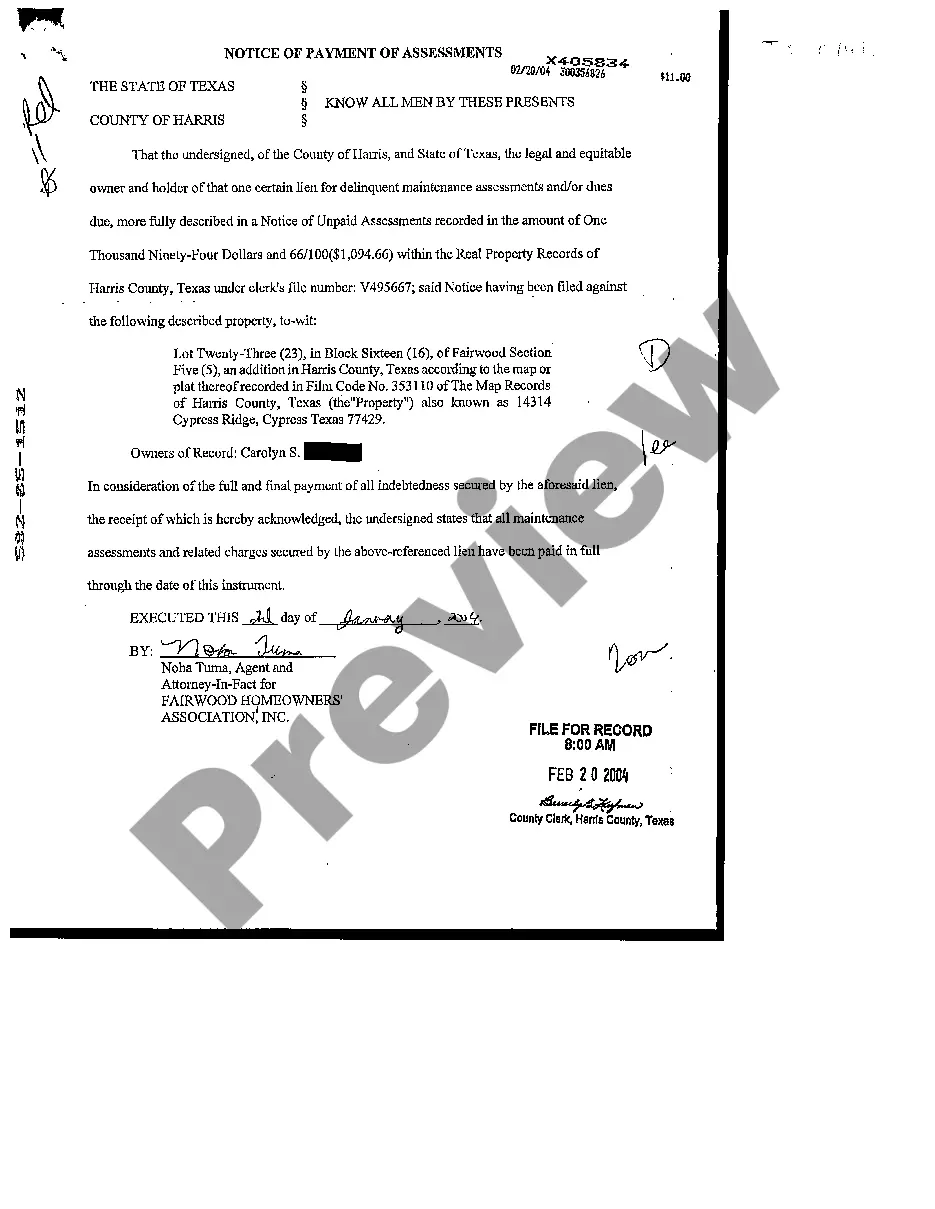

The Austin Texas Notice of Payments of Assessments is an official document issued by the City of Austin or a homeowner association to notify property owners about the payment requirements for assessments or fees related to their property. This notice serves to inform property owners of the amount they are obligated to pay, the due date, and the payment options available to them. The Notice typically includes essential details such as the property owner's name and address, the property identification or parcel number, and the specific assessment period for which payment is due. It may also consist of the name and contact information of the issuing authority responsible for managing these assessments. There are different types of Austin Texas Notice of Payments of Assessments that property owners may come across, depending on the nature of their property and its jurisdiction. Some common types of assessments notices include: 1. Property Taxes: Austin residents receive an annual Notice of Property Tax Assessment from the Travis County Tax Office, specifying the assessed value of their property and the corresponding tax payment due date. 2. Homeowner Association Assessments: Property owners residing within planned communities, condominiums, or neighborhoods governed by a homeowner association may receive periodic assessment notices. These notices outline the required payments for maintaining and managing shared amenities and services such as landscaping, road maintenance, security, or community facilities. 3. Special Assessments: Austin may occasionally levy special assessments on property owners to fund specific projects or improvements that benefit the community, such as road repairs, sewer system upgrades, or neighborhood revitalization. The Notice of Payment for Special Assessments notifies property owners about the additional financial obligation and the purpose behind it. These assessment notices play a crucial role in promoting transparency and ensuring that property owners are aware of their financial responsibilities towards the community or municipality. It is important for property owners to carefully review these notices, understand the payment requirements, and comply with the designated deadlines to avoid penalties or legal consequences.

Austin Texas Notice of Payments of Assessments

State:

Texas

City:

Austin

Control #:

TX-C142

Format:

PDF

Instant download

This form is available by subscription

Description

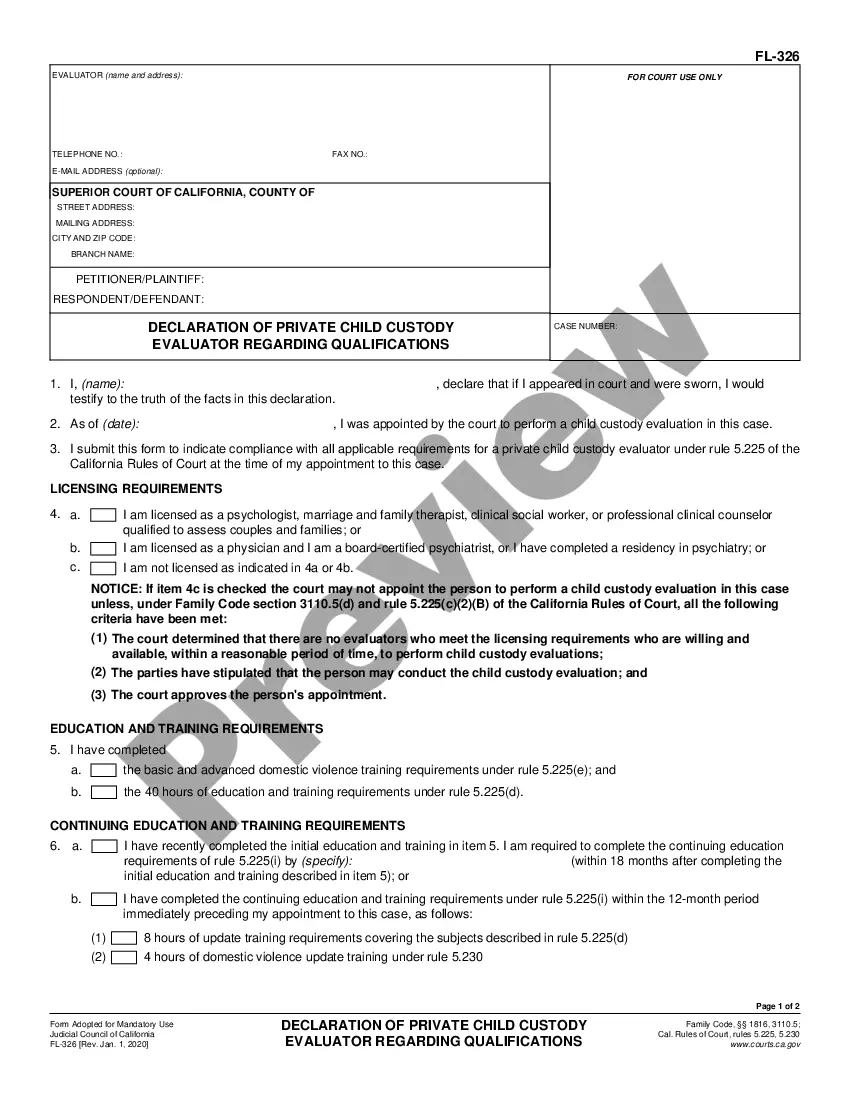

Notice of Payments of Assessments

The Austin Texas Notice of Payments of Assessments is an official document issued by the City of Austin or a homeowner association to notify property owners about the payment requirements for assessments or fees related to their property. This notice serves to inform property owners of the amount they are obligated to pay, the due date, and the payment options available to them. The Notice typically includes essential details such as the property owner's name and address, the property identification or parcel number, and the specific assessment period for which payment is due. It may also consist of the name and contact information of the issuing authority responsible for managing these assessments. There are different types of Austin Texas Notice of Payments of Assessments that property owners may come across, depending on the nature of their property and its jurisdiction. Some common types of assessments notices include: 1. Property Taxes: Austin residents receive an annual Notice of Property Tax Assessment from the Travis County Tax Office, specifying the assessed value of their property and the corresponding tax payment due date. 2. Homeowner Association Assessments: Property owners residing within planned communities, condominiums, or neighborhoods governed by a homeowner association may receive periodic assessment notices. These notices outline the required payments for maintaining and managing shared amenities and services such as landscaping, road maintenance, security, or community facilities. 3. Special Assessments: Austin may occasionally levy special assessments on property owners to fund specific projects or improvements that benefit the community, such as road repairs, sewer system upgrades, or neighborhood revitalization. The Notice of Payment for Special Assessments notifies property owners about the additional financial obligation and the purpose behind it. These assessment notices play a crucial role in promoting transparency and ensuring that property owners are aware of their financial responsibilities towards the community or municipality. It is important for property owners to carefully review these notices, understand the payment requirements, and comply with the designated deadlines to avoid penalties or legal consequences.

Free preview

How to fill out Austin Texas Notice Of Payments Of Assessments?

If you’ve already utilized our service before, log in to your account and download the Austin Texas Notice of Payments of Assessments on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Austin Texas Notice of Payments of Assessments. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!