Waco Texas Contract for Deed: Understanding the Basics If you're considering buying or selling real estate in Waco, Texas, you may have come across the term "Contract for Deed." This article will provide a detailed description of what a Waco Texas Contract for Deed entails, covering its definition, process, benefits, and potential drawbacks. The Waco Texas Contract for Deed, also known as a land contract or installment sale agreement, is a financial arrangement used in real estate transactions. It allows for the purchase of property without involving a traditional mortgage lender. Instead of obtaining financing from a bank, the seller acts as the financier, providing the buyer with financing options. In this type of arrangement, the seller retains legal ownership of the property until the buyer completes all the required payments. During this time, the buyer has equitable rights to possess and use the property. This is different from a traditional mortgage, where the buyer receives the deed upon closing the purchase and takes ownership immediately. Different Types of Waco Texas Contracts for Deed: 1. Standard Contract for Deed: This is the most common type of Contract for Deed used in Waco, Texas. It outlines the terms and conditions of the agreement, including the purchase price, interest rate, payment schedule, and any other specific provisions agreed upon by the parties involved. 2. Lease Option Contract for Deed: This variation incorporates a lease with an option to purchase the property at a later date. It allows the buyer to lease the property first while having the option to buy it within a specified timeframe. A portion of the monthly lease payment is usually credited toward the purchase price if the buyer exercises the option. Advantages of a Waco Texas Contract for Deed: 1. More accessible financing: For buyers who may not qualify for traditional mortgages, a Contract for Deed offers an alternative way to purchase property. Credit history or down payment requirements may be less stringent, making homeownership more attainable for individuals with lower credit scores. 2. Flexible payment terms: Since the buyer and seller negotiate the terms directly, they have more flexibility in tailoring the payment schedule, interest rate, and overall financing arrangement to meet their specific needs. This can be particularly beneficial for parties seeking non-traditional payment options. 3. Faster closing process: Compared to traditional mortgage processes, which involve extensive paperwork and approval times, a Waco Texas Contract for Deed typically allows for a faster closing. With fewer parties involved, the transaction can be completed more efficiently. Considerations and Potential Drawbacks: 1. Lack of immediate ownership: Buyers should understand that the seller retains legal ownership until the final payment is made. While the buyer has the right to use and possess the property during this period, they cannot claim full ownership until completing all payment obligations. 2. Risk of contract default: If the buyer fails to make payments as agreed, the seller may have the right to terminate the contract and retain ownership of the property. This can lead to the loss of any equity built up and potential legal consequences for the buyer. 3. Title concerns: Buyers should conduct thorough due diligence before entering into a Contract for Deed. Ensuring the property has a clean title and conducting necessary inspections is crucial to avoid future disputes or unexpected issues. In conclusion, a Waco Texas Contract for Deed offers an alternative approach to traditional financing for real estate transactions. It provides flexibility for both buyers and sellers, making homeownership more accessible to a broader range of individuals. However, it is essential for parties involved to carefully review the terms and understand the potential risks before entering into this type of agreement. Proper legal guidance and due diligence are crucial to a successful Contract for Deed transaction in Waco, Texas.

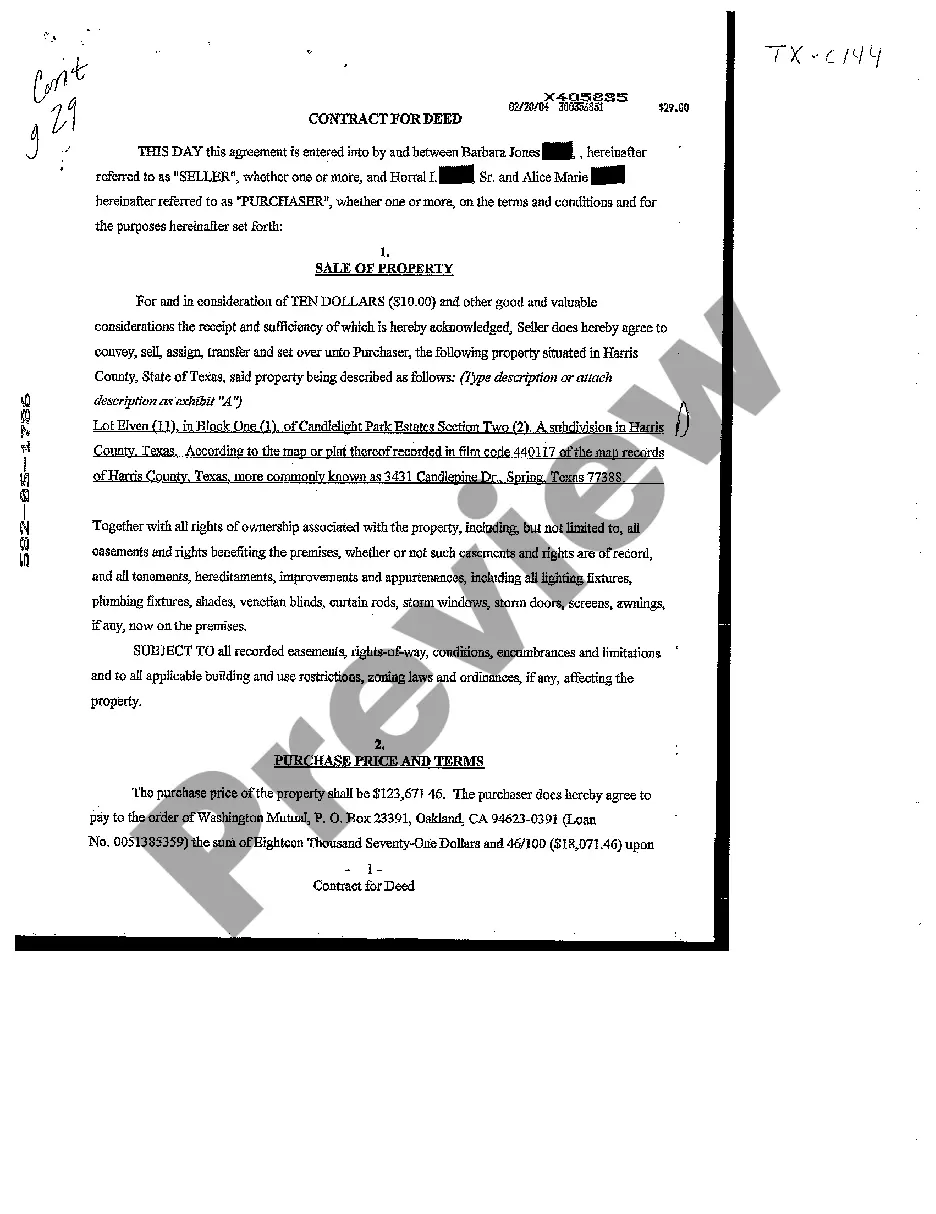

Waco Texas Contract for Deed

State:

Texas

City:

Waco

Control #:

TX-C144

Format:

PDF

Instant download

This form is available by subscription

Description

Contract for Deed

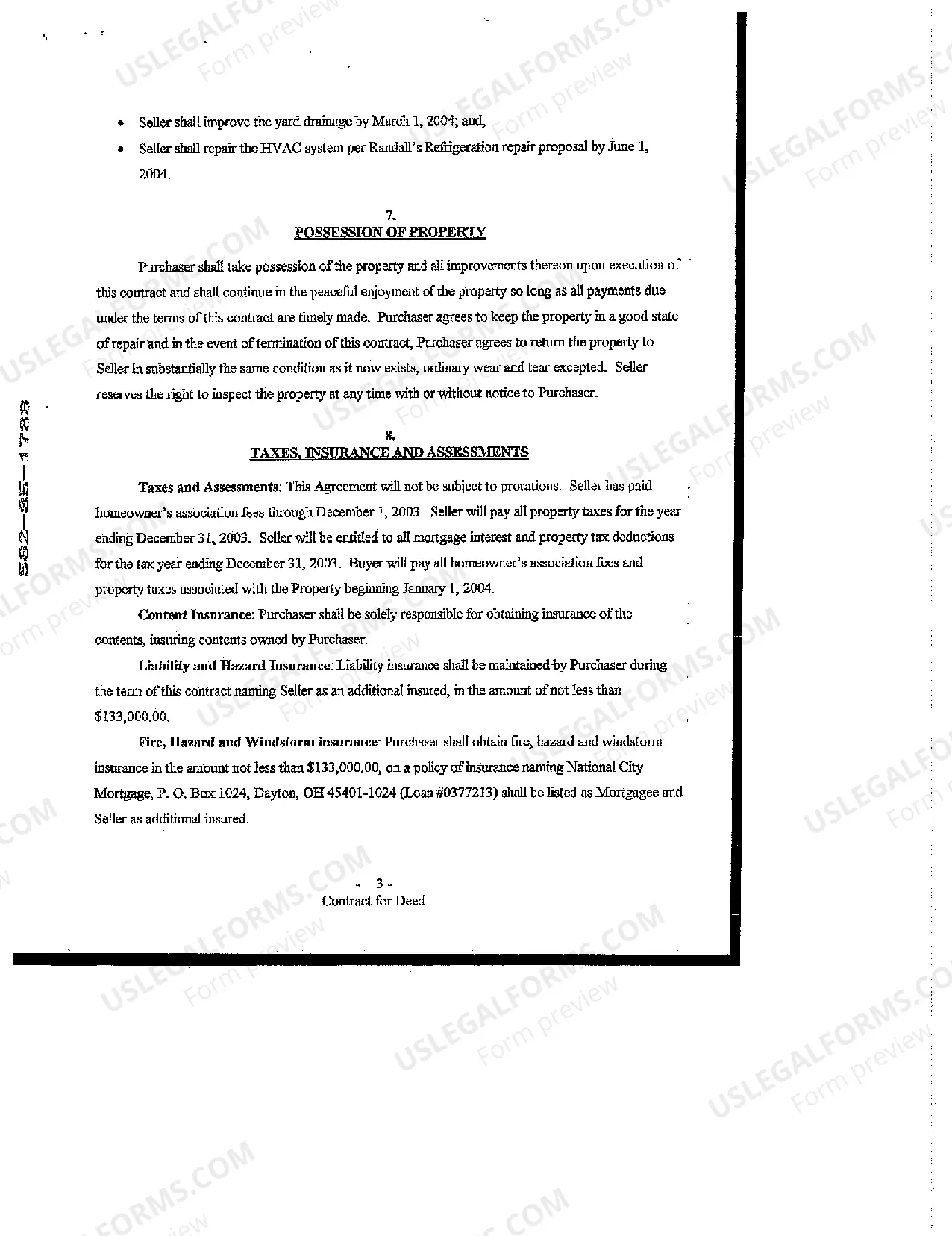

Waco Texas Contract for Deed: Understanding the Basics If you're considering buying or selling real estate in Waco, Texas, you may have come across the term "Contract for Deed." This article will provide a detailed description of what a Waco Texas Contract for Deed entails, covering its definition, process, benefits, and potential drawbacks. The Waco Texas Contract for Deed, also known as a land contract or installment sale agreement, is a financial arrangement used in real estate transactions. It allows for the purchase of property without involving a traditional mortgage lender. Instead of obtaining financing from a bank, the seller acts as the financier, providing the buyer with financing options. In this type of arrangement, the seller retains legal ownership of the property until the buyer completes all the required payments. During this time, the buyer has equitable rights to possess and use the property. This is different from a traditional mortgage, where the buyer receives the deed upon closing the purchase and takes ownership immediately. Different Types of Waco Texas Contracts for Deed: 1. Standard Contract for Deed: This is the most common type of Contract for Deed used in Waco, Texas. It outlines the terms and conditions of the agreement, including the purchase price, interest rate, payment schedule, and any other specific provisions agreed upon by the parties involved. 2. Lease Option Contract for Deed: This variation incorporates a lease with an option to purchase the property at a later date. It allows the buyer to lease the property first while having the option to buy it within a specified timeframe. A portion of the monthly lease payment is usually credited toward the purchase price if the buyer exercises the option. Advantages of a Waco Texas Contract for Deed: 1. More accessible financing: For buyers who may not qualify for traditional mortgages, a Contract for Deed offers an alternative way to purchase property. Credit history or down payment requirements may be less stringent, making homeownership more attainable for individuals with lower credit scores. 2. Flexible payment terms: Since the buyer and seller negotiate the terms directly, they have more flexibility in tailoring the payment schedule, interest rate, and overall financing arrangement to meet their specific needs. This can be particularly beneficial for parties seeking non-traditional payment options. 3. Faster closing process: Compared to traditional mortgage processes, which involve extensive paperwork and approval times, a Waco Texas Contract for Deed typically allows for a faster closing. With fewer parties involved, the transaction can be completed more efficiently. Considerations and Potential Drawbacks: 1. Lack of immediate ownership: Buyers should understand that the seller retains legal ownership until the final payment is made. While the buyer has the right to use and possess the property during this period, they cannot claim full ownership until completing all payment obligations. 2. Risk of contract default: If the buyer fails to make payments as agreed, the seller may have the right to terminate the contract and retain ownership of the property. This can lead to the loss of any equity built up and potential legal consequences for the buyer. 3. Title concerns: Buyers should conduct thorough due diligence before entering into a Contract for Deed. Ensuring the property has a clean title and conducting necessary inspections is crucial to avoid future disputes or unexpected issues. In conclusion, a Waco Texas Contract for Deed offers an alternative approach to traditional financing for real estate transactions. It provides flexibility for both buyers and sellers, making homeownership more accessible to a broader range of individuals. However, it is essential for parties involved to carefully review the terms and understand the potential risks before entering into this type of agreement. Proper legal guidance and due diligence are crucial to a successful Contract for Deed transaction in Waco, Texas.

Free preview

How to fill out Waco Texas Contract For Deed?

If you’ve already used our service before, log in to your account and save the Waco Texas Contract for Deed on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Waco Texas Contract for Deed. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!