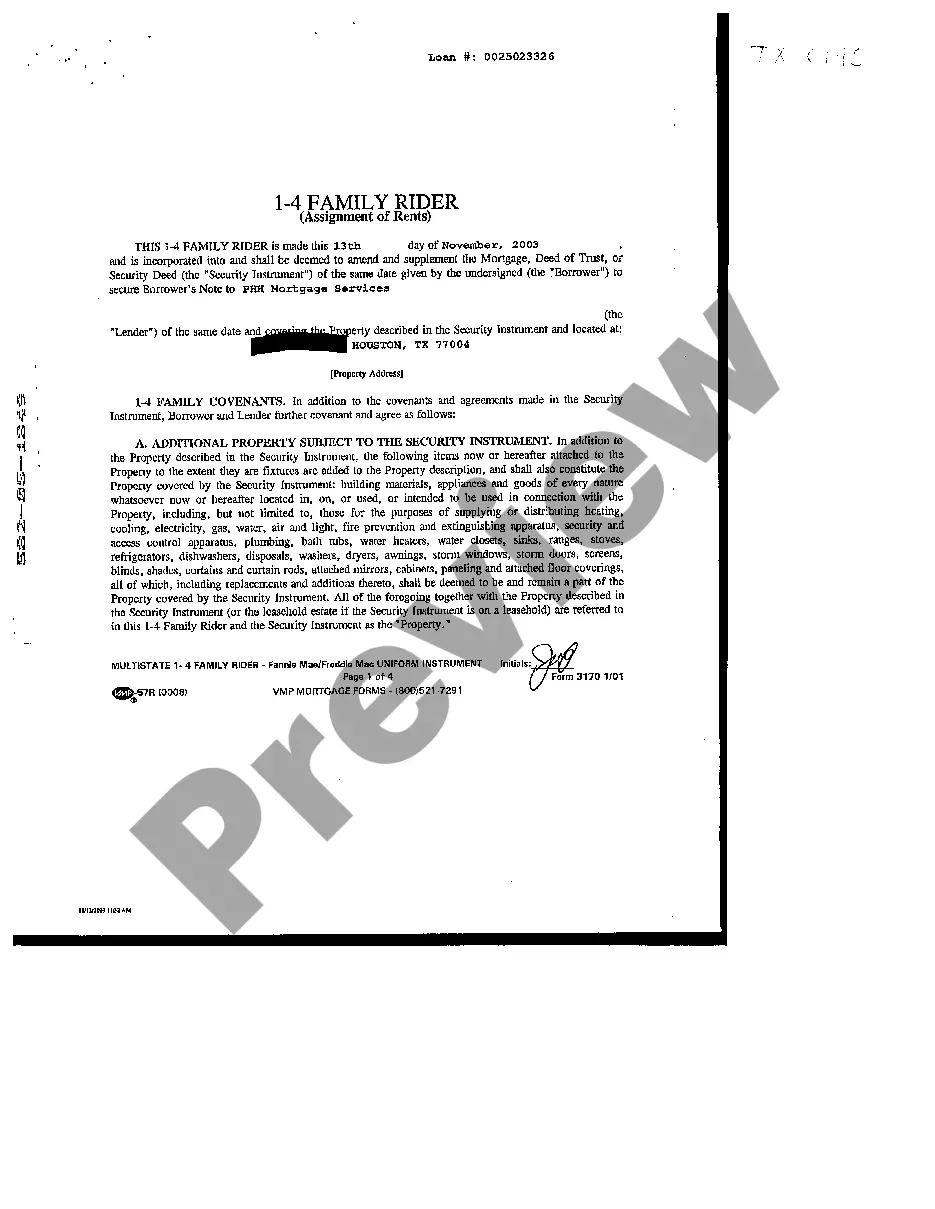

The Houston Texas Family Rider Assignment of Rents is a legal document that allows for the assignment of rental income from a property to a family member in the event of the property owner's incapacity or death. This rider is often attached or added to a family's estate plan or will, outlining the specific provisions regarding the assignment of rental income. The purpose of the Houston Texas Family Rider Assignment of Rents is to ensure the uninterrupted receipt and management of rental income by a designated family member, typically a spouse or child, in case the property owner becomes unable to manage the rental property themselves. This document serves as a crucial component of estate planning, as it allows for the smooth transition of the property's rental income to the designated family member, preventing potential financial difficulties or disputes over the management of the property. It provides clarity and guidance on the assignment process, ensuring that the family member receiving the rental income has legal authority and responsibilities in managing the property. The Houston Texas Family Rider Assignment of Rents may involve specific provisions that need to be addressed, such as the duration of the assignment, the percentage of rental income assigned, and any conditions or restrictions placed on the designated family member. These provisions can be tailored to meet the unique circumstances and preferences of the property owner and their family. Different types or variations of the Houston Texas Family Rider Assignment of Rents may exist, depending on the specific needs and goals of the property owner and their family. Some common variations include assigning a percentage of rental income, delegating the management of the property to the designated family member, or granting specific powers related to leasing and maintenance decisions. Overall, the Houston Texas Family Rider Assignment of Rents provides a legal framework for the smooth transfer of rental income and management responsibilities to a designated family member, safeguarding the financial interests of the property owner's family in times of incapacity or death.

Houston Texas Family Rider Assignment of Rents

Description

How to fill out Houston Texas Family Rider Assignment Of Rents?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Houston Texas Family Rider Assignment of Rents gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Houston Texas Family Rider Assignment of Rents takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Houston Texas Family Rider Assignment of Rents. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!