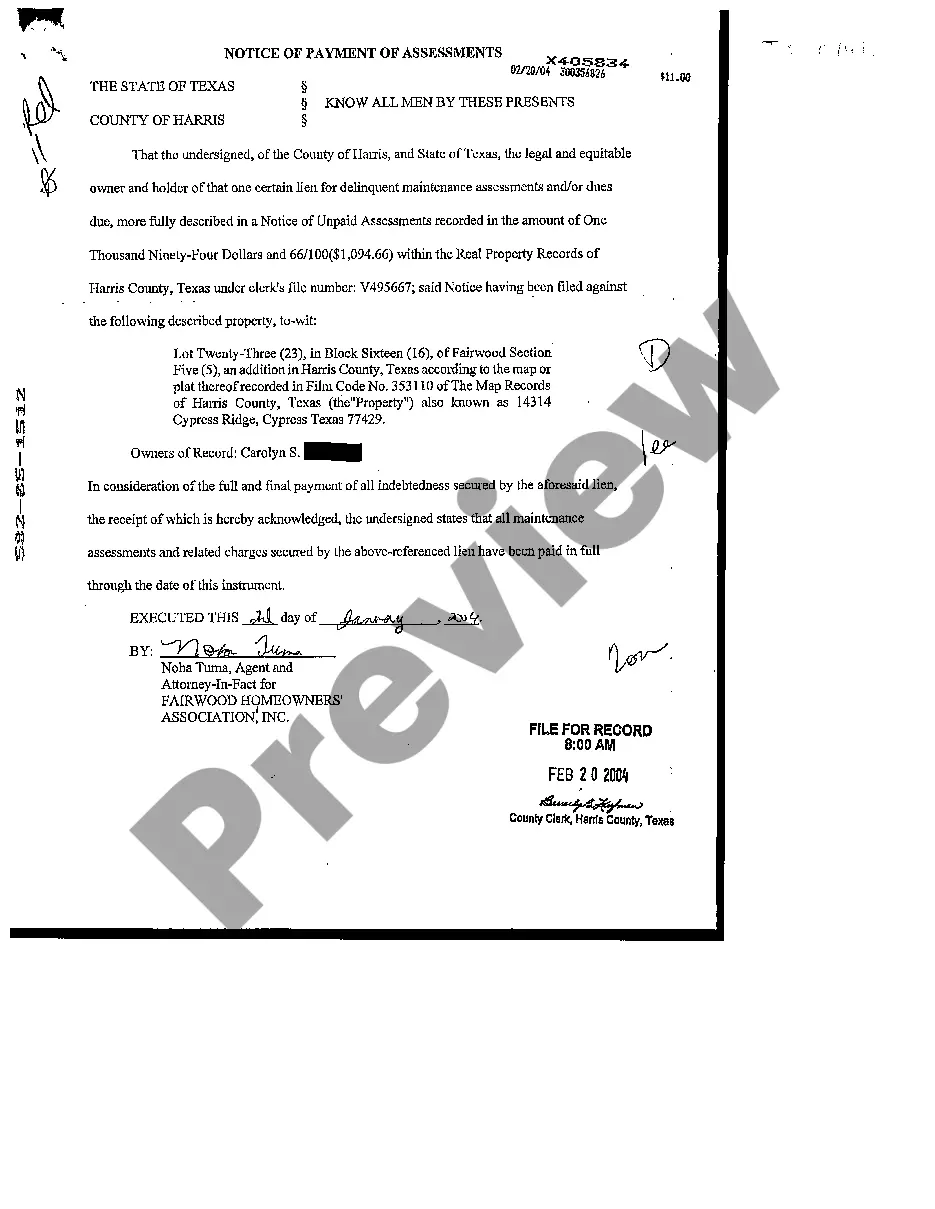

Harris County, located in Texas, issues a Notice of Payments of Assessments to inform property owners about their financial obligations towards their property assessments. This formal notice serves as a reminder to residents or property owners regarding their upcoming payments for various assessments and other related dues. It is an essential document that helps maintain financial transparency and ensures timely payment compliance within the county. The Harris Texas Notice of Payments of Assessments typically contains important information, including the name and address of the property owner, property identification details, and the due amount for assessment payments. It also specifies the due date or period within which the payment needs to be made to avoid any penalties or late fees. In addition, it may provide documentation explaining the purpose and nature of the assessment, which could include funding for infrastructure improvements, public services, or community development projects. Different types of assessments may be included in the Harris Texas Notice of Payments. These assessments can vary depending on the specific location or community within Harris County. Some common types of assessments may include: 1. Property Tax Assessments: These assessments are levied on property owners based on the value of their property. They contribute to funding schools, emergency services, county government operations, and other essential services. 2. Special District Assessments: Special district assessments are imposed on properties located within specific districts to fund services such as water and sewage management, road maintenance, street lighting, and landscaping within the district boundaries. 3. Homeowners Association (HOA) Assessments: HOA assessments are specific to properties located within communities governed by homeowners associations. These fees contribute to the maintenance and management of common areas, amenities, and other services provided by the association. It is crucial for property owners to carefully review the Harris Texas Notice of Payments of Assessments and ensure timely payment. Failure to comply with assessment payment obligations may result in penalties, interest charges, or even legal action. In summary, the Harris Texas Notice of Payments of Assessments is an important communication from Harris County to property owners, outlining their financial obligations regarding assessments. It serves as a reminder to property owners to make timely payments for various types of assessments, such as property tax, special district assessments, or HOA fees. By strictly adhering to these payment requirements, property owners contribute to the upkeep and improvement of their communities and support essential public services.

Harris Texas Notice of Payments of Assessments

Description

How to fill out Harris Texas Notice Of Payments Of Assessments?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal services that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Harris Texas Notice of Payments of Assessments or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Harris Texas Notice of Payments of Assessments complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Harris Texas Notice of Payments of Assessments is suitable for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!