Travis Texas Rescission of Acceleration of Loan Maturity refers to a legal process by which the acceleration of loan maturity is canceled or reversed in Travis County, Texas. This process allows borrowers to revert their loan back to its original repayment schedule, eliminating the need to repay the full loan amount immediately. In Travis County, Texas, there are several types of Travis Texas Rescission of Acceleration of Loan Maturity, which include: 1. Home Loan Rescission: This type of rescission applies to residential mortgages or home loans in Travis County, Texas. It allows homeowners to reverse the acceleration of loan maturity and resume making regular monthly payments as agreed upon in the original loan agreement. 2. Commercial Loan Rescission: This type of rescission applies to commercial loans, which are obtained for business purposes, in Travis County, Texas. It allows business owners to undo the acceleration of loan maturity and continue making scheduled payments without the immediate demand for full repayment. 3. Personal Loan Rescission: This type of rescission pertains to personal loans, such as auto loans or personal lines of credit, in Travis County, Texas. It enables borrowers to reverse the acceleration of loan maturity and resume regular installment payments as outlined in the original loan terms. The Travis Texas Rescission of Acceleration of Loan Maturity process typically involves the following steps: 1. Notification: The borrower must notify the lender in writing about their intention to rescind the acceleration of loan maturity. This notification should include essential details, such as the loan account number, borrower's information, and the reason for rescission. 2. Documentation: The borrower may need to provide supporting documentation, such as proof of financial hardship, legal documents, or any other relevant paperwork to support their rescission request. 3. Communication: The lender and borrower engage in discussions to negotiate and reach an agreement on the rescission of acceleration of loan maturity. This may involve modifications to the loan terms or repayment plans to accommodate the borrower's financial situation. 4. Agreement: Once both parties agree on the terms of the rescission, a written agreement is prepared and signed by the borrower and the lender. This agreement outlines the revised loan terms, including the reinstatement of the original repayment schedule. 5. Compliance: The borrower is required to comply with the revised loan agreement, making all future payments as scheduled. Failure to adhere to the agreed-upon terms may result in the lender resuming the acceleration of loan maturity or initiating legal action. Travis Texas Rescission of Acceleration of Loan Maturity provides borrowers in Travis County, Texas, with an opportunity to rectify their financial situations and avoid the immediate pressure of repaying their loans. By reversing the acceleration of loan maturity, borrowers can resume regular payments and work towards fulfilling their loan obligations while maintaining their financial stability.

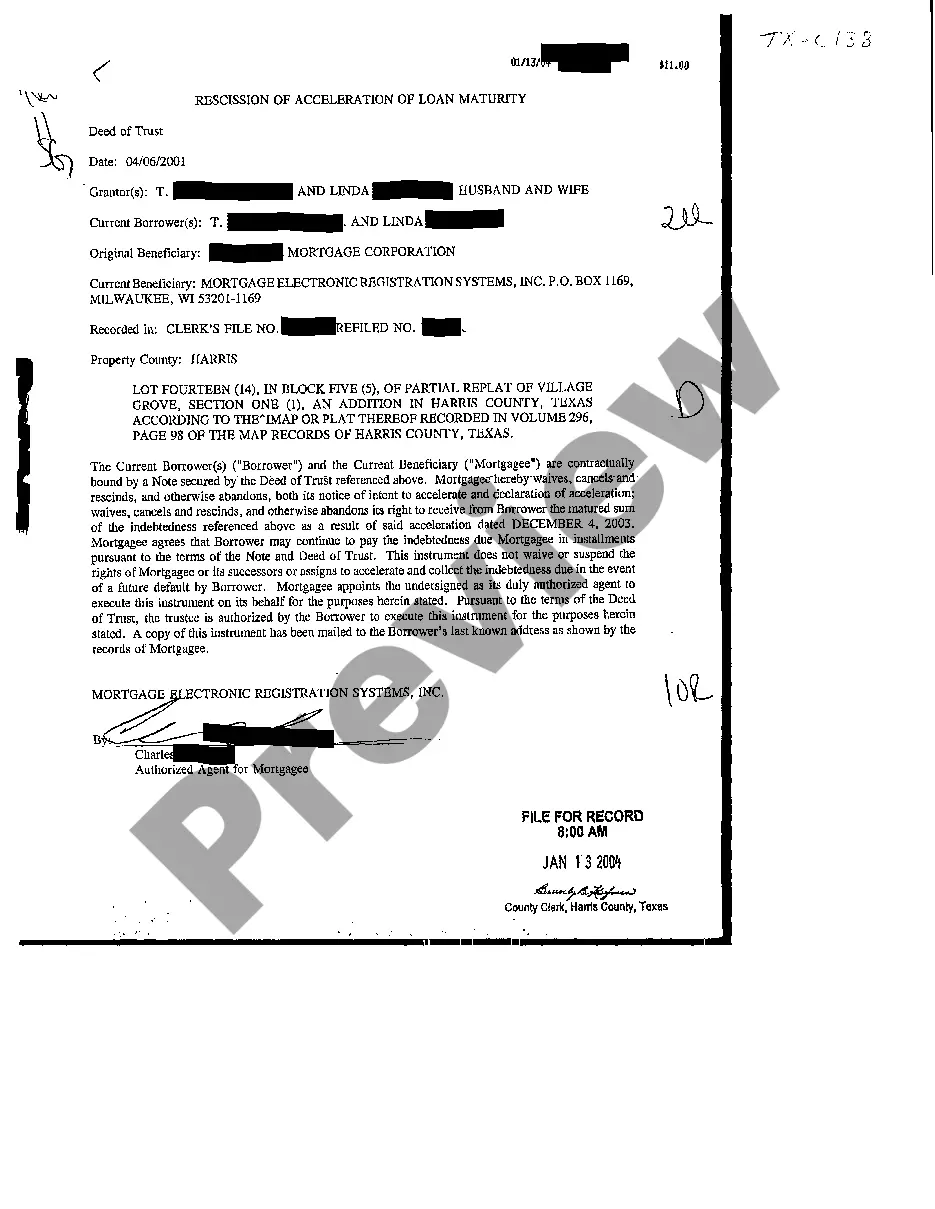

Travis Texas Rescission of Acceleration of Loan Maturity

Description

How to fill out Travis Texas Rescission Of Acceleration Of Loan Maturity?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Travis Texas Rescission of Acceleration of Loan Maturity becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Travis Texas Rescission of Acceleration of Loan Maturity takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Travis Texas Rescission of Acceleration of Loan Maturity. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!