the predetermined repayment terms, and compliance with any loan modification guidelines provided by the lender. 4. Potential Consequences of Non-compliance: Failure to meet the requirements of Rescission of Acceleration of Loan Maturity can have severe consequences. Lenders may proceed with foreclosure proceedings, resulting in the loss of the property and potential damage to the borrower's credit score. Types of League City Texas Rescission of Acceleration of Loan Maturity: 1. Standard Rescission of Acceleration of Loan Maturity: This type refers to the typical provision offered by lenders in League City, Texas, allowing borrowers to roll back the acceleration of the loan maturity date upon fulfilling the necessary conditions within a specified timeline. 2. Court-Ordered Rescission of Acceleration of Loan Maturity: In some cases, borrowers may seek legal intervention or file a lawsuit to obtain a court-ordered rescission of the acceleration of loan maturity. The decision rests with the court, based on specific circumstances presented by the borrower and lender. 3. Negotiated Rescission of Acceleration of Loan Maturity: Under certain circumstances, borrowers and lenders may negotiate alternative solutions to rescind the acceleration of loan maturity. This may involve modifying the loan agreement, settling outstanding dues, or agreeing to a revised repayment plan. By understanding the concepts and types of League City Texas Rescission of Acceleration of Loan Maturity, borrowers can take informed actions in addressing default situations and potentially preserving their financial stability and property ownership.

Free preview

How to fill out League City Texas Rescission Of Acceleration Of Loan Maturity?

If you’ve already used our service before, log in to your account and save the League City Texas Rescission of Acceleration of Loan Maturity on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your League City Texas Rescission of Acceleration of Loan Maturity. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!