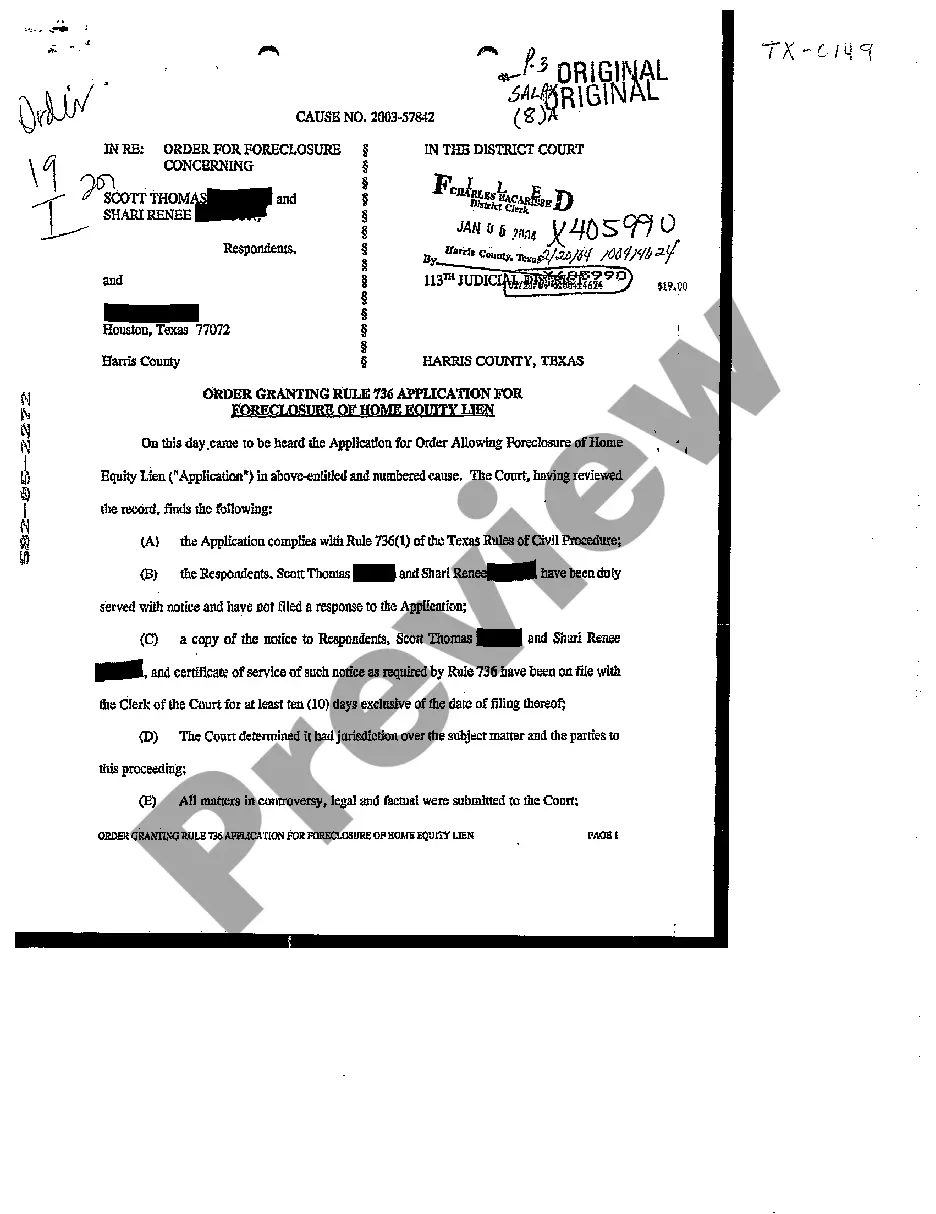

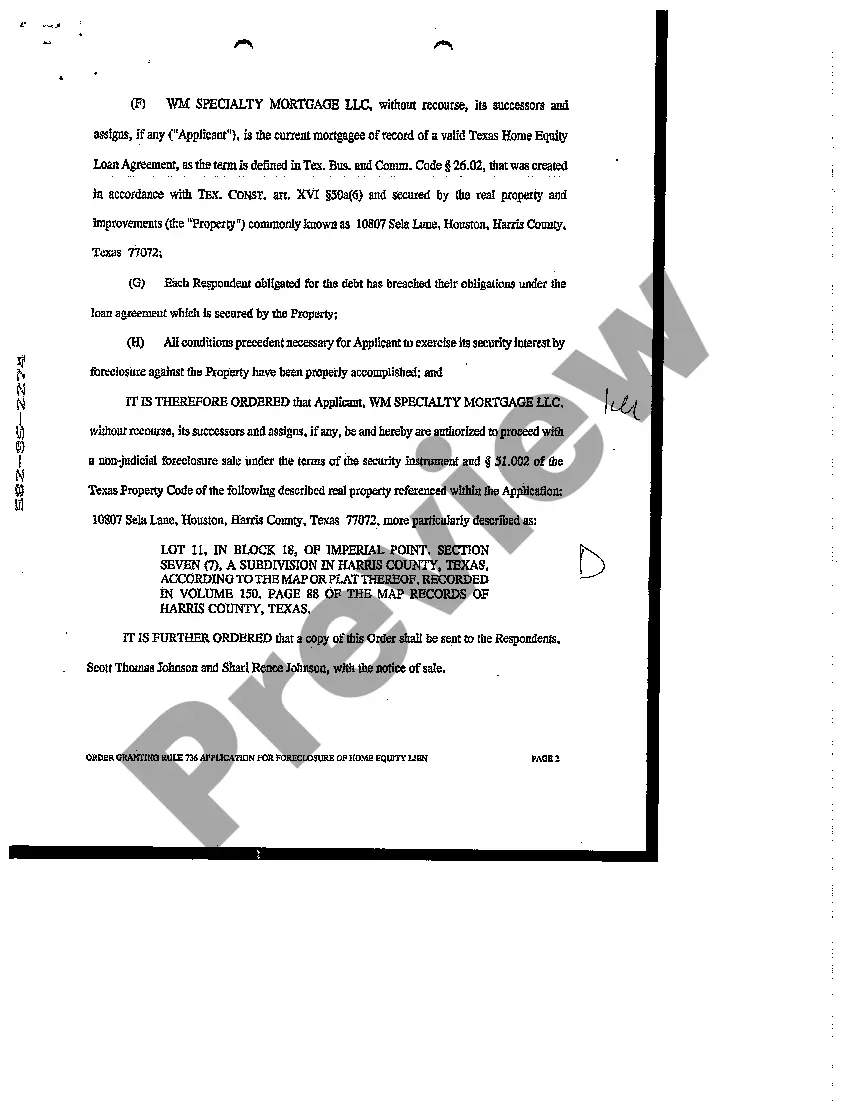

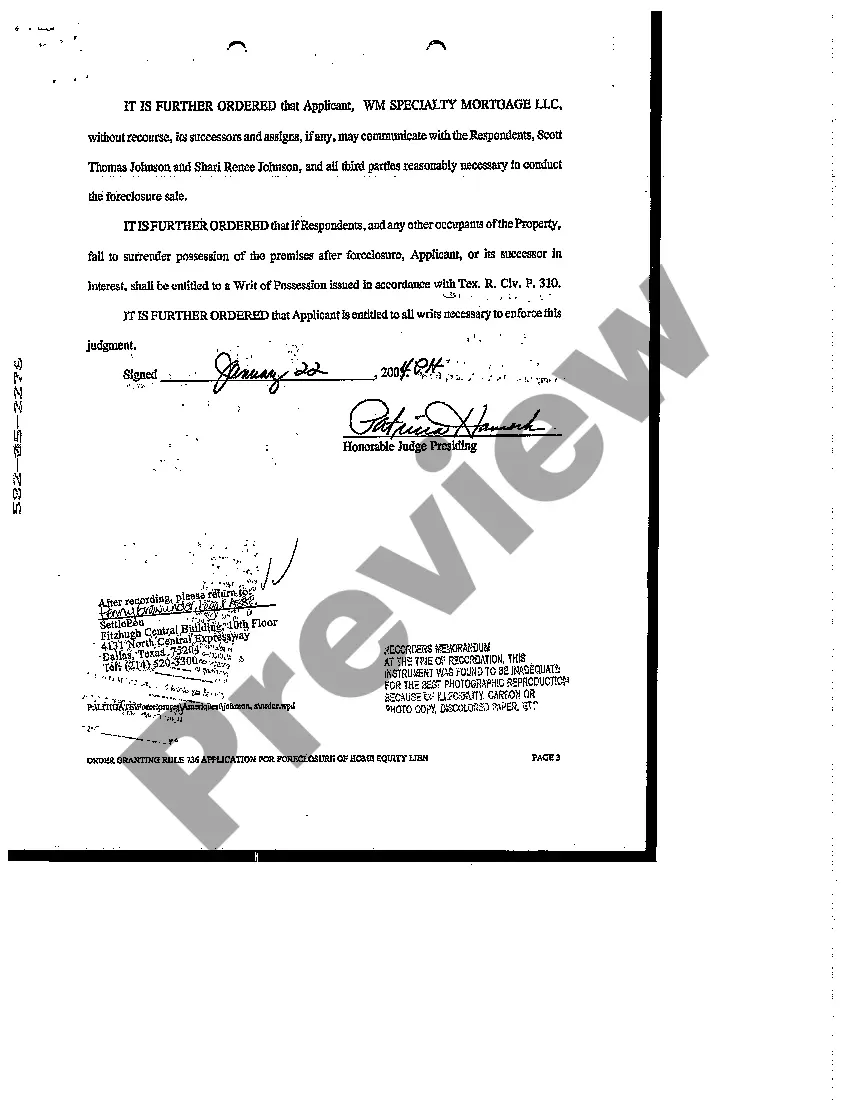

Brownsville, Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien In Brownsville, Texas, a Rule 736 application for foreclosure of a home equity lien allows lenders to obtain a court order to foreclose on a property in cases where the homeowner has defaulted on their home equity loan. This legal process ensures that lenders have the ability to recoup their investment and recover outstanding loan amounts. When a homeowner fails to make necessary payments on their home equity loan, the lender can file a Rule 736 application seeking permission from the court to proceed with foreclosure. This application is an essential step in the foreclosure process as it initiates the legal proceedings required to reclaim the property securing the loan. In order for the court to grant the Rule 736 application, several conditions must be met. The lender must demonstrate that the borrower has defaulted on the home equity loan, and that the loan is secured by a home equity lien on the property. The lender must also prove that it has complied with all notice requirements and given the homeowner ample opportunity to cure the default. Once the Rule 736 application is approved by the court, the lender can proceed with the foreclosure process. They will provide notice to the homeowner, giving them a final opportunity to resolve the default and avoid foreclosure. If the homeowner fails to do so, the lender can proceed with the sale of the property through a foreclosure auction. It is important to note that there are different types of Brownsville, Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien, namely: 1. Nonjudicial Foreclosure: In this type of foreclosure, the lender follows a streamlined process outlined by the Texas Property Code. It allows the lender to foreclose on the property without going through the court system, provided the loan documents contain a power of sale clause. 2. Judicial Foreclosure: In cases where the loan documents do not include a power of sale clause, or the lender chooses the judicial foreclosure route, the lender must file a lawsuit in court seeking a judgment on the foreclosure. This process can be more time-consuming and involves the court's direct involvement in the foreclosure proceedings. The Brownsville, Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien serves as a crucial legal document that ensures lenders can protect their investment when borrowers default on their home equity loans. It provides a clear and regulated pathway for lenders to reclaim the property securing the loan and recoup outstanding amounts through foreclosure auctions.

Brownsville Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

Description

How to fill out Brownsville Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for attorney services that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Brownsville Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Brownsville Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Brownsville Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is suitable for you, you can select the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!