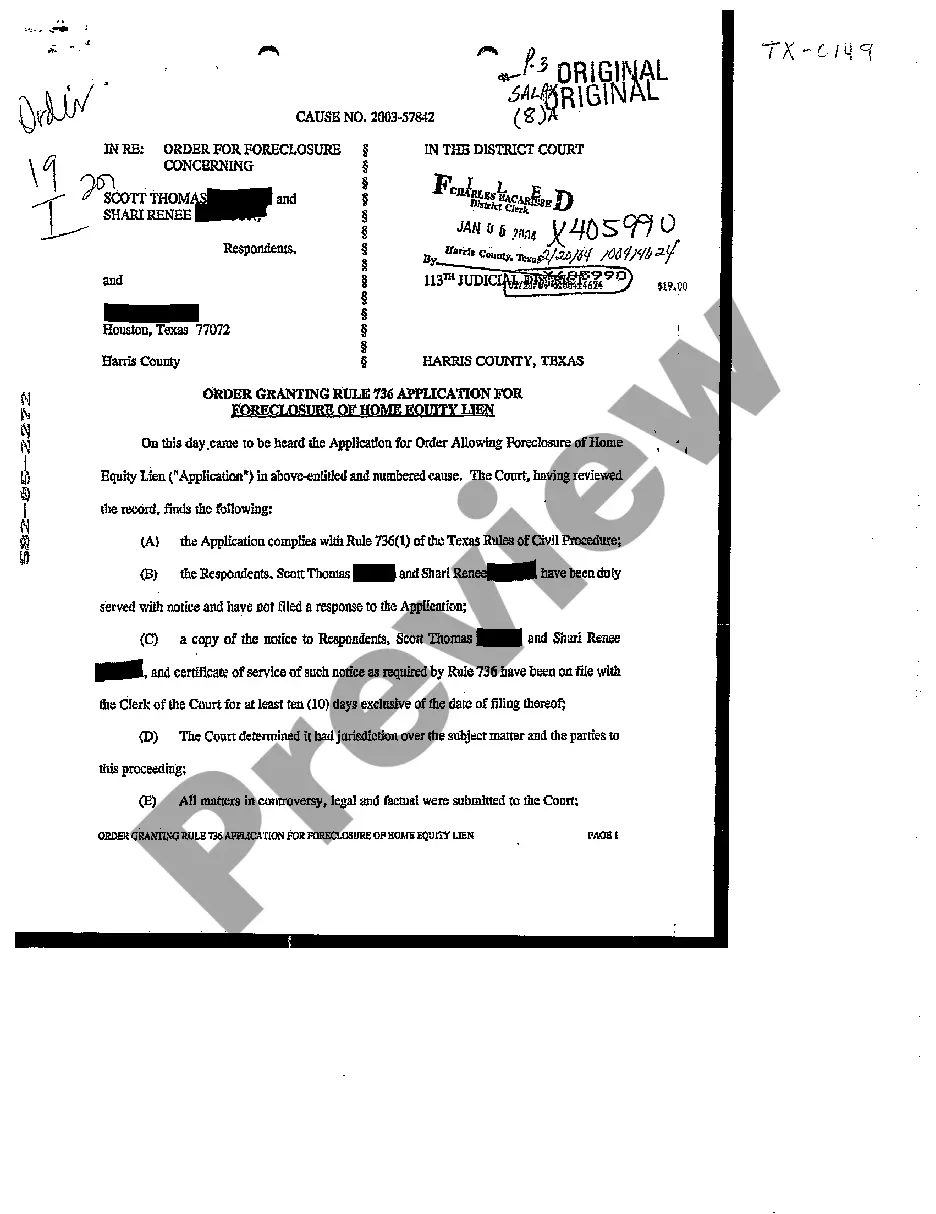

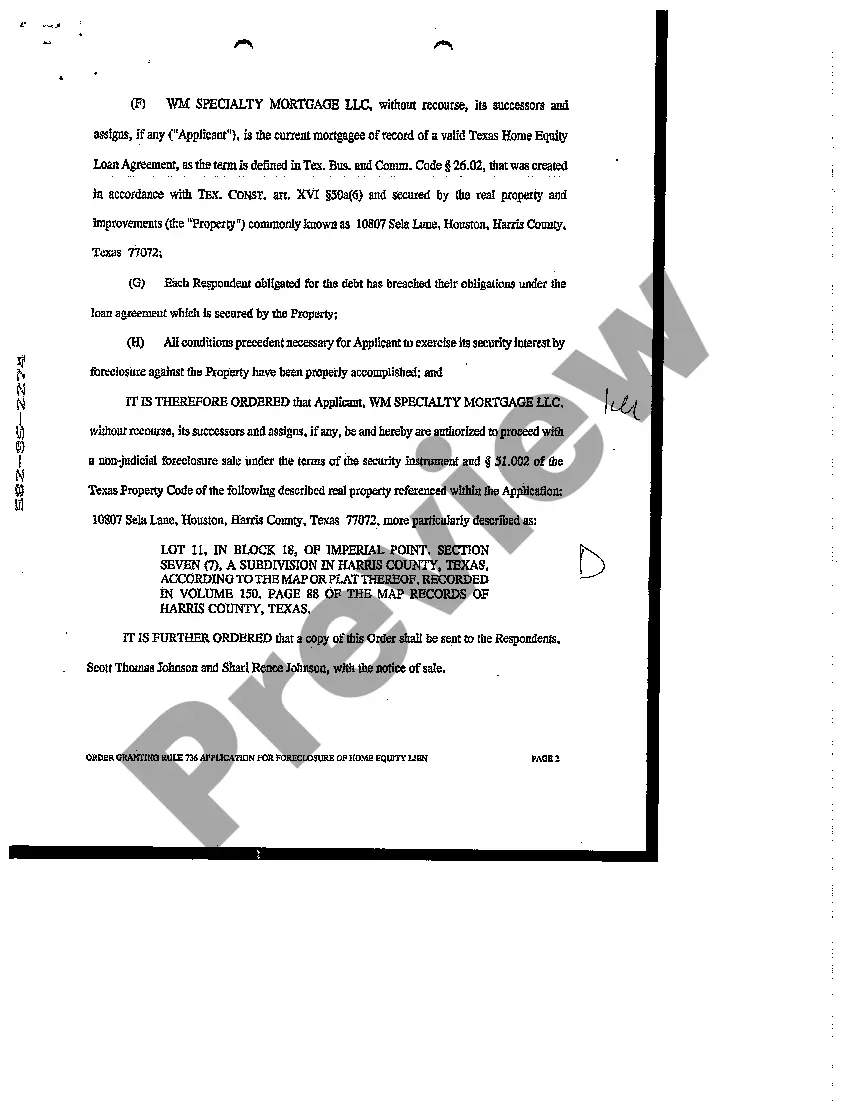

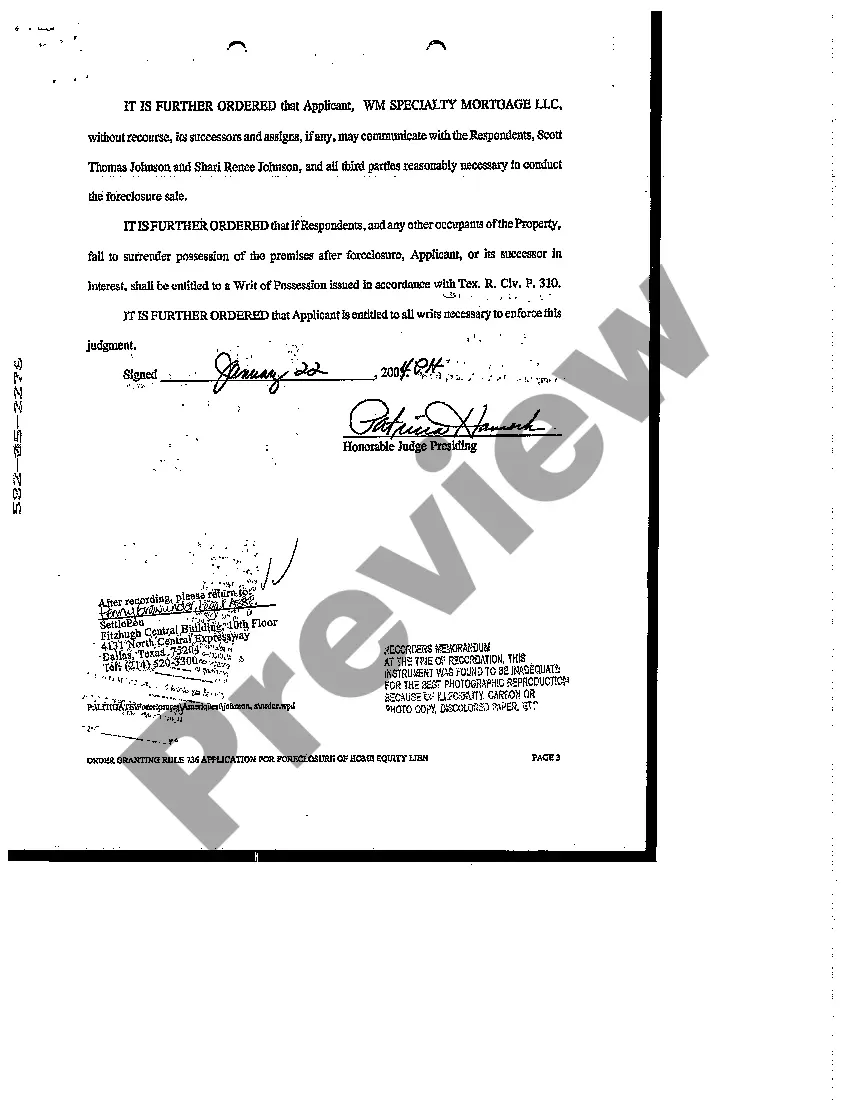

Title: Understanding the Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien Introduction: In Carrollton, Texas, the Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal procedure that allows mortgage lenders to seek foreclosure on the property when the borrower defaults on a home equity loan. This detailed description aims to explain the process, requirements, and possible outcomes of the foreclosure proceeding in Carrollton, Texas. 1. Definition and Purpose: The Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien refers to a court order that approves the lender's request for foreclosure. Its purpose is to facilitate the enforcement of the home equity lien when a borrower fails to fulfill their loan obligations. 2. Process of Rule 736 Foreclosure Application: To initiate the Rule 736 foreclosure process, the lender files an application with the Carrollton court, providing evidence of default and compliance with legal procedures. The court assesses the application and grants the order if all prerequisites are met. 3. Documentation and Requirements: To obtain an Order Granting Rule 736 Application for Foreclosure of Home Equity Lien, the lender must provide documentation such as a certified copy of the loan agreement, payment history, notice of default, acceleration letter, and proof of compliance with statutory notice requirements. Meeting these requirements is crucial for lenders who wish to proceed with foreclosure. 4. Different Types of Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien: Within the Carrollton jurisdiction, the Rule 736 Application for Foreclosure of Home Equity Lien can encompass various scenarios, including: — Voluntary Foreclosure Application: When a homeowner acknowledges the default and requests the court to proceed with foreclosure promptly. — Involuntary Foreclosure Application: When the lender, after serving notices and following statutory procedures, petitions the court for foreclosure due to borrower default. — Partial Foreclosure Application: In cases where a borrower has defaulted on a portion of the home equity loan, the lender may seek foreclosure limited to the defaulted amount. 5. Potential Outcomes of a Rule 736 Foreclosure Application: Once the Carrollton court grants the Order Granting Rule 736 Application for Foreclosure of Home Equity Lien, potential outcomes may include: — The lender proceeds with the foreclosure process and sells the property to recover the outstanding loan amount. — The borrower reaches a settlement with the lender, allowing them to retain ownership of the property by paying the overdue amount or entering into a modified repayment plan. — The borrower contests the application, presenting evidence that they are not in default or asserting violations of the mortgage agreement or statutory requirements. Conclusion: The Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal mechanism that enables lenders to enforce their rights in cases of borrower default. By understanding the process, requirements, and potential outcomes of the Rule 736 foreclosure application, homeowners and lenders in Carrollton can navigate this complex legal proceeding effectively.

Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

Description

How to fill out Carrollton Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

Do you need a reliable and affordable legal forms supplier to buy the Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien? US Legal Forms is your go-to option.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Restart the search if the template isn’t good for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Carrollton Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.