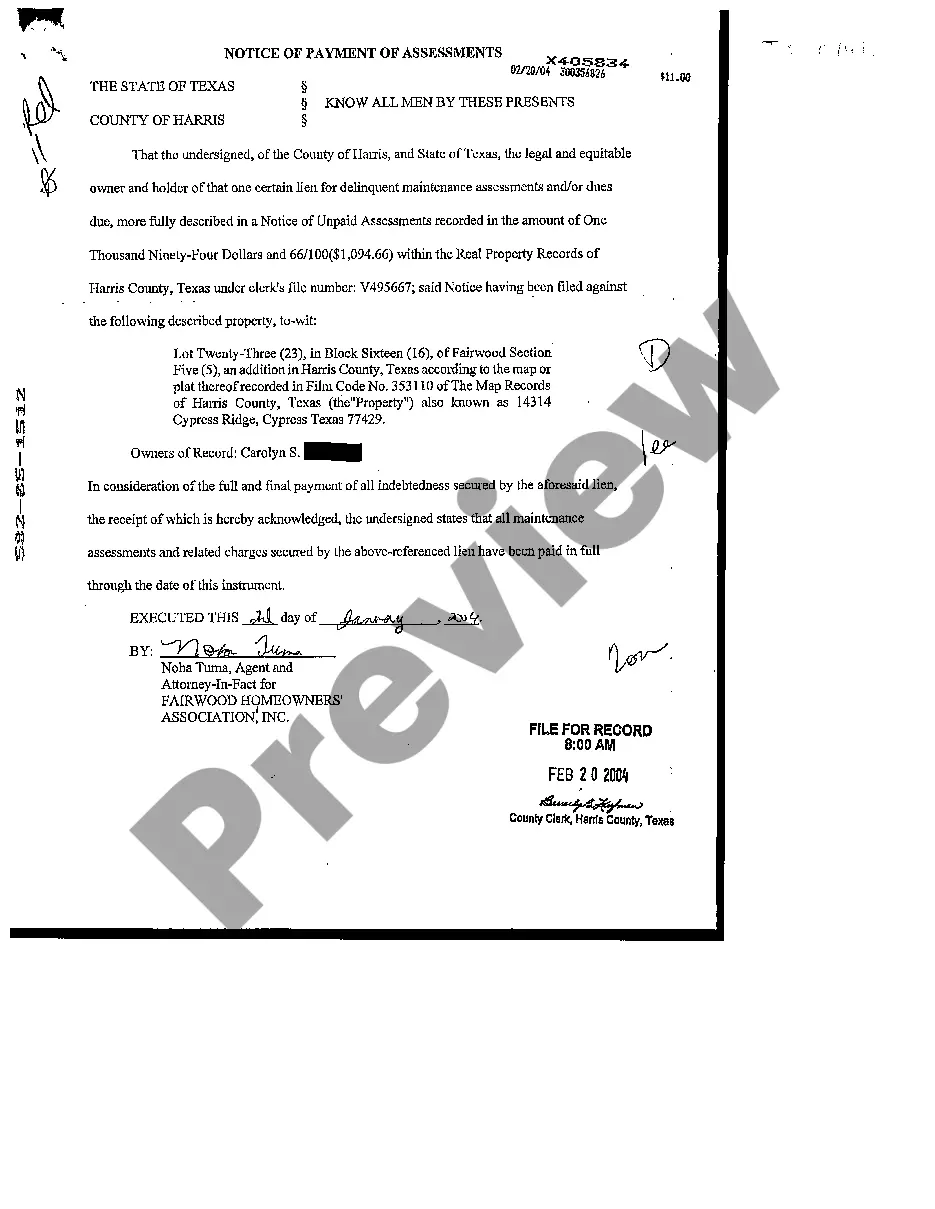

The Houston Texas Notice of Payments of Assessments refers to a legal document that provides information regarding necessary payments of assessments imposed on property owners in Houston, Texas. This notice serves as a formal communication from the relevant authorities to property owners, informing them of their financial obligations towards maintaining and improving their communities or neighborhoods. There are several types of Houston Texas Notice of Payments of Assessments, including: 1. Homeowners Association Assessments: This type of assessment notice is typically sent to property owners who reside within a homeowners' association (HOA). Has been responsible for maintaining common areas, amenities, and managing various services for the community. The notice outlines the specific amount due, payment deadline, and instructions on how to remit the payment. 2. Property Tax Assessments: This notice is sent by the local taxing authority, usually the Harris County Appraisal District (HAD), to property owners to inform them of the assessed value of their property for tax purposes. Property owners receive an annual notice outlining the valuation and any applicable tax rates. The notice also includes information about potential exemptions, protest procedures, and payment deadlines. 3. Special District Assessments: Special Districts may levy assessments on property owners to fund specific projects or services within a defined district, such as street maintenance, drainage improvements, or public safety. The notice provides property owners with detailed information about the nature of the assessment, the purpose it serves, the assessment amount, and payment instructions. 4. Municipal Utility District (MUD) Assessments: Mud are special governmental entities that provide water, sewage, and drainage services in certain areas. MUD assessments are used to cover the cost of infrastructure, maintenance, and other related expenses. Property owners within a MUD receive a notice specifying the assessed amount, payment schedule, and options for remitting the payment. In summary, the Houston Texas Notice of Payments of Assessments encompasses various types of notices sent to property owners, detailing the specific assessment amount, payment deadlines, and other relevant instructions. These notices could include assessments imposed by homeowners associations, property tax authorities, special districts, or municipal utility districts. It is crucial for property owners to carefully review these notices to understand their financial obligations and ensure timely payments are made to avoid penalties or other consequences.

Houston Texas Notice of Payments of Assessments

Description

How to fill out Houston Texas Notice Of Payments Of Assessments?

If you are looking for a relevant form template, it’s extremely hard to choose a better place than the US Legal Forms site – one of the most considerable libraries on the web. Here you can get thousands of document samples for business and individual purposes by categories and regions, or keywords. With our advanced search feature, getting the most up-to-date Houston Texas Notice of Payments of Assessments is as elementary as 1-2-3. Additionally, the relevance of each and every record is proved by a team of professional lawyers that on a regular basis check the templates on our platform and revise them in accordance with the newest state and county requirements.

If you already know about our platform and have a registered account, all you should do to get the Houston Texas Notice of Payments of Assessments is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the sample you require. Look at its description and utilize the Preview feature to check its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to get the proper record.

- Confirm your decision. Click the Buy now button. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the file format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Houston Texas Notice of Payments of Assessments.

Each template you save in your user profile does not have an expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an extra version for modifying or creating a hard copy, you can come back and download it once more at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Houston Texas Notice of Payments of Assessments you were looking for and thousands of other professional and state-specific templates in a single place!