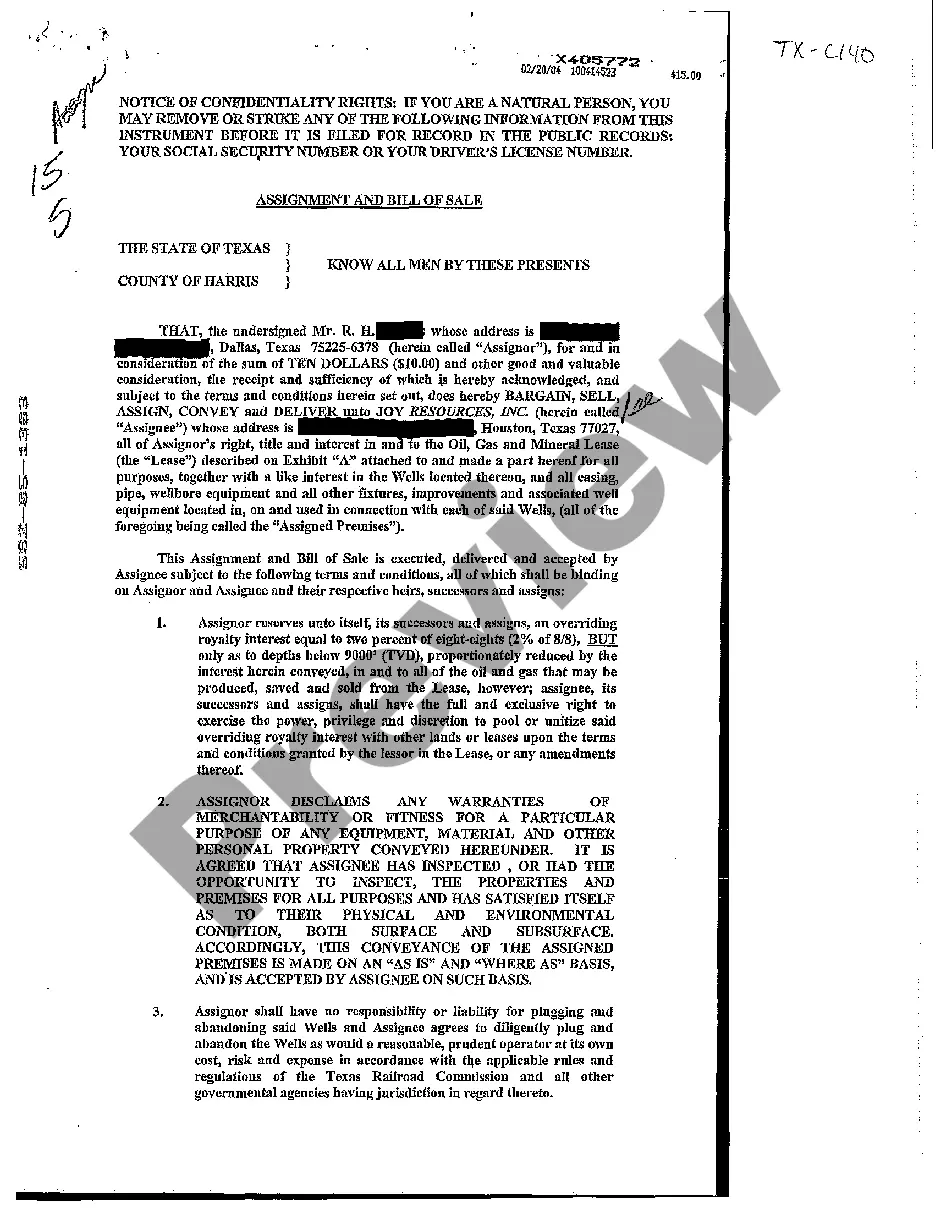

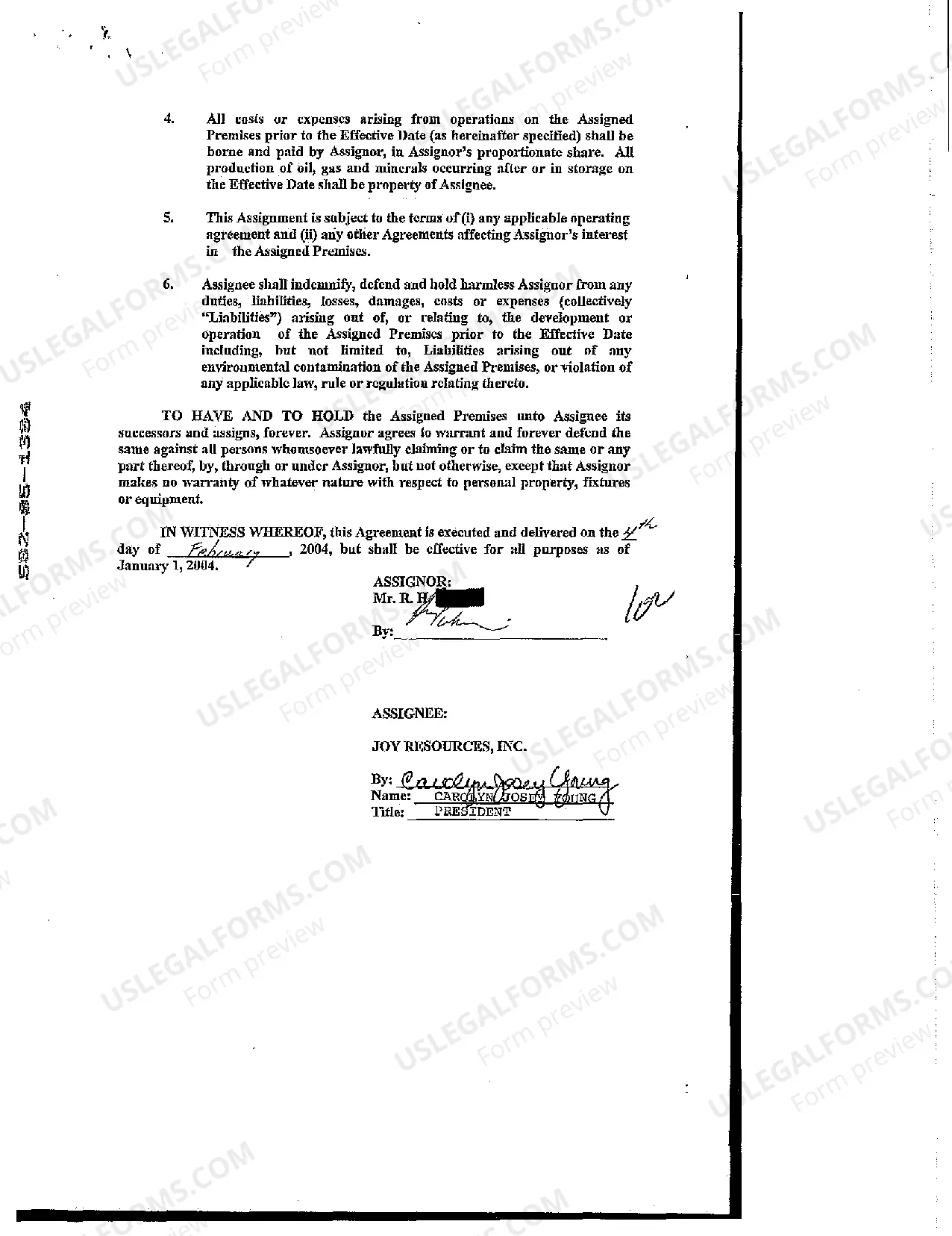

This form is used when the Seller sells, assigns, and transfers, to Buyer, and Buyer's successors and assigns, all of Seller's rights, title, interests, and properties described within, and all rights, estates, powers and privileges appurtenant to those rights, interests, and properties.

The Collin Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease is a legal document that transfers rights or interests in oil, gas, and mineral leases located in Collin County, Texas. This document serves as an agreement between the assignor (current leaseholder) and the assignee (new leaseholder) for the transfer of these rights. Keywords: Collin Texas Assignment, Bill of Sale, Oil Gas and Mineral Lease, legal document, transfer rights, interests, Collin County, Texas, assignor, assignee. There are different types of Collin Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease, depending on the specific purpose or circumstances. Some of these variations include: 1. Assignment of Oil, Gas, and Mineral Lease: This type of assignment involves the transfer of all rights, interests, and obligations related to the lease from the assignor to the assignee. It typically includes a detailed description of the lease, including land descriptions, lease term, royalty payments, and other specific terms. 2. Partial Assignment of Oil, Gas, and Mineral Lease: In certain cases, the assignor may choose to transfer only a portion of their rights or interests in the lease to the assignee. This type of assignment specifies which parts or percentages of the lease are being transferred, allowing for partial ownership or royalty payments. 3. Assignment of Overriding Royalty Interest: An overriding royalty interest refers to a share of proceeds from the production of minerals, oil, or gas, granted specifically to a party other than the leaseholder. This type of assignment involves the transfer of such overriding royalty interests from the assignor to the assignee. 4. Assignment and Assumption of Operating Agreement: In addition to the lease itself, there may also be an associated operating agreement that outlines various operational responsibilities and obligations between multiple parties involved in the extraction and production of oil, gas, or minerals. This type of assignment refers to the transfer of such operating agreements between the parties involved. It's important to consult with legal professionals or experts in oil, gas, and mineral lease transactions to ensure that the specific Collin Texas Assignment and Bill of Sale meets all the necessary requirements and addresses the unique circumstances of the transfer.The Collin Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease is a legal document that transfers rights or interests in oil, gas, and mineral leases located in Collin County, Texas. This document serves as an agreement between the assignor (current leaseholder) and the assignee (new leaseholder) for the transfer of these rights. Keywords: Collin Texas Assignment, Bill of Sale, Oil Gas and Mineral Lease, legal document, transfer rights, interests, Collin County, Texas, assignor, assignee. There are different types of Collin Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease, depending on the specific purpose or circumstances. Some of these variations include: 1. Assignment of Oil, Gas, and Mineral Lease: This type of assignment involves the transfer of all rights, interests, and obligations related to the lease from the assignor to the assignee. It typically includes a detailed description of the lease, including land descriptions, lease term, royalty payments, and other specific terms. 2. Partial Assignment of Oil, Gas, and Mineral Lease: In certain cases, the assignor may choose to transfer only a portion of their rights or interests in the lease to the assignee. This type of assignment specifies which parts or percentages of the lease are being transferred, allowing for partial ownership or royalty payments. 3. Assignment of Overriding Royalty Interest: An overriding royalty interest refers to a share of proceeds from the production of minerals, oil, or gas, granted specifically to a party other than the leaseholder. This type of assignment involves the transfer of such overriding royalty interests from the assignor to the assignee. 4. Assignment and Assumption of Operating Agreement: In addition to the lease itself, there may also be an associated operating agreement that outlines various operational responsibilities and obligations between multiple parties involved in the extraction and production of oil, gas, or minerals. This type of assignment refers to the transfer of such operating agreements between the parties involved. It's important to consult with legal professionals or experts in oil, gas, and mineral lease transactions to ensure that the specific Collin Texas Assignment and Bill of Sale meets all the necessary requirements and addresses the unique circumstances of the transfer.