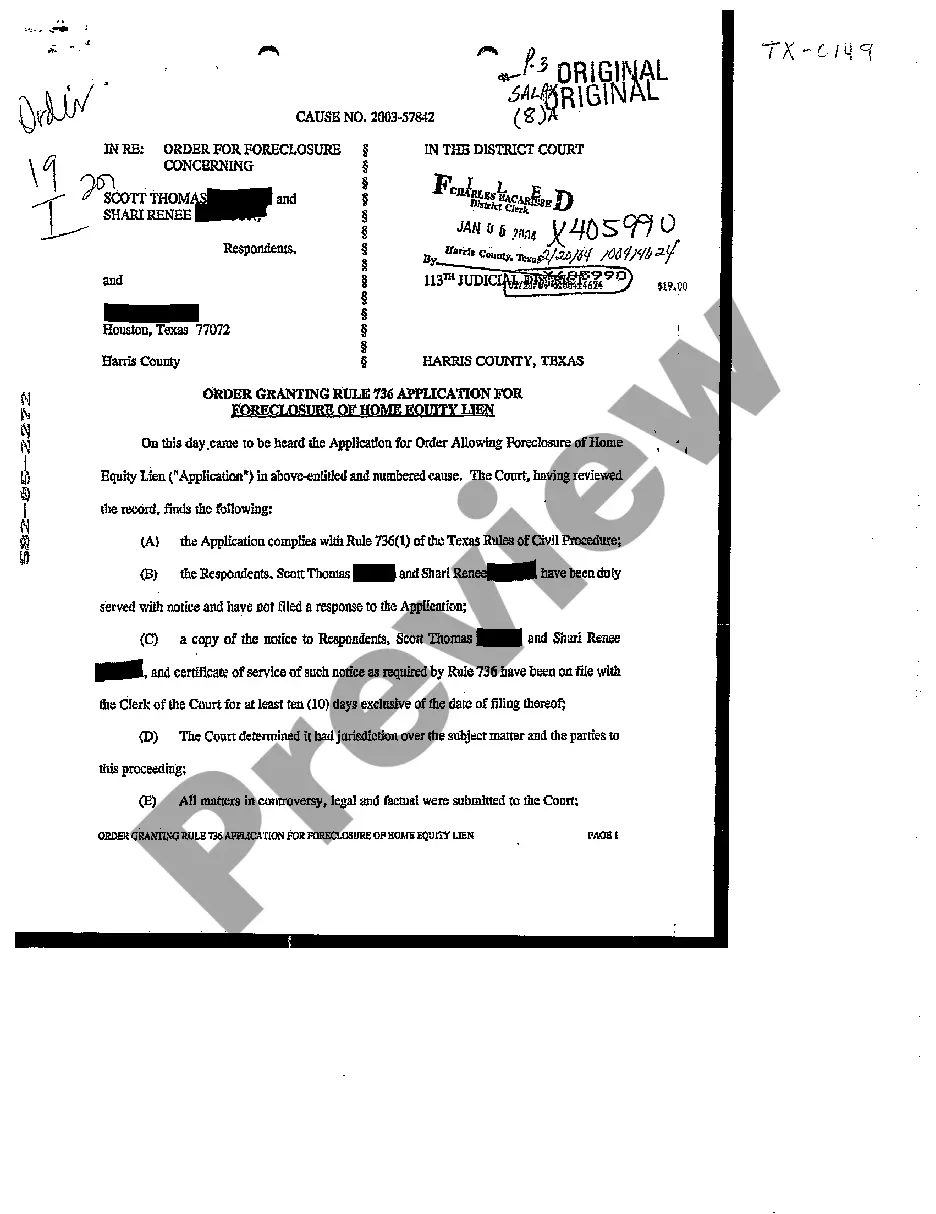

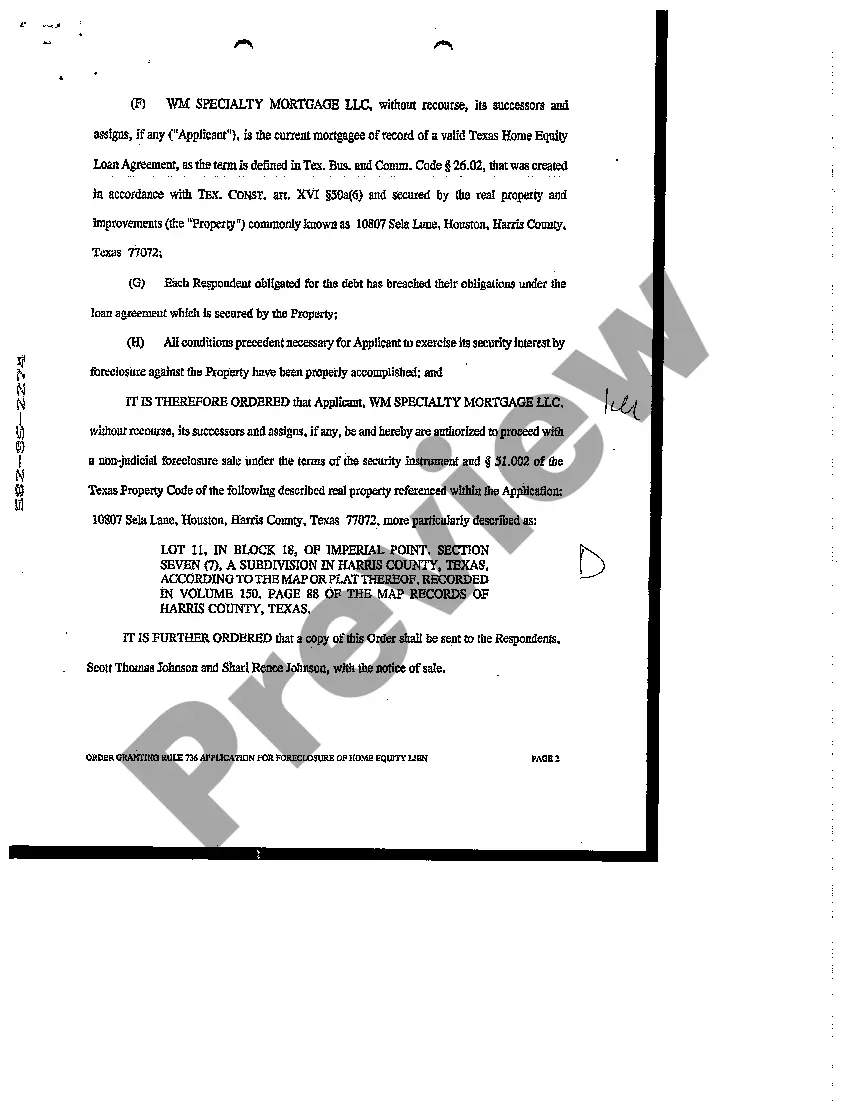

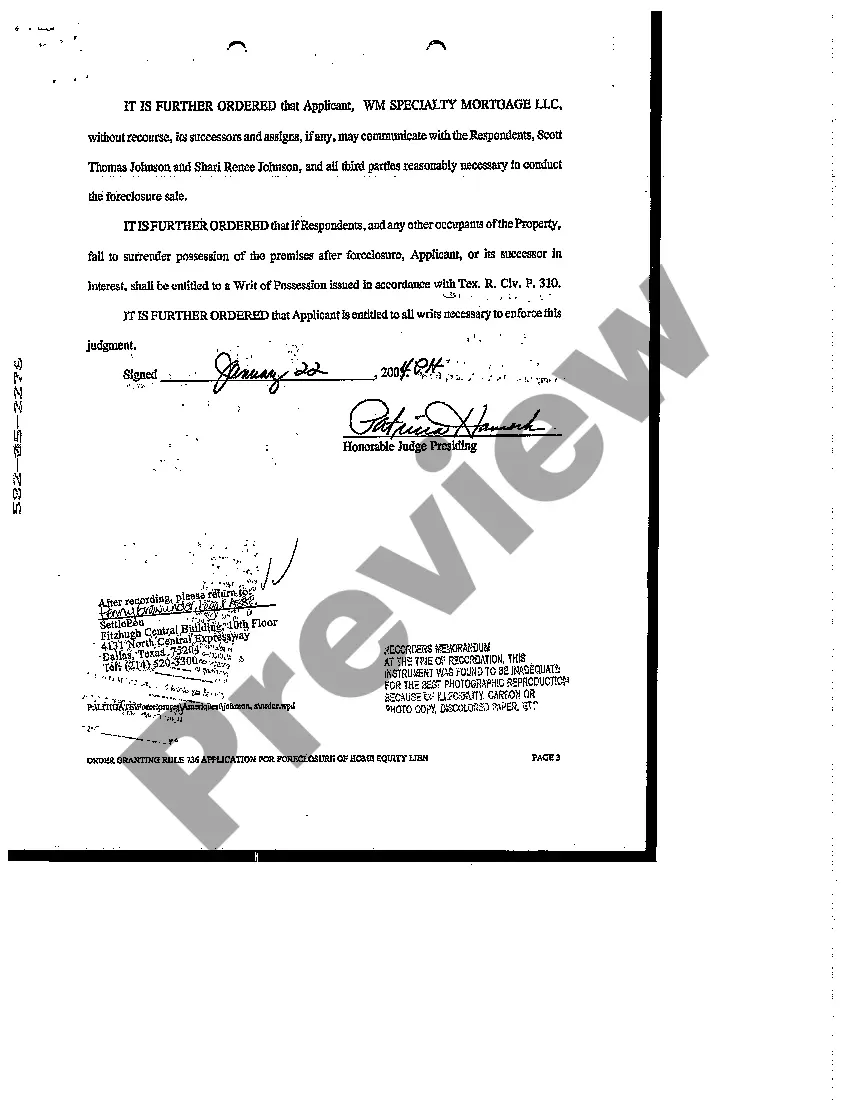

Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process that allows a lender to initiate foreclosure proceedings on a property in Collin County, Texas, when the homeowner defaults on their home equity loan. This order grants the lender permission to proceed with the foreclosure, subject to specific guidelines outlined in Rule 736 of the Texas Rules of Civil Procedure. Foreclosure of Home Equity Lien: Foreclosure is a legal process by which a lender enforces its rights to sell a property to recover the outstanding loan balance when the borrower defaults on their mortgage payments. In Collin, Texas, the foreclosure process for home equity loans follows specific protocols stipulated by Rule 736. Texas Rules of Civil Procedure: The Texas Rules of Civil Procedure govern the procedures and conduct of civil litigation in Texas courts. Rule 736 is a specific provision within these rules that pertains to the foreclosure of home equity liens. It outlines the requirements and steps involved in the foreclosure process, ensuring fairness and protection of both the borrower's and lender's rights. Collin County, Texas: Collin County is a county located in North Texas, encompassing cities such as Plano, Frisco, McKinney, and Allen. As part of the greater Dallas-Fort Worth metropolitan area, Collin County is known for its vibrant economy, rapid growth, and thriving real estate market. Home Equity Lien: A home equity lien is a type of loan taken out against the value of a property. It allows homeowners to borrow against the equity they have built up in their homes. When borrowers default on their home equity loans, lenders can initiate foreclosure proceedings to recoup the outstanding debt. Different Types of Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien: 1. Judicial Foreclosure: In this type of foreclosure, the lender files a lawsuit against the homeowner to obtain a court order allowing them to foreclose on the property. The court oversees the entire process, ensuring compliance with the law and protecting the borrower's rights. 2. Non-Judicial Foreclosure: In certain circumstances, Texas law allows lenders to foreclose on a property without involving the court system. Non-judicial foreclosures typically involve a series of notices and auctions, as outlined in Rule 736, granting lenders the authority to proceed with the foreclosure. 3. Home Equity Line of Credit (HELOT) Foreclosure: This type of foreclosure specifically applies to home equity lines of credit. If a borrower defaults on their HELOT payments, the lender can initiate the foreclosure process, following the guidelines established under Rule 736, to recover the outstanding debt. In summary, Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien pertains to the legal process by which lenders in Collin County, Texas, can initiate foreclosure proceedings to recover the outstanding debt from homeowners who have defaulted on their home equity loans.

Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

Description

How to fill out Collin Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

Are you looking for a trustworthy and affordable legal forms supplier to get the Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien? US Legal Forms is your go-to option.

Whether you require a basic agreement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Collin Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien in any provided format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online for good.