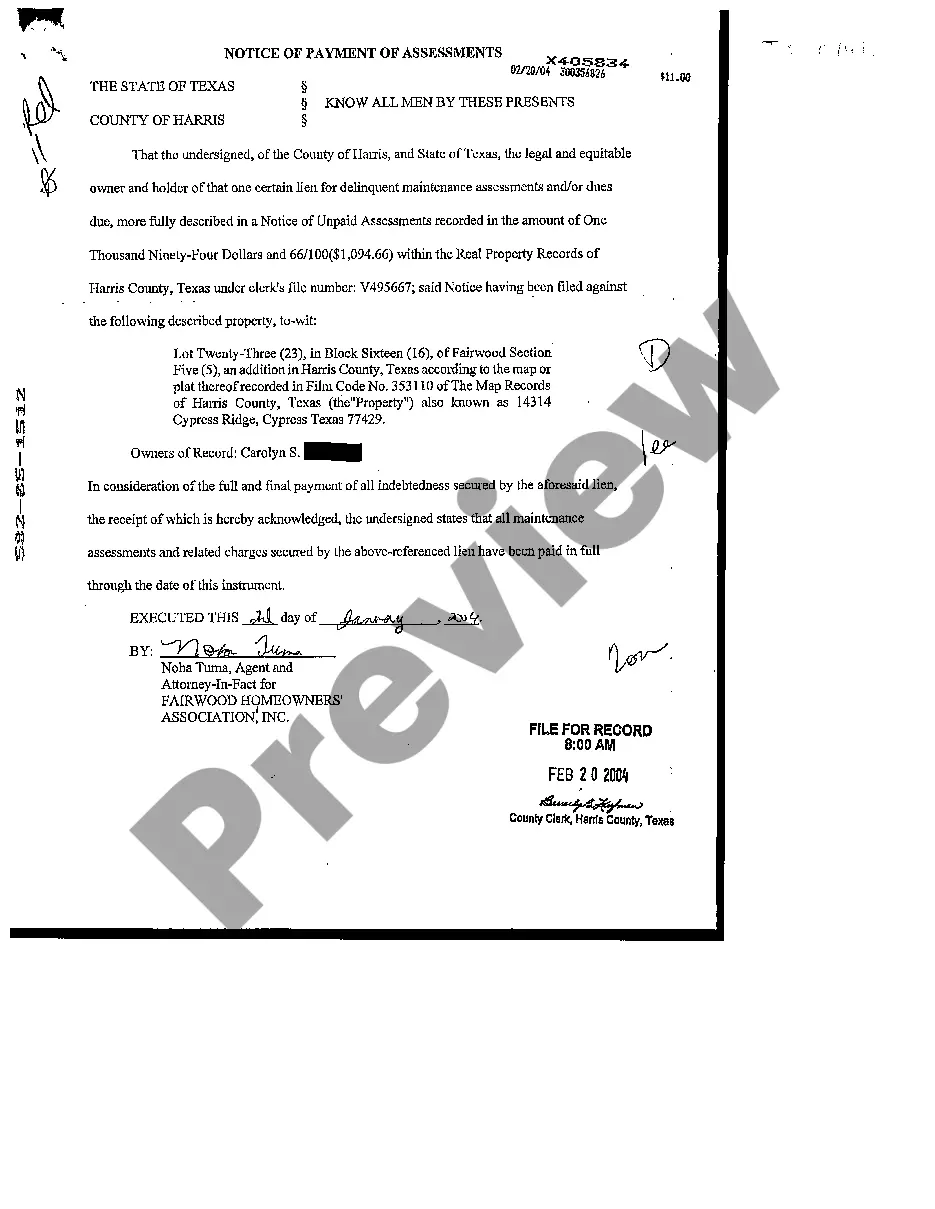

The Bexar Texas Notice of Payments of Assessments is an official document that serves as a notice for property owners in Bexar County, Texas regarding their assessment payments. It provides detailed information about the amount, due dates, and specific instructions related to assessments imposed on their property. This notice is an essential communication tool to keep property owners informed about their financial obligations towards various assessments like property taxes, homeowners association fees, and special district assessments. It ensures that property owners understand the specific payment schedule and any penalties or late fees involved. The Bexar Texas Notice of Payments of Assessments includes key information such as the property owner's name, property address, legal description of the property, and a breakdown of the assessments. It also mentions the due dates for each assessment, typically structured on an annual or periodic basis. Property owners must carefully review this notice to ensure they meet the payment deadlines and comply with the rules outlined by relevant authorities. Failure to make timely payments can result in penalties, interest charges, or even legal consequences, such as liens on the property. Different types of Bexar Texas Notice of Payments of Assessments may include: 1. Property Tax Assessment Notice: This notice informs property owners about the assessed value of their property and the corresponding property tax amount due. It includes details about any exemptions, discounts, or deductions applicable. 2. Homeowners Association (HOA) Assessment Notice: This notice notifies property owners about the dues and fees required to maintain common areas, amenities, and services within a homeowners' association. It encompasses a wide range of expenses, such as landscaping, security, and general maintenance. 3. Special District Assessment Notice: This notice pertains to additional assessments levied by special districts to fund infrastructure improvements, public services, or community development projects in designated areas. Examples may include road maintenance districts, water improvement districts, or municipal utility districts. 4. Improvement District Assessment Notice: This notice relates to assessments imposed specifically for the development or improvement of designated areas, including construction of public facilities, parks, and utilities. Property owners within the improvement district are responsible for financing the associated costs. In summary, the Bexar Texas Notice of Payments of Assessments is a critical document for property owners, outlining their financial obligations related to various assessments. It helps property owners stay informed, meet payment deadlines, and avoid penalties or legal consequences. Whether it's property tax assessments, HOA dues, special district assessments, or improvement district assessments, these notices ensure transparency and facilitate the proper upkeep and development of the Bexar County community.

Bexar Texas Notice of Payments of Assessments

State:

Texas

County:

Bexar

Control #:

TX-C142

Format:

PDF

Instant download

This form is available by subscription

Description

Notice of Payments of Assessments

The Bexar Texas Notice of Payments of Assessments is an official document that serves as a notice for property owners in Bexar County, Texas regarding their assessment payments. It provides detailed information about the amount, due dates, and specific instructions related to assessments imposed on their property. This notice is an essential communication tool to keep property owners informed about their financial obligations towards various assessments like property taxes, homeowners association fees, and special district assessments. It ensures that property owners understand the specific payment schedule and any penalties or late fees involved. The Bexar Texas Notice of Payments of Assessments includes key information such as the property owner's name, property address, legal description of the property, and a breakdown of the assessments. It also mentions the due dates for each assessment, typically structured on an annual or periodic basis. Property owners must carefully review this notice to ensure they meet the payment deadlines and comply with the rules outlined by relevant authorities. Failure to make timely payments can result in penalties, interest charges, or even legal consequences, such as liens on the property. Different types of Bexar Texas Notice of Payments of Assessments may include: 1. Property Tax Assessment Notice: This notice informs property owners about the assessed value of their property and the corresponding property tax amount due. It includes details about any exemptions, discounts, or deductions applicable. 2. Homeowners Association (HOA) Assessment Notice: This notice notifies property owners about the dues and fees required to maintain common areas, amenities, and services within a homeowners' association. It encompasses a wide range of expenses, such as landscaping, security, and general maintenance. 3. Special District Assessment Notice: This notice pertains to additional assessments levied by special districts to fund infrastructure improvements, public services, or community development projects in designated areas. Examples may include road maintenance districts, water improvement districts, or municipal utility districts. 4. Improvement District Assessment Notice: This notice relates to assessments imposed specifically for the development or improvement of designated areas, including construction of public facilities, parks, and utilities. Property owners within the improvement district are responsible for financing the associated costs. In summary, the Bexar Texas Notice of Payments of Assessments is a critical document for property owners, outlining their financial obligations related to various assessments. It helps property owners stay informed, meet payment deadlines, and avoid penalties or legal consequences. Whether it's property tax assessments, HOA dues, special district assessments, or improvement district assessments, these notices ensure transparency and facilitate the proper upkeep and development of the Bexar County community.

Free preview

How to fill out Bexar Texas Notice Of Payments Of Assessments?

If you’ve already used our service before, log in to your account and save the Bexar Texas Notice of Payments of Assessments on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bexar Texas Notice of Payments of Assessments. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!