A College Stations Texas Contract for Deed, also known as a land contract or installment sale agreement, is a legal document that outlines the purchase agreement between a seller or owner and a buyer, allowing the buyer to occupy and use the property while making payments over time. In this arrangement, the seller acts as the lender, financing the sale of the property instead of requiring the buyer to secure traditional mortgage financing. This innovative type of agreement offers several advantages for both buyers and sellers. For buyers, a College Station Texas Contract for Deed may provide an opportunity to purchase a property without the need for a large upfront payment or a perfect credit score. This can be particularly beneficial for individuals who may not qualify for traditional financing or those who prefer a more flexible payment plan. For sellers, entering into a College Station Texas Contract for Deed can help attract a larger pool of prospective buyers, particularly those who may have difficulty obtaining a mortgage through conventional means. Additionally, by becoming the lender, sellers can generate a steady monthly income while retaining legal ownership of the property until the full purchase price is paid off. There are different types of College Station Texas Contracts for Deed available depending on the specific terms and conditions of the agreement. These variations include: 1. Fixed-Term Contract for Deed: This type of contract sets a specific duration of time for the buyer to make periodic payments until the final payment is due, upon which the buyer will receive full ownership of the property. 2. Balloon Payment Contract for Deed: In this arrangement, the buyer makes regular payments over a fixed period, typically a few years, and then must make one large final payment (balloon payment) at the end to complete the purchase. 3. Adjustable-Rate Contract for Deed: With this type of contract, the interest rate applied to the outstanding balance may fluctuate periodically according to market conditions, affecting the total payment amount. 4. Subject-To Contract for Deed: This variation allows the buyer to assume the existing mortgage on the property rather than entering into a completely new financing agreement with the seller. It's important for both parties to carefully review and negotiate the terms of a College Station Texas Contract for Deed before entering into the agreement. Consulting with a qualified real estate attorney or professional can ensure all legal requirements are met and that both buyer and seller are protected throughout the transaction process.

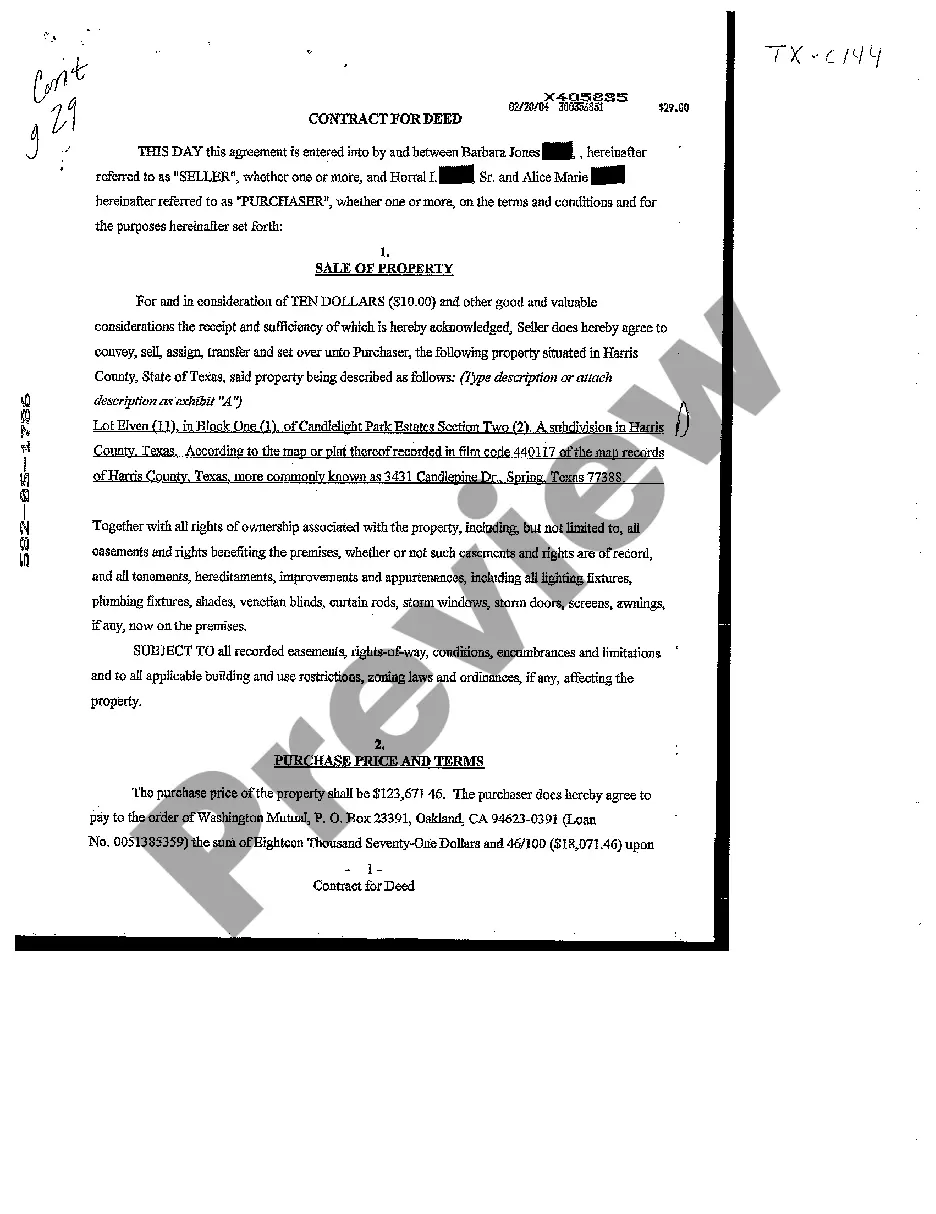

College Station Texas Contract for Deed

State:

Texas

City:

College Station

Control #:

TX-C144

Format:

PDF

Instant download

This form is available by subscription

Description

Contract for Deed

A College Stations Texas Contract for Deed, also known as a land contract or installment sale agreement, is a legal document that outlines the purchase agreement between a seller or owner and a buyer, allowing the buyer to occupy and use the property while making payments over time. In this arrangement, the seller acts as the lender, financing the sale of the property instead of requiring the buyer to secure traditional mortgage financing. This innovative type of agreement offers several advantages for both buyers and sellers. For buyers, a College Station Texas Contract for Deed may provide an opportunity to purchase a property without the need for a large upfront payment or a perfect credit score. This can be particularly beneficial for individuals who may not qualify for traditional financing or those who prefer a more flexible payment plan. For sellers, entering into a College Station Texas Contract for Deed can help attract a larger pool of prospective buyers, particularly those who may have difficulty obtaining a mortgage through conventional means. Additionally, by becoming the lender, sellers can generate a steady monthly income while retaining legal ownership of the property until the full purchase price is paid off. There are different types of College Station Texas Contracts for Deed available depending on the specific terms and conditions of the agreement. These variations include: 1. Fixed-Term Contract for Deed: This type of contract sets a specific duration of time for the buyer to make periodic payments until the final payment is due, upon which the buyer will receive full ownership of the property. 2. Balloon Payment Contract for Deed: In this arrangement, the buyer makes regular payments over a fixed period, typically a few years, and then must make one large final payment (balloon payment) at the end to complete the purchase. 3. Adjustable-Rate Contract for Deed: With this type of contract, the interest rate applied to the outstanding balance may fluctuate periodically according to market conditions, affecting the total payment amount. 4. Subject-To Contract for Deed: This variation allows the buyer to assume the existing mortgage on the property rather than entering into a completely new financing agreement with the seller. It's important for both parties to carefully review and negotiate the terms of a College Station Texas Contract for Deed before entering into the agreement. Consulting with a qualified real estate attorney or professional can ensure all legal requirements are met and that both buyer and seller are protected throughout the transaction process.

Free preview

How to fill out College Station Texas Contract For Deed?

If you’ve already used our service before, log in to your account and save the College Station Texas Contract for Deed on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your College Station Texas Contract for Deed. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!