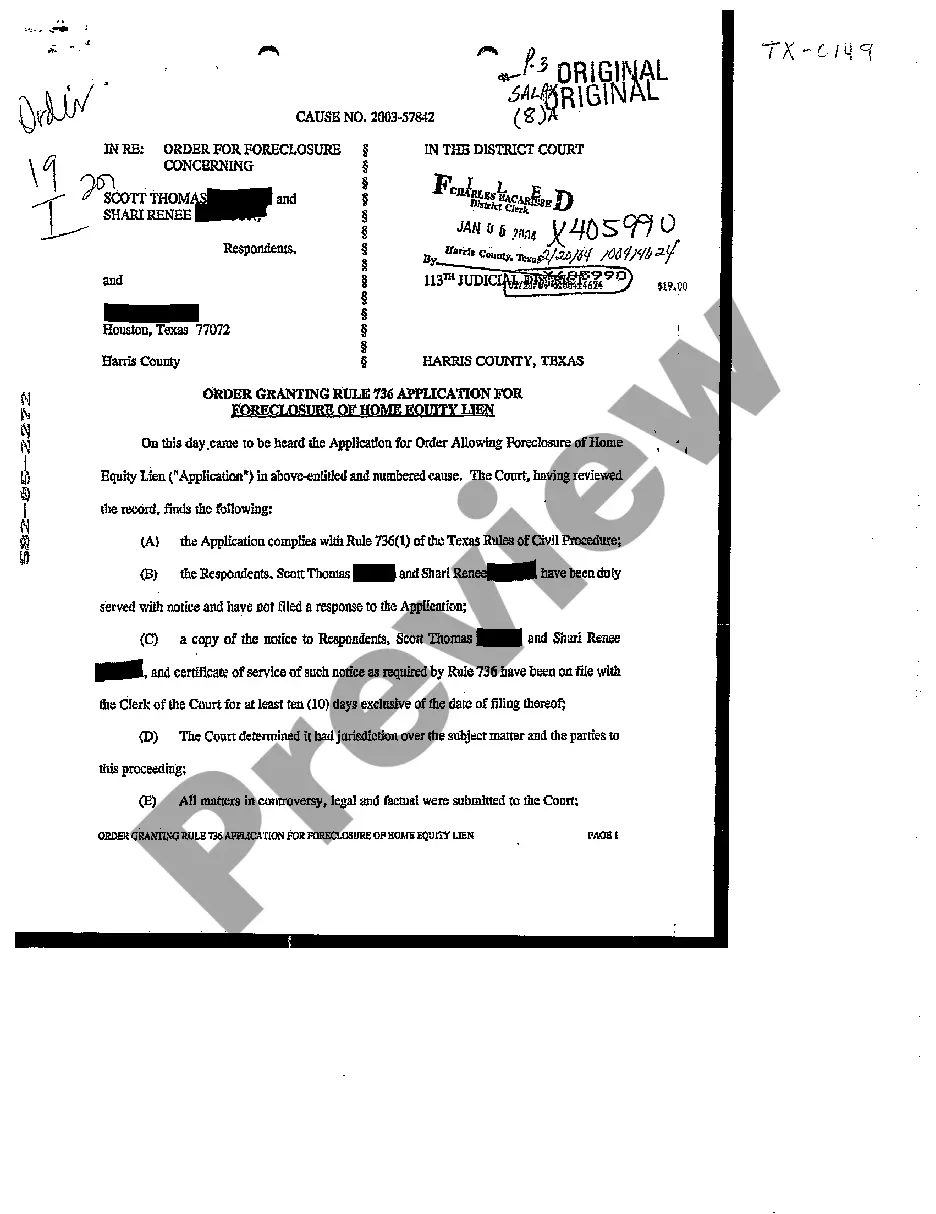

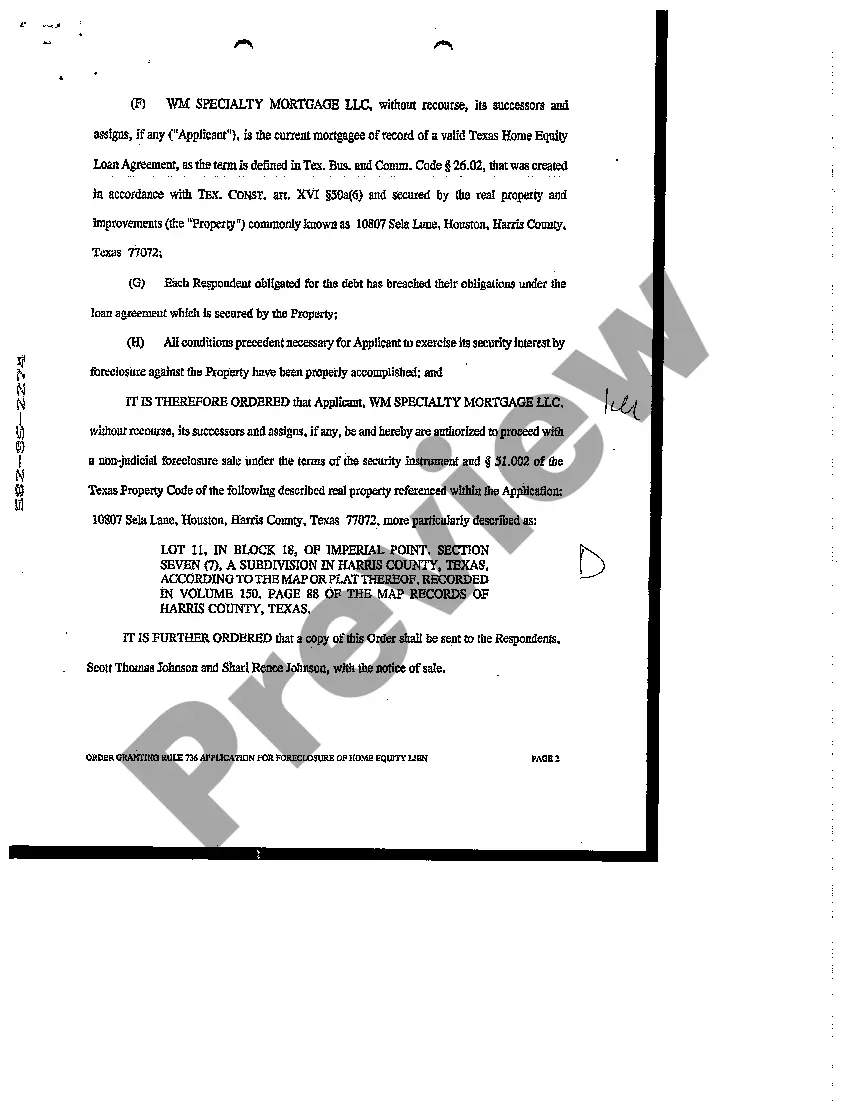

College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process that allows lenders to foreclose on a property in College Station, Texas when the borrower fails to make payments on their home equity loan. This application is filed in accordance with Rule 736 of the Texas Rules of Civil Procedure. Home equity liens are a type of loan that allows homeowners to borrow against the equity they have built up in their property. When borrowers default on these loans, lenders have the option to file an application for foreclosure to recover the outstanding debt. The Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a court order issued by a judge that approves the lender's request to proceed with foreclosure proceedings. This order is typically granted after the lender has proven that the borrower has defaulted on the terms of the home equity loan and has been given sufficient notice of the foreclosure action. There may be several types of College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien, including: 1. Non-judicial foreclosure: In some cases, the foreclosure process may be non-judicial, meaning it does not require court intervention. This typically occurs when the home equity loan agreement includes a power of sale clause, allowing the lender to sell the property directly without court involvement. 2. Judicial foreclosure: Alternatively, the lender may choose to pursue a judicial foreclosure, which involves filing a lawsuit against the borrower in order to obtain a court-ordered foreclosure sale. This is a more formal and time-consuming process that requires court approval at various stages. 3. Acceleration clause: Some home equity loan agreements include an acceleration clause, which allows the lender to demand immediate payment of the entire loan balance if the borrower defaults on their monthly payments. If the borrower fails to meet this demand within a specified timeframe, the lender can then proceed with the foreclosure process. 4. Redemption rights: In Texas, borrowers have the right to redeem their property after a foreclosure sale by paying the outstanding debt in full. This allows them to regain ownership of the property within a certain period of time following the foreclosure sale. Overall, the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal tool used by lenders to recoup their losses when borrowers default on their home equity loans in College Station, Texas. This process ensures that both lenders and borrowers are protected and that the foreclosure process is conducted in accordance with the law.

College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

Description

How to fill out College Station Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien would work for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Generally, the timeline to foreclose on a home in Texas can be as short as 60 days to as long as several months, depending on various factors. Once a College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is issued, this timeline might decrease. Being informed about the foreclosure process helps you prepare effectively. Consider using uslegalforms for valuable insights and necessary documents to ensure you are well-equipped.

The misconception that foreclosure in Texas takes a full 120 days can lead to confusion. In reality, the process can often be completed within 60 to 90 days, especially after a College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien has been submitted. It’s essential to act quickly and familiarize yourself with the timelines, as well as the necessary documents. Our platform, uslegalforms, can provide resources to assist you during this time.

In Texas, the average timeframe for a bank to complete the foreclosure process is typically around 60 to 90 days after you stop making mortgage payments. However, once the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is filed, this timeline can accelerate. It's important to understand your rights during this time and seek assistance if needed. Utilizing platforms like uslegalforms can guide you through the process and help you understand what to expect.

Typically, in Texas, homeowners can be behind by two or three months before foreclosure proceedings may start. However, the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien can accelerate this process in some cases. In light of this, it’s crucial for homeowners to communicate with lenders at the first sign of payment difficulties to explore alternatives.

In Texas, a lien can generally stay on a property as long as the debt secured by that lien remains unpaid. Specifically, a College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien permits the lender to enforce the lien until the debt is resolved. Homeowners should remain vigilant and work to resolve any outstanding debts to prevent long-term issues.

In Texas, you can generally miss two or three payments before facing the risk of foreclosure. While lenders may start the foreclosure process after missing just two payments, the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien will only occur after a certain notice period. To avoid this situation, addressing payment issues quickly with your lender is essential.

In Texas, lenders must adhere to strict requirements for notifying homeowners about foreclosure sales, including timely mailings and detailed information. This notice should include the date, time, and location of the sale, as well as the property details. Familiarizing yourself with the requirements linked to the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien can ensure you receive all necessary information.

The 37-day foreclosure rule in Texas mandates a specific timeline for notices related to foreclosure sales. Lenders must send relevant notices to borrowers at least 37 days before a foreclosure sale, allowing adequate time for homeowners to respond or seek assistance. Knowledge of the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien can equip you with vital information on this timeline.

After a foreclosure sale, if the home sells for more than the outstanding debt, the excess funds are considered surplus. Homeowners can file a claim to receive these funds, ensuring they have all necessary documentation ready. Many find it helpful to refer to the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien for guidance on accessing these surplus proceeds.

A request for notice of mortgage foreclosure is a formal document that allows a borrower to receive notifications before a foreclosure sale occurs. This notice gives homeowners a chance to address their situation and explore options. By filing this request, you can stay informed when dealing with the College Station Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien.