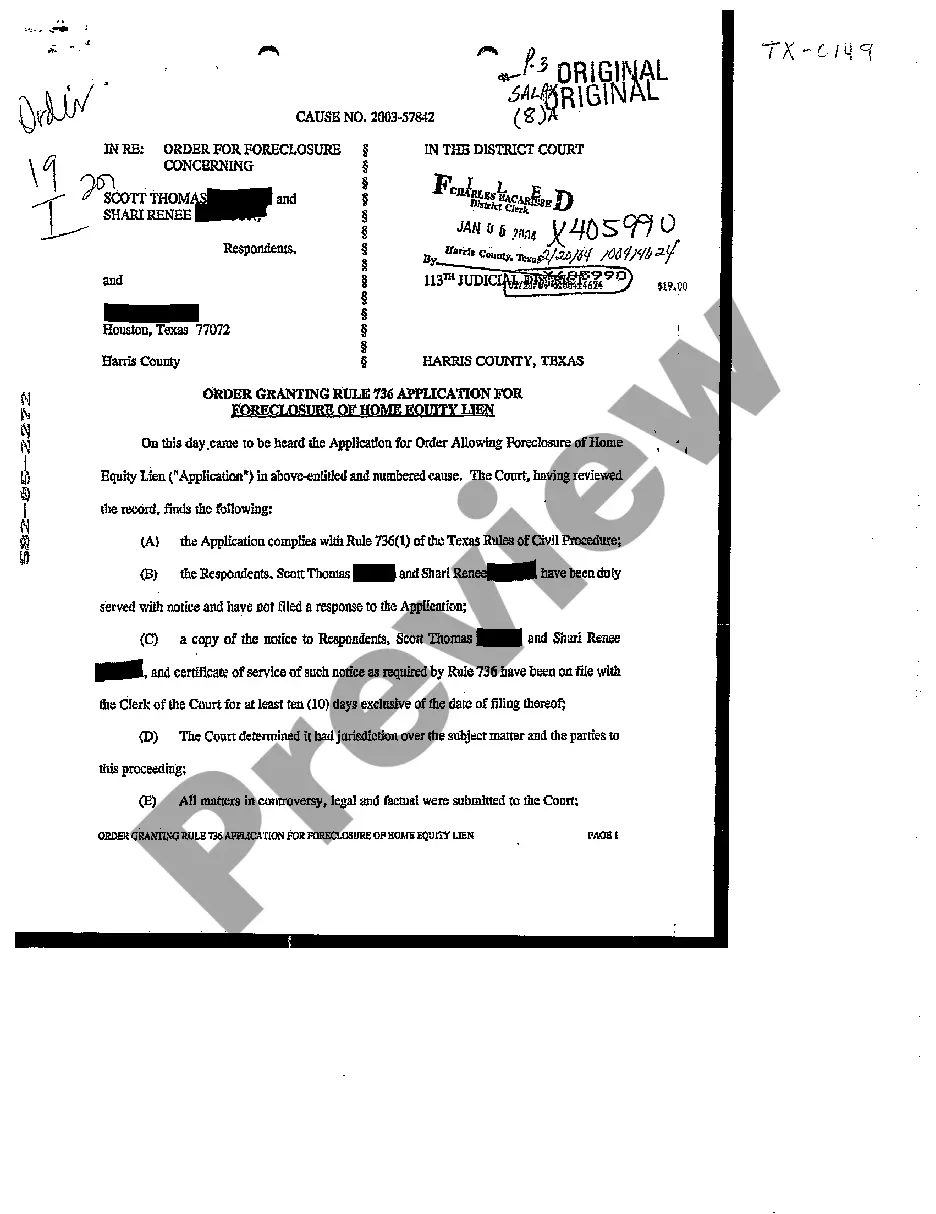

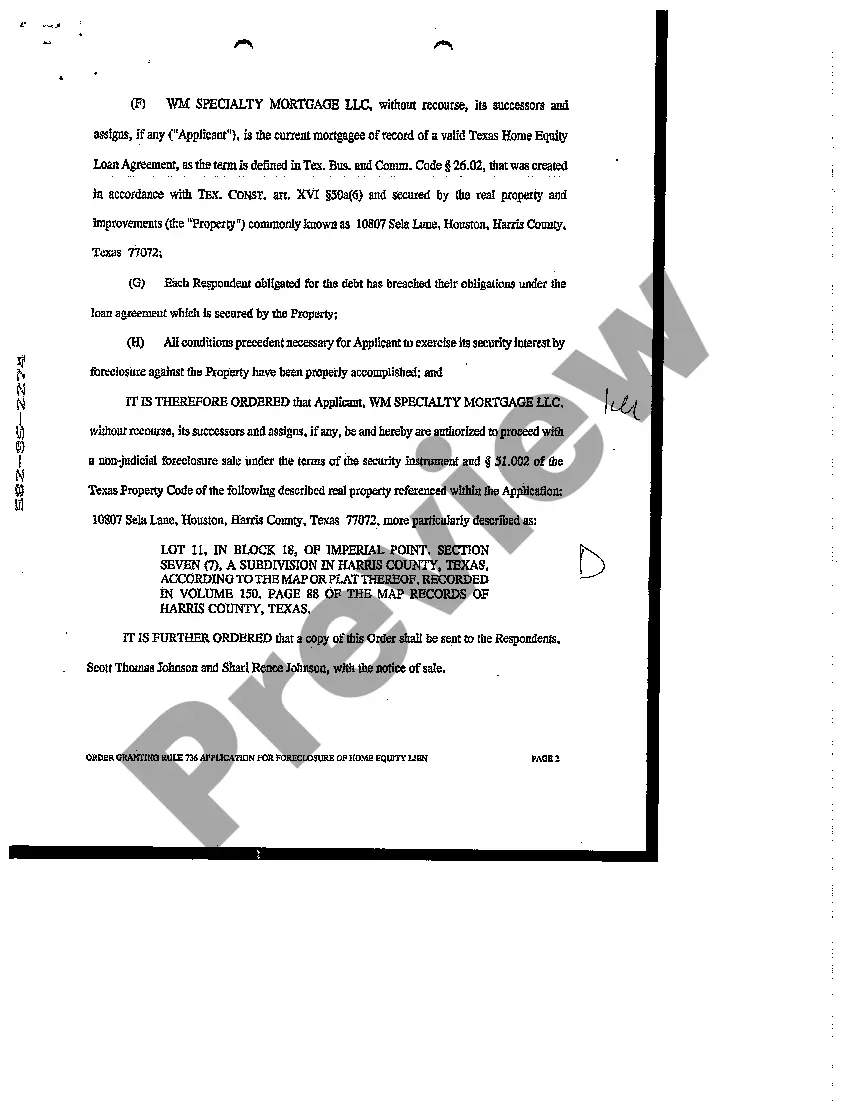

Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process in Bexar County, Texas, that allows lenders to seek foreclosure on a property due to non-payment of a home equity lien. This application is made under Rule 736 of the Texas Rules of Civil Procedure, which outlines the procedures for judicial foreclosure. The Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is typically filed by lenders or their representatives when a borrower has defaulted on their home equity loan or mortgage. This rule specifically applies to cases where a home equity lien has been placed on the property, providing the lender with a legal interest in the property as collateral for the loan. The process starts with the lender filing an application with the court requesting permission to foreclose on the property. The application must comply with the requirements set forth in Rule 736, including providing details of the home equity loan, the borrower's default, and the amount owed. The lender must also demonstrate that they have complied with all the notice and disclosure requirements of the home equity loan agreement. Once the application is submitted, it is reviewed by the court. If the court finds that the lender has met all the necessary requirements and provided sufficient evidence of default, they may grant the order for foreclosure. This order authorizes the lender to proceed with the sale of the property through a public auction or sheriff's sale to recover the outstanding debt. It is important to note that there can be various types of Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien, depending on the specific circumstances of each case. Some common types may include: 1. Standard Rule 736 Application: This is the most common type of application for foreclosure of a home equity lien, initiated by the lender against a borrower who has defaulted on their loan. 2. Acceleration Clause Application: In some cases, the lender may have exercised an acceleration clause in the loan agreement, declaring the total amount of the loan due immediately. In such cases, the application would reflect the acceleration of the debt and the subsequent foreclosure request. 3. Multiple Lien holder Application: If there are multiple lien holders or creditors with an interest in the property, a joint application may be filed by all parties seeking foreclosure. This ensures that all the creditors' interests are protected and the proceeds from the sale are distributed accordingly. 4. Protective Order Application: In certain situations, the borrower may contest the foreclosure or seek to delay the process. In response, the lender may file a protective order application, requesting the court to protect their rights and prevent any undue delays in the foreclosure process. These are some examples of the different types of Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien that can be encountered depending on the specific circumstances of each case. It is always important for borrowers and lenders to seek legal advice to understand their rights and obligations when dealing with foreclosure proceedings.

Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process in Bexar County, Texas, that allows lenders to seek foreclosure on a property due to non-payment of a home equity lien. This application is made under Rule 736 of the Texas Rules of Civil Procedure, which outlines the procedures for judicial foreclosure. The Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is typically filed by lenders or their representatives when a borrower has defaulted on their home equity loan or mortgage. This rule specifically applies to cases where a home equity lien has been placed on the property, providing the lender with a legal interest in the property as collateral for the loan. The process starts with the lender filing an application with the court requesting permission to foreclose on the property. The application must comply with the requirements set forth in Rule 736, including providing details of the home equity loan, the borrower's default, and the amount owed. The lender must also demonstrate that they have complied with all the notice and disclosure requirements of the home equity loan agreement. Once the application is submitted, it is reviewed by the court. If the court finds that the lender has met all the necessary requirements and provided sufficient evidence of default, they may grant the order for foreclosure. This order authorizes the lender to proceed with the sale of the property through a public auction or sheriff's sale to recover the outstanding debt. It is important to note that there can be various types of Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien, depending on the specific circumstances of each case. Some common types may include: 1. Standard Rule 736 Application: This is the most common type of application for foreclosure of a home equity lien, initiated by the lender against a borrower who has defaulted on their loan. 2. Acceleration Clause Application: In some cases, the lender may have exercised an acceleration clause in the loan agreement, declaring the total amount of the loan due immediately. In such cases, the application would reflect the acceleration of the debt and the subsequent foreclosure request. 3. Multiple Lien holder Application: If there are multiple lien holders or creditors with an interest in the property, a joint application may be filed by all parties seeking foreclosure. This ensures that all the creditors' interests are protected and the proceeds from the sale are distributed accordingly. 4. Protective Order Application: In certain situations, the borrower may contest the foreclosure or seek to delay the process. In response, the lender may file a protective order application, requesting the court to protect their rights and prevent any undue delays in the foreclosure process. These are some examples of the different types of Bexar Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien that can be encountered depending on the specific circumstances of each case. It is always important for borrowers and lenders to seek legal advice to understand their rights and obligations when dealing with foreclosure proceedings.