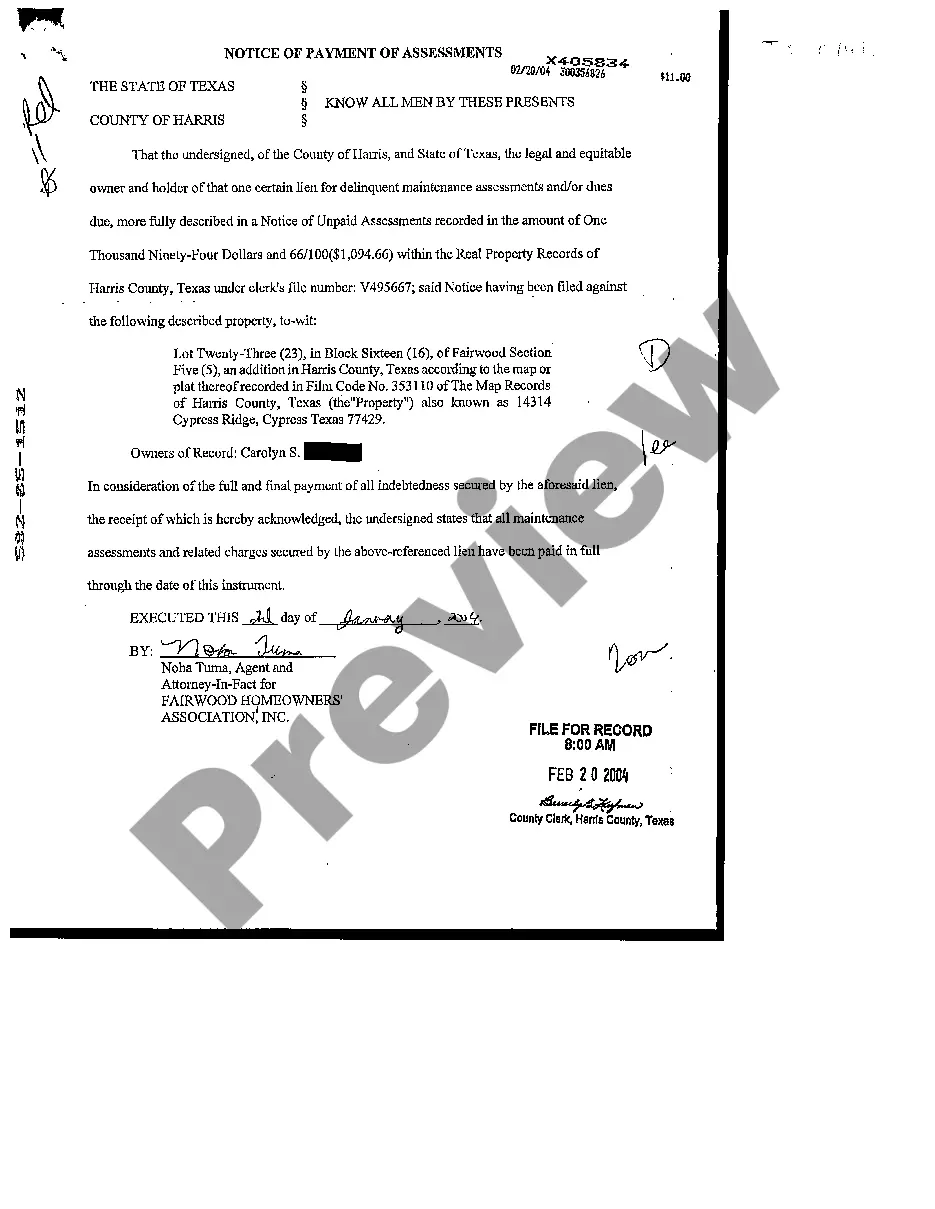

Dallas Texas Notice of Payments of Assessments is a legal document that serves as a notification to property owners regarding the payments of assessments. These assessments are typically fees charged by homeowner or condominium associations to cover the costs of maintaining and improving common areas and shared amenities within a community. The Dallas Texas Notice of Payments of Assessments is an important communication tool used by associations to inform property owners about their financial obligations towards the community. It outlines the specific amount due, payment deadlines, and acceptable methods of payment. This document also highlights the consequences of late or non-payment, which may include late fees, interest charges, or even legal action. There are several types of Dallas Texas Notice of Payments of Assessments, each catering to the specific needs of different types of properties or community associations. These variations include: 1. Residential Property Assessment Notice: This type of notice is sent to homeowners within residential communities, such as single-family homes or townhouses. It informs homeowners about their annual or monthly assessments to cover expenses like landscaping, security, and maintenance of common areas like parks, playgrounds, or swimming pools. 2. Condominium Assessment Notice: This notice is specifically designed for owners of condominium units. It outlines the assessments related to the upkeep and management of shared facilities like elevators, parking structures, gyms, or common areas like lobbies and hallways. Additionally, it may also include fees for services like garbage collection or building insurance. 3. Apartment Complex Assessment Notice: This notice targets tenants residing in apartment complexes. It provides detailed information about fees associated with maintaining the shared facilities of the complex, including amenities like clubhouses, fitness centers, or on-site management services. It may also include any additional charges for utilities or maintenance services. 4. Commercial Property Assessment Notice: This notice is directed towards owners of commercial properties, such as office buildings, shopping centers, or industrial parks. It highlights the assessments related to the upkeep and management of shared spaces like parking lots, landscaping, security systems, or common areas like lobbies and hallways. It may also include fees for services like maintenance, repairs, or garbage collection. In conclusion, the Dallas Texas Notice of Payments of Assessments is a crucial document for property owners within various types of communities or associations. It ensures transparency and compliance with financial obligations, while also maintaining the financial health and longevity of the community.

Dallas Texas Notice of Payments of Assessments

Description

How to fill out Dallas Texas Notice Of Payments Of Assessments?

Make use of the US Legal Forms and get instant access to any form sample you require. Our beneficial platform with a huge number of templates simplifies the way to find and obtain virtually any document sample you require. You are able to export, fill, and certify the Dallas Texas Notice of Payments of Assessments in just a few minutes instead of browsing the web for hours attempting to find an appropriate template.

Using our collection is an excellent strategy to increase the safety of your form filing. Our professional attorneys on a regular basis check all the records to make certain that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you get the Dallas Texas Notice of Payments of Assessments? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, stick to the instruction listed below:

- Find the form you require. Ensure that it is the form you were hoping to find: examine its title and description, and make use of the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Indicate the format to obtain the Dallas Texas Notice of Payments of Assessments and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. We are always happy to assist you in any legal procedure, even if it is just downloading the Dallas Texas Notice of Payments of Assessments.

Feel free to take advantage of our platform and make your document experience as efficient as possible!

Form popularity

FAQ

In addition, your tax receipt is evidence that you paid the tax if a taxing unit sues you for delinquent taxes. In most cases, you must pay your property taxes by Jan. 31.

Property taxes in Texas are due annually, but paid in arrears. The Texas property tax year runs from January 1st through December 31st. Other things you should keep in mind: Most Counties in Texas issue Yearly Tax Statements between October and November of the current tax year.

For questions about property tax bills and collections, call the Property Tax Assistance Division's Information Services Team at 512-305-9999 or 1-800-252-9121 (press 3).

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours.

Your property tax amount is calculated by taking the appraised value (as determined by the appraisal district) and subtracting any appropriate exemptions (granted by the appraisal district) to determine the taxable value, then multiplying this taxable value by each applicable taxing entity's tax rate.

Payment Methods In Person. Visit any of our convenient tax office locations.By Mail. Dallas County Tax Office.By Telephone. Call JPMorgan Chase Bank at (877) 253-0150.Online. Transfer.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.

Property tax bills are sent out from October. So, you should receive yours well in advance of the January 31st deadline. If you haven't received your property tax bill by December, you should contact your local tax offices for your county.

Yes. Texas government agencies maintain property records at the county level and provide access to interested public requesters according to the Texas Public Information Act. Unless sealed by a court order or statute, property records in Texas are in the public domain and available upon request.

Interesting Questions

More info

I have been cited for multiple offenses for failure to pay fines, fines and penalties. To avoid prosecution for multiple offenses of failure to pay, I believe I should submit to mandatory payment of the fines, fines and penalties on or before March 26 and also pay the remaining balance of my installment agreement by October of this year. The only reason I do not is because of the penalties. Can a late fee be assessed? A late fee of one and one-half percent (one-eighth of one percent) will be assessed by the collector on each delinquent bill by one and one-half years after the date when interest has begun accruing (the date when the payment first becomes delinquent) as calculated on an accurate balance reported during the billing period. Interest is calculated each month until the bill is paid in full when you receive the bill in the mail.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.