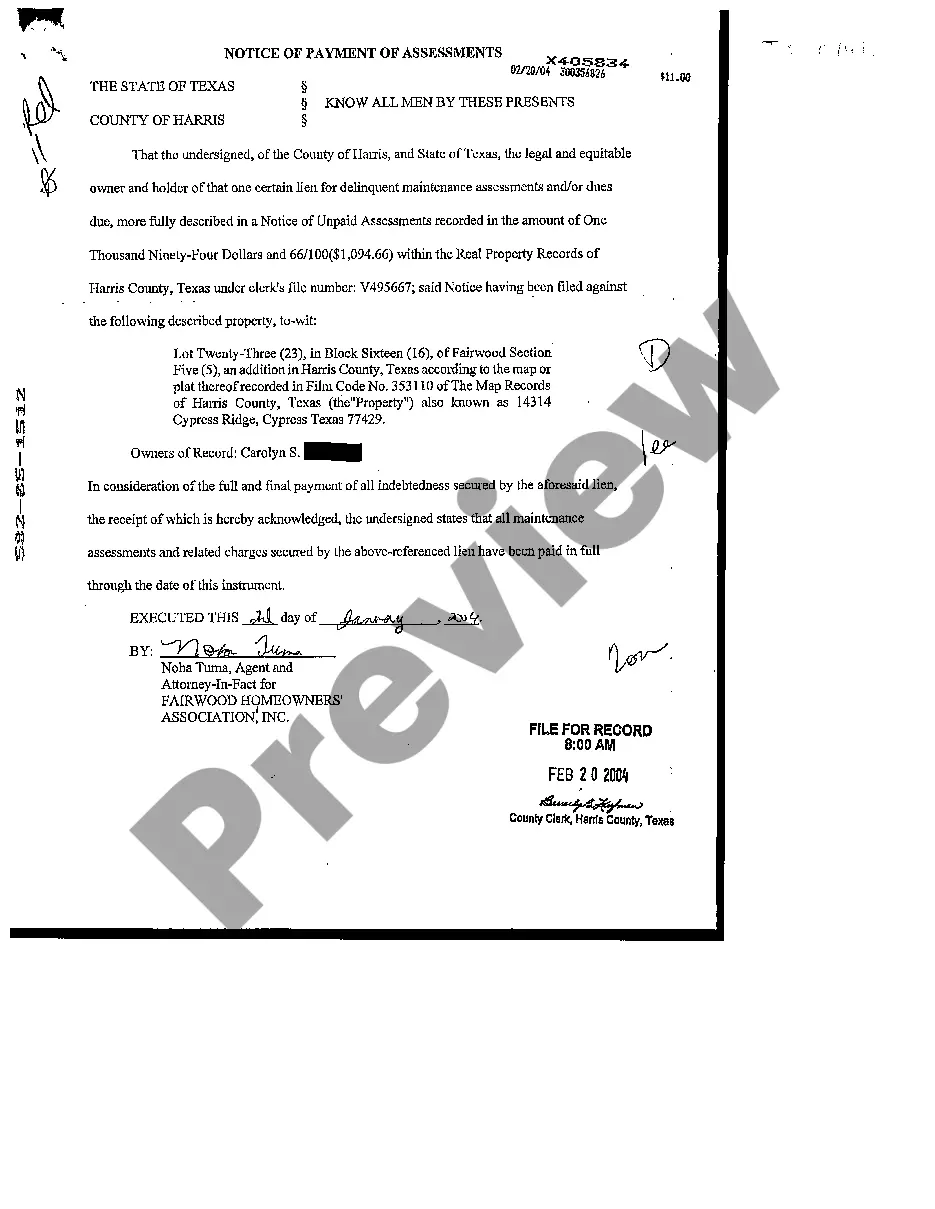

Travis Texas Notice of Payments of Assessments is a legal document designed to outline the specific payment obligations of property owners within Travis County, Texas. This notice serves as an important communication tool between the county and property owners, providing crucial information regarding the payment of assessments and ensuring compliance with local regulations. This notice serves as a reminder for property owners to fulfill their financial responsibilities within the designated timeframe. It typically includes pertinent details such as the amount due, payment deadlines, acceptable payment methods, and the consequences of non-compliance. In Travis County, there might be specific types of notices depending on the nature of the assessment payments. Some common types of Travis Texas Notice of Payments of Assessments include: 1. Property Tax Assessment Notice: This notice is sent annually to property owners, providing information about their property tax obligations. It outlines the assessed value of the property, any exemptions or deductions applicable, the tax rate, and the total tax amount due. Property owners are typically given specific deadlines to make their payments to avoid penalties or interest. 2. Homeowners Association (HOA) Assessment Notice: This notice is issued by Has two homeowners within a particular community or development. It outlines the assessments levied by the HOA to fund shared expenses such as maintenance, amenities, and landscaping. These notices specify the amount, due dates, and payment method options for homeowners to fulfill their obligations. 3. Special Assessment District (SAD) Notice: In certain situations, a SAD notice might be issued, particularly in instances where infrastructure improvements or services are being funded through special assessments. These notices contain information about the purpose of the assessment, the amount levied, and the timeframe for payment. It's crucial for property owners in Travis County to review these notices promptly upon receipt and take appropriate action to fulfill their payment obligations. Failure to do so can result in penalties, interest, property liens, or legal ramifications. In summary, Travis Texas Notice of Payments of Assessments are essential tools for property owners in Travis County to understand and fulfill their financial responsibilities. Whether it pertains to property taxes, HOA assessments, or special assessments, these notices provide clear instructions and deadlines for payment, ensuring compliance with local regulations while maintaining the overall well-being of the community.

Travis Texas Notice of Payments of Assessments

Description

How to fill out Travis Texas Notice Of Payments Of Assessments?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any legal education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the Travis Texas Notice of Payments of Assessments or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Travis Texas Notice of Payments of Assessments in minutes using our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are new to our platform, ensure that you follow these steps prior to obtaining the Travis Texas Notice of Payments of Assessments:

- Ensure the template you have chosen is specific to your location considering that the rules of one state or county do not work for another state or county.

- Review the document and go through a brief outline (if provided) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the Travis Texas Notice of Payments of Assessments once the payment is done.

You’re good to go! Now you can go ahead and print out the document or complete it online. If you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.