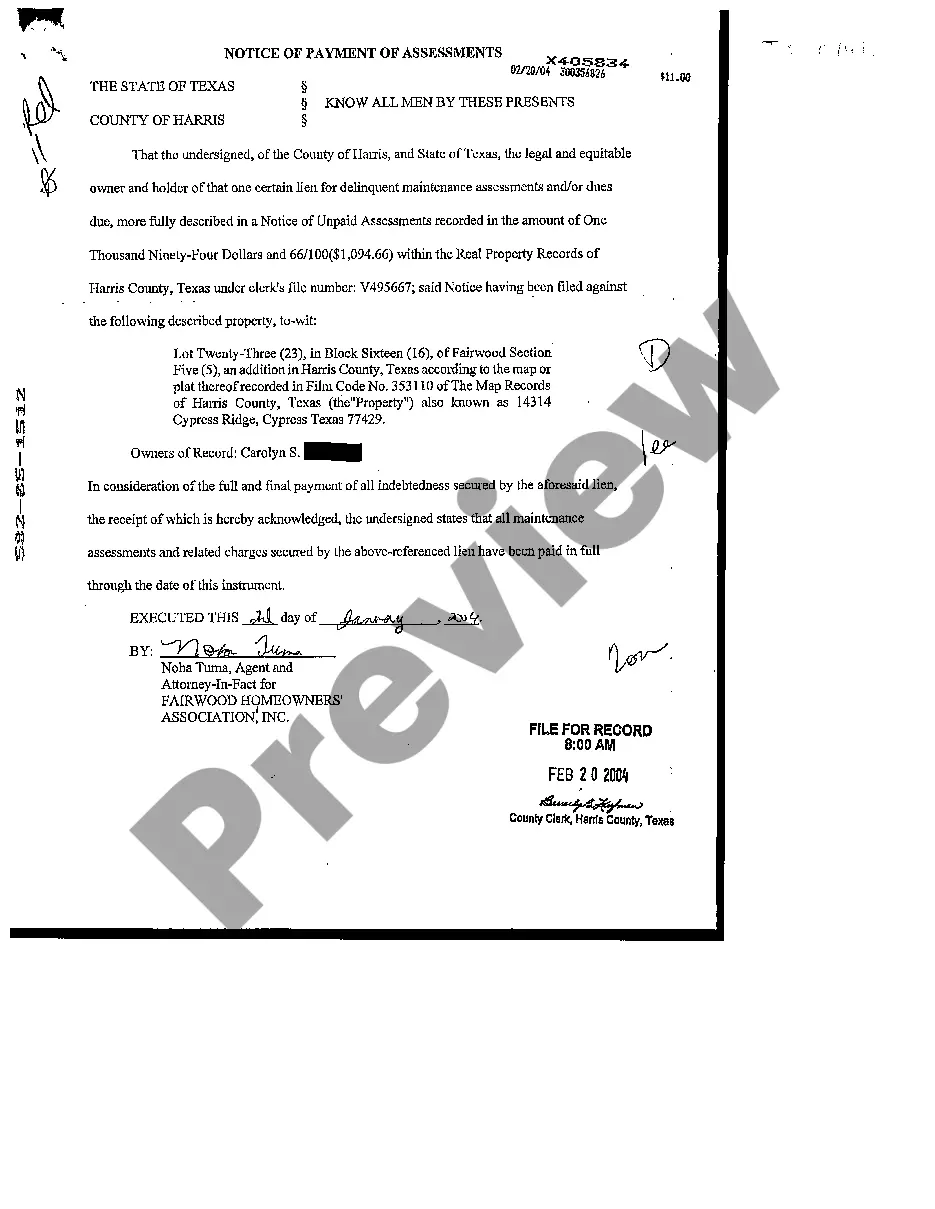

The Sugar Land Texas Notice of Payments of Assessments is an essential document that pertains to property owners within the Sugar Land area. This notice serves as a formal communication regarding the payment of assessments and is sent by the appropriate governing body, typically a homeowners association or a property management company. It outlines the financial obligations that property owners must fulfill to maintain the upkeep and functionality of their respective communities. Keywords: Sugar Land Texas, Notice of Payments, Assessments, property owners, governing body, homeowners association, property management company, financial obligations, upkeep, functionality, communities. There are different types of Sugar Land Texas Notice of Payments of Assessments, including: 1. Regular Assessment Notice: This notice is sent periodically, typically on a monthly, quarterly, or yearly basis, informing property owners of their regular assessments. Regular assessments are recurring fees designed to cover ongoing maintenance costs, administration fees, or other agreed-upon expenses necessary to maintain the community. 2. Special Assessment Notice: In certain circumstances, property owners may receive a special assessment notice, which outlines an additional one-time fee that goes beyond the regular assessments. Special assessments are generally required to fund unexpected repairs, capital improvements, or to address any financial deficiency faced by the governing body. This notice specifies the amount, purpose, and due date for the special assessment. 3. Delinquent Assessment Notice: If a property owner fails to make timely payments, a delinquent assessment notice may be issued. This notice serves as a reminder to settle outstanding dues promptly, emphasizing the potential consequences of continued non-payment, such as late fees, interest, or even legal actions. It typically includes a breakdown of the owed amount, payment instructions, and a deadline for payment resolution. 4. Assessment Collection Notice: In more severe cases of non-payment, an assessment collection notice may be sent, indicating the initiation of formal collection procedures. This notice warns property owners of the impending consequences for prolonged non-payment, including the possibility of a lien being placed on the property or even foreclosure proceedings. It is essential for property owners in Sugar Land, Texas, to carefully review the Sugar Land Texas Notice of Payments of Assessments to ensure compliance with their financial obligations. Timely payment of assessments helps maintain the overall quality and desirability of the community, providing essential services, amenities, and a cohesive neighborhood environment.

Sugar Land Texas Notice of Payments of Assessments

Description

How to fill out Sugar Land Texas Notice Of Payments Of Assessments?

If you are searching for a relevant form template, it’s difficult to find a more convenient platform than the US Legal Forms website – one of the most considerable online libraries. Here you can find a huge number of document samples for company and personal purposes by categories and states, or key phrases. Using our high-quality search function, finding the most up-to-date Sugar Land Texas Notice of Payments of Assessments is as elementary as 1-2-3. Moreover, the relevance of each and every record is proved by a group of professional lawyers that regularly check the templates on our platform and update them in accordance with the latest state and county requirements.

If you already know about our platform and have a registered account, all you should do to get the Sugar Land Texas Notice of Payments of Assessments is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the sample you want. Read its description and make use of the Preview feature to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to get the proper document.

- Confirm your selection. Choose the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Sugar Land Texas Notice of Payments of Assessments.

Each form you save in your profile does not have an expiry date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to get an extra version for modifying or creating a hard copy, you may come back and export it once more at any moment.

Make use of the US Legal Forms extensive catalogue to get access to the Sugar Land Texas Notice of Payments of Assessments you were seeking and a huge number of other professional and state-specific samples in one place!