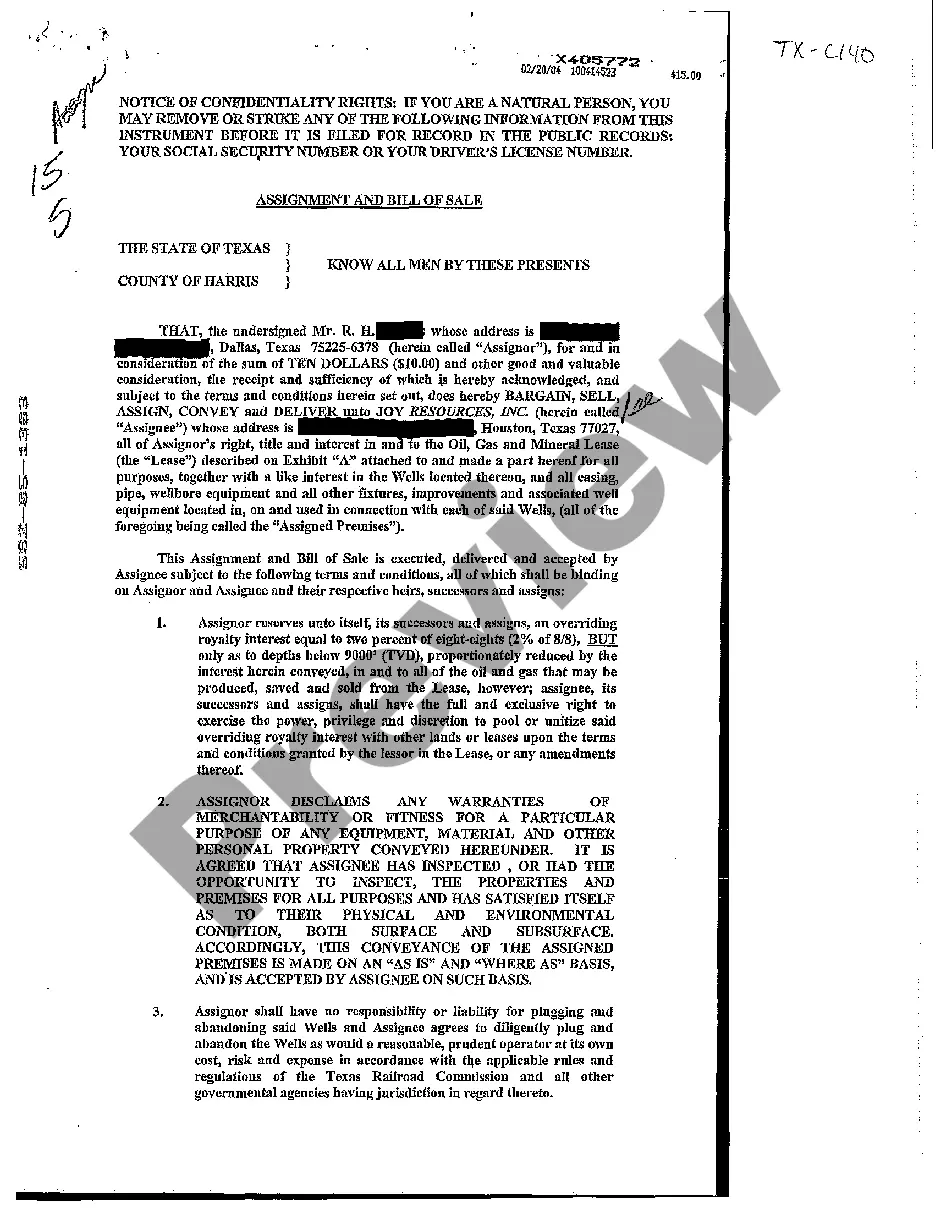

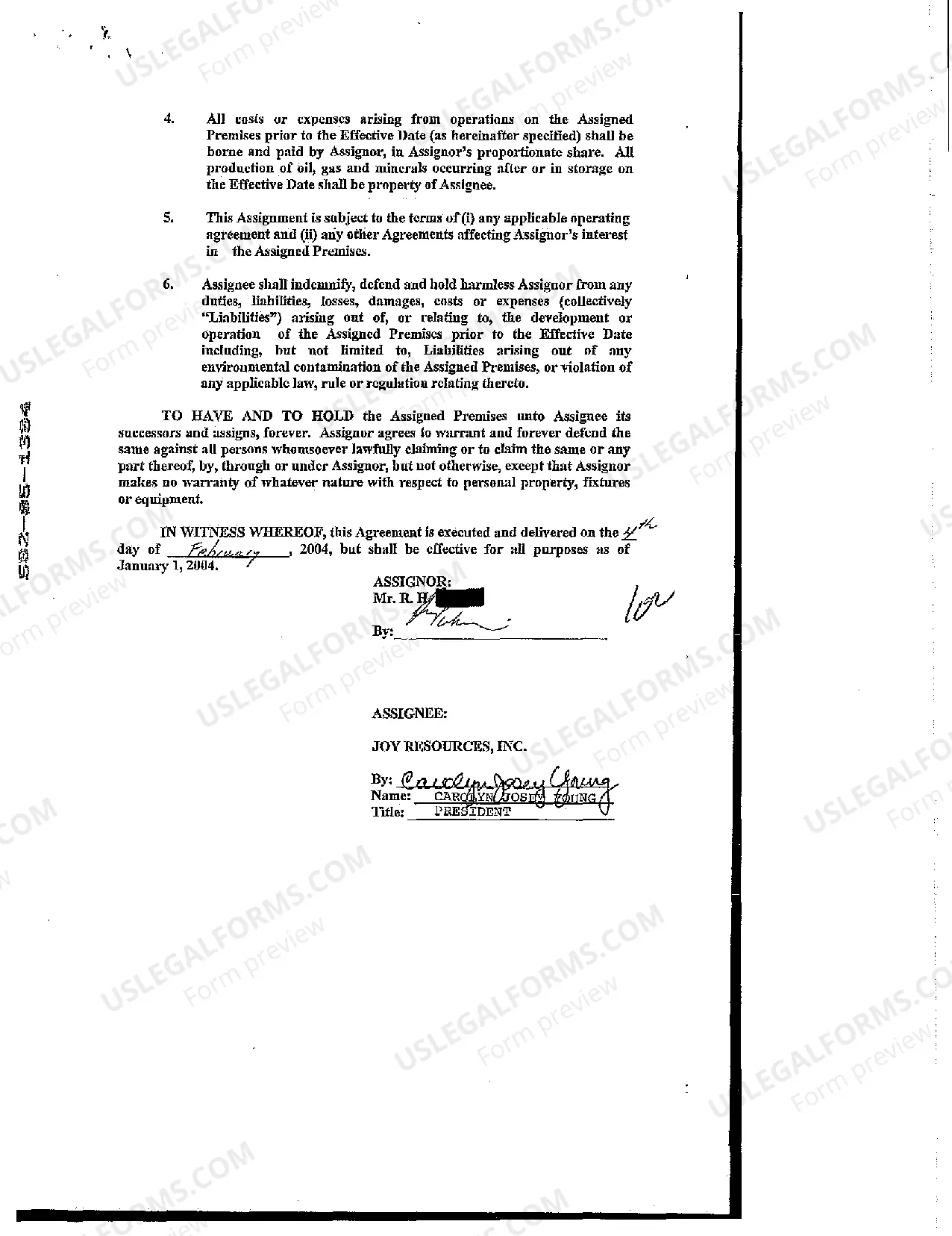

This form is used when the Seller sells, assigns, and transfers, to Buyer, and Buyer's successors and assigns, all of Seller's rights, title, interests, and properties described within, and all rights, estates, powers and privileges appurtenant to those rights, interests, and properties.

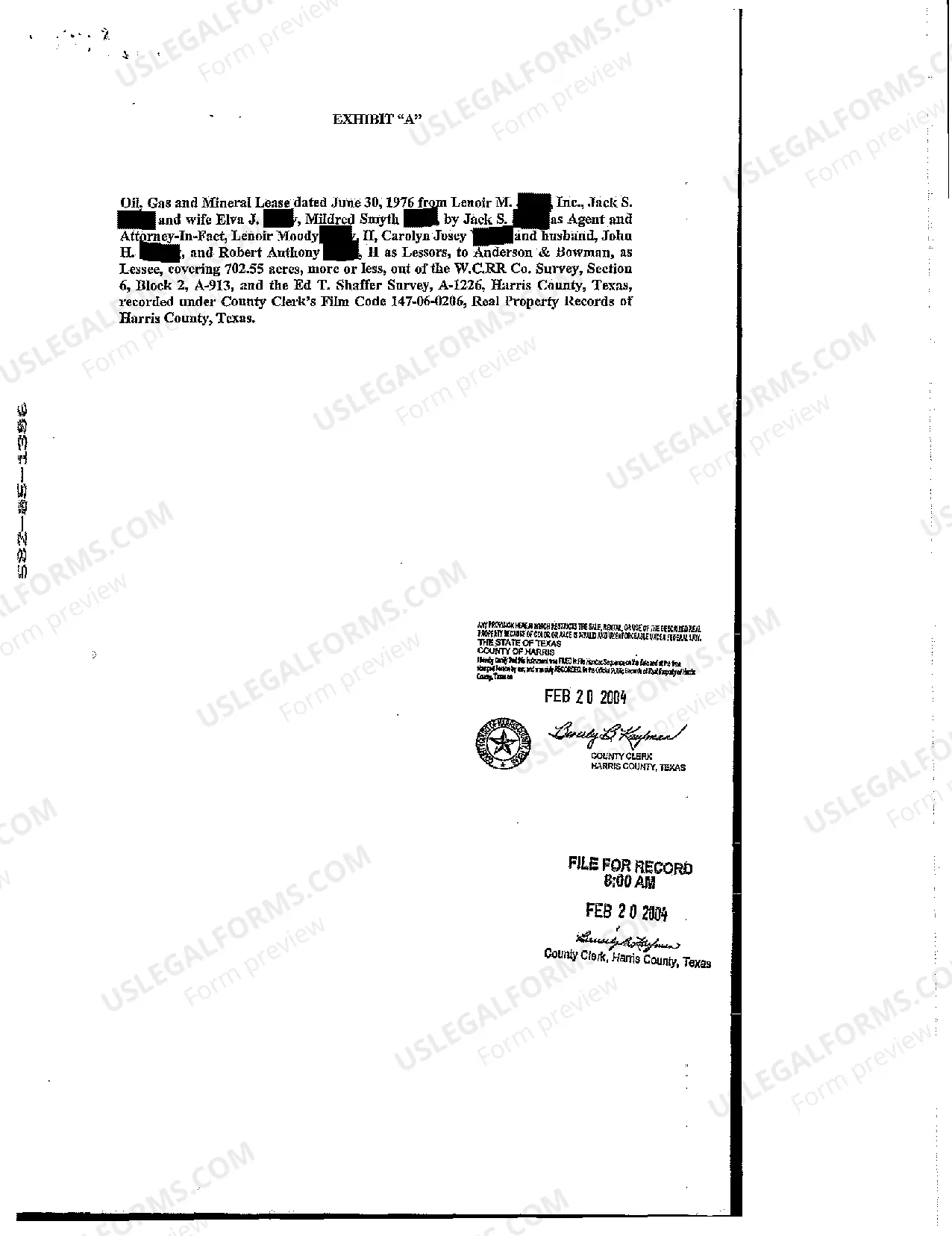

Dallas Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease are legally binding documents used in the transfer of ownership or rights related to oil, gas, and mineral leases in the Dallas, Texas region. These documents outline the terms and conditions of the transfer and provide a record of the transaction. The Dallas Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease typically include the following key elements: 1. Parties Involved: The document identifies the parties involved in the transaction, including the assignor (current owner) and assignee (new owner). 2. Lease Identification: The specific lease being assigned and sold is described in detail, including lease number, legal description, and any relevant additional information. 3. Consideration: The agreed-upon consideration, which is the financial or non-financial value exchanged for the assignment of the lease, is clearly stated. 4. Assignor's Representations and Warranties: The assignor provides assurances that they are the rightful owner of the lease and have full authority to transfer it. They also state that the lease is free of any liens or encumbrances. 5. Assignee's Acknowledgement: The assignee acknowledges that they have reviewed and understood the terms of the assignment and bill of sale and accept any associated risks. 6. Effective Date and Execution: The document includes the date on which the assignment and bill of sale become effective, as well as the signatures of both parties and any witnesses. Additionally, there may be different types or variations of the Dallas Texas Assignment and Bill of Sale for Oil Gas and Mineral Lease, depending on specific circumstances. These could include: 1. Partial Assignment: When only a portion of the lease is being transferred, rather than the entire interest. 2. Royalty Interest Assignment: In cases where the assignor wants to transfer only their royalty interests, which entitle them to a percentage of the revenue generated from the lease. 3. Working Interest Assignment: This type of assignment transfers both ownership and operational responsibilities of the lease, including the duty to contribute to costs and expenses. 4. Assignment of Overrides: An override is a share of production or revenue carved out of the working interest. This type of assignment may involve the transfer of override rights and obligations. 5. Assignment and Bill of Sale with Surface Rights: In some cases, the assignment may also include the rights to access and use the surface of the leased property for drilling or other oil and gas activities. 6. Encumbrance Assignment: If there are existing mortgages, liens, or other encumbrances on the lease, a separate assignment and bill of sale may be required to transfer ownership subject to such encumbrances. It is important for parties involved in the transfer of oil, gas, and mineral leases in Dallas, Texas to consult with legal professionals experienced in this field to ensure both the assignment and bill of sale accurately represent their intentions and comply with applicable laws and regulations.