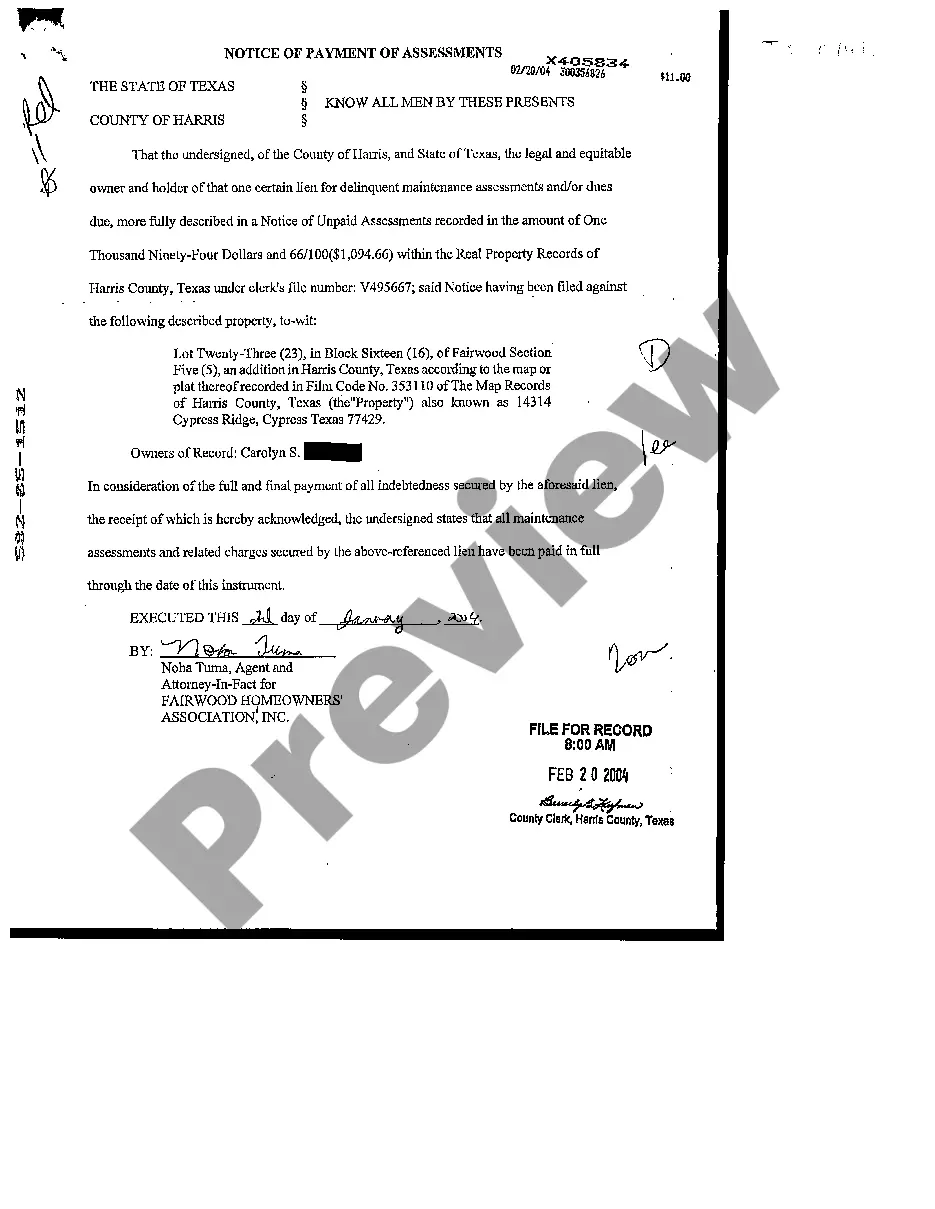

Irving Texas Notice of Payments of Assessments is an essential document that property owners in Irving, Texas, should be familiar with. It serves as a formal notice to property owners regarding the payments of assessments related to their properties. This detailed description will provide valuable insights into what the notice entails and its significance in the local community. The Irving Texas Notice of Payments of Assessments primarily outlines the responsibilities of property owners to make timely and accurate payments for various assessments associated with their properties. These assessments typically include property taxes, homeowner association fees, special district charges, and other relevant levies. It is crucial for property owners to understand the notice's content to avoid potential penalties, interest charges, or legal actions. Property owners in Irving, Texas, receive the Notice of Payments of Assessments from the respective authorities responsible for collecting these assessments. Different types of Irving Texas Notice of Payments of Assessments may include: 1. Property Tax Notice: This type of notice specifies the amount due in property taxes based on the assessed value of the property. It includes important dates, payment methods, and instructions on appealing the assessment if necessary. 2. Homeowner Association Fee Notice: For residents living in managed communities or neighborhoods with homeowner associations, this notice outlines the payments due for maintaining shared amenities, security services, landscaping, and other community-related expenses. It provides a breakdown of fees, due dates, and penalties for late payments. 3. Special District Assessment Notice: In certain areas, special districts may be set up to fund development projects or public services such as water and sewage systems, infrastructure improvements, or road maintenance. This notice informs property owners about their required contributions to these special districts. It includes the assessment amount, payment schedule, and contact information for any inquiries. Irving Texas Notice of Payments of Assessments is a critical tool for property owners to understand their financial obligations and fulfill them promptly. By adhering to the guidelines outlined in the notice, property owners can maintain good standing in the community, avoid potential legal consequences, and contribute to the overall development and well-being of Irving, Texas.

Irving Texas Notice of Payments of Assessments

Description

How to fill out Irving Texas Notice Of Payments Of Assessments?

Irrespective of social or occupational rank, finalizing law-related documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unfeasible for an individual without any legal background to draft these types of documents from the ground up, primarily due to the intricate vocabulary and legal subtleties they encompass.

This is where US Legal Forms proves beneficial.

Confirm that the template you have selected is appropriate for your region, as the regulations of one state or locality may not apply to another.

Review the document and examine a brief summary (if available) of situations the paper can address.

- Our platform offers a vast array with over 85,000 ready-to-use state-specific documents applicable for nearly any legal circumstance.

- US Legal Forms additionally serves as an excellent resource for associates or legal advisors looking to conserve time utilizing our DIY papers.

- Whether you seek the Irving Texas Notice of Payments of Assessments or any other documentation that will be suitable for your state or locality, with US Legal Forms, everything is accessible.

- Here’s how you can swiftly acquire the Irving Texas Notice of Payments of Assessments using our reliable platform.

- If you are already a current user, you can go ahead to Log In to your account for downloading the required form.

- If you are not familiar with our platform, ensure you adhere to these steps before obtaining the Irving Texas Notice of Payments of Assessments.

Form popularity

FAQ

In Dallas County, the homestead exemption works by lowering the taxable value of your primary residence. Homeowners must apply through the appraisal district to receive this exemption, and it can lead to significant tax savings. The process includes submitting necessary documentation to confirm ownership and residency. Understanding the intricacies of the Irving Texas Notice of Payments of Assessments will provide further insights into how these benefits can impact your tax obligations.

Property tax rates in Irving, Texas, generally fall around 2% of the appraised property value. Various factors, including local assessments and exemptions, can influence your final tax bill. Staying informed about property tax rates is crucial for homeowners, particularly when reviewing the Irving Texas Notice of Payments of Assessments. Understanding these rates will help you budget effectively for your housing costs.

The savings from the homestead exemption in Texas can vary widely depending on your home’s appraised value. In general, homeowners can save hundreds of dollars annually, as a significant portion of the home’s value becomes tax-exempt. This exemption can especially aid families and individuals during challenging economic times. For more tailored calculations, consider reviewing the Irving Texas Notice of Payments of Assessments or consulting local tax officials.

Qualifying for the Texas homestead exemption primarily requires you to own the property and use it as your primary residence. Additionally, you must be a resident of Texas and meet certain age or disability criteria in some cases. It is essential to apply for this exemption, as eligibility can significantly lower your property tax bill. When you explore the Irving Texas Notice of Payments of Assessments, it becomes clear why many homeowners pursue this exemption.

The homestead exemption in Irving, Texas, reduces the amount of property taxes you owe on your home. It allows homeowners to exclude a certain portion of their home's value from taxation. This exemption is designed to provide financial relief to property owners, making homeownership more affordable. By understanding the Irving Texas Notice of Payments of Assessments, you can better navigate the benefits it provides.

To figure out your property taxes in Texas, start by checking the assessed value of your property, which is available through your local appraisal district. Multiply that value by the applicable tax rate for your area to estimate your taxes. The Irving Texas Notice of Payments of Assessments can also provide you with detailed insights into your tax calculations and payments, making the process much more manageable.

The property tax for a house in Texas varies significantly based on its location and market value, typically averaging 1.8% to 2.5%. Each county sets its tax rate, so it's vital to stay informed about your specific area. You can easily find this information in the Irving Texas Notice of Payments of Assessments, which summarizes your tax liabilities in a clear manner.

In Irving, Texas, property taxes can average around 2.6% of the home's assessed value. This amount can change based on certain factors such as exemptions, property improvements, and local rates. To monitor your property tax obligations effectively, refer to the Irving Texas Notice of Payments of Assessments, which outlines critical details regarding your payments.

The property tax rate in Irving, Texas, typically falls around 2.5% to 3.0% of the assessed value of your home. This rate may change slightly based on specific tax levies from local taxing authorities. Understanding the Irving Texas Notice of Payments of Assessments can assist you in keeping track of any changes to your property taxes, ensuring you remain informed and prepared.

To challenge a property tax assessment in Texas, you can file a protest with your local appraisal review board. This process typically requires you to present evidence that supports your claim for a lower valuation. Utilizing resources like the Irving Texas Notice of Payments of Assessments can provide essential details on how to navigate this challenging but critical process effectively.