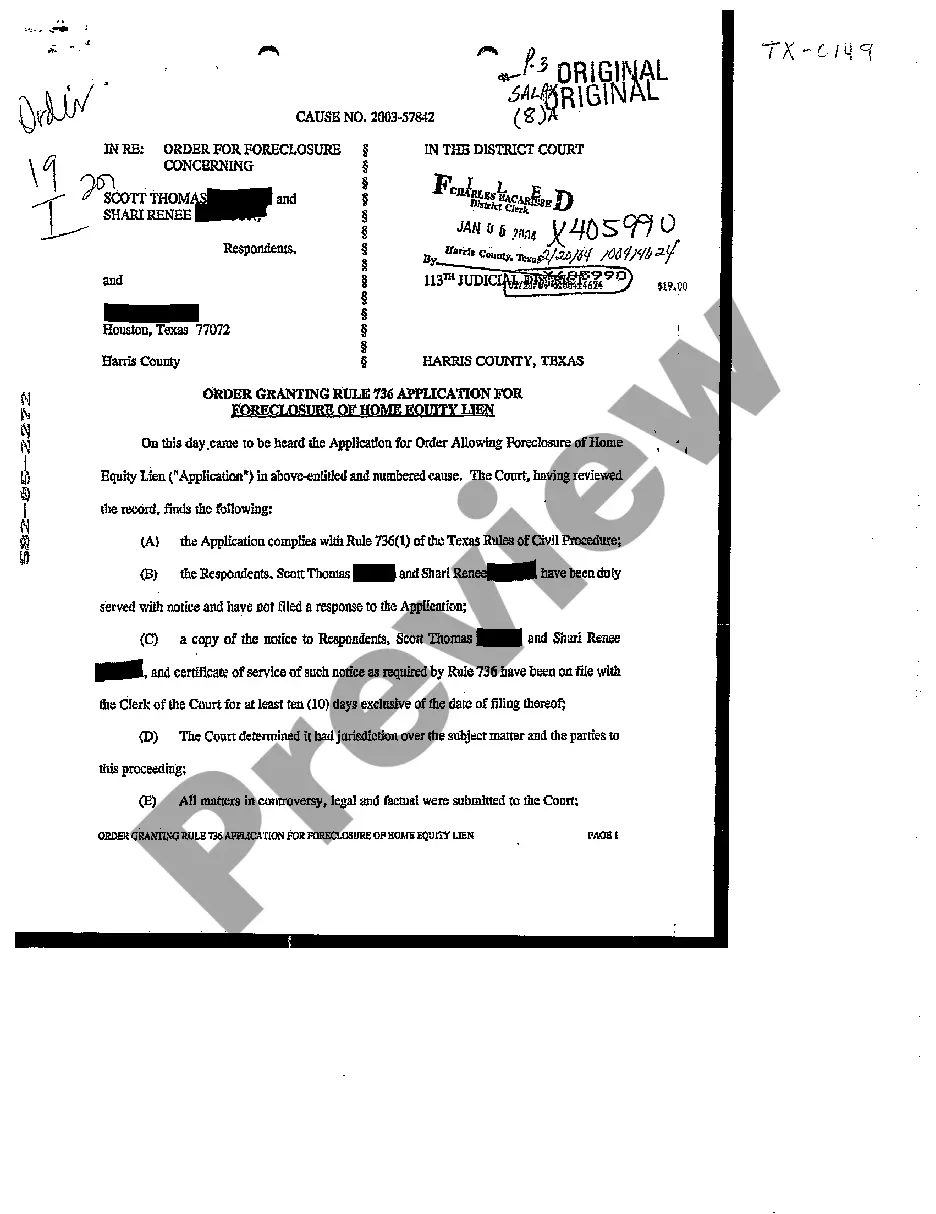

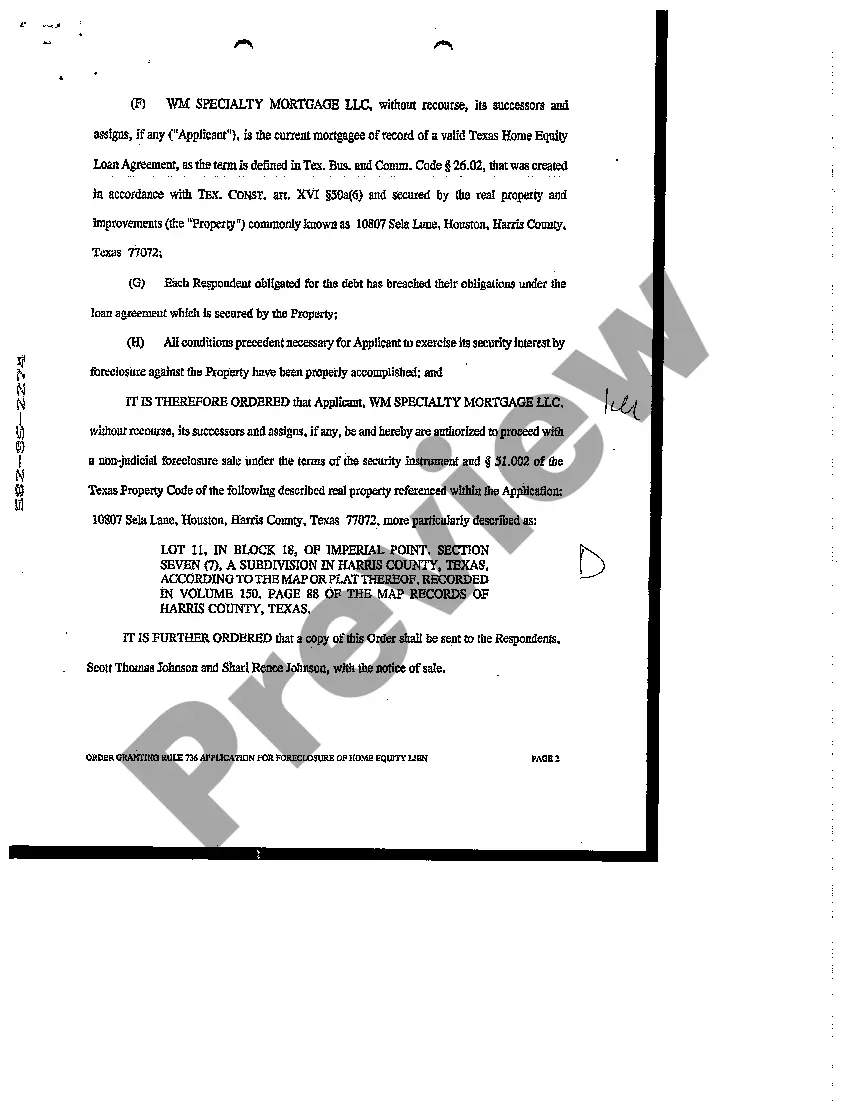

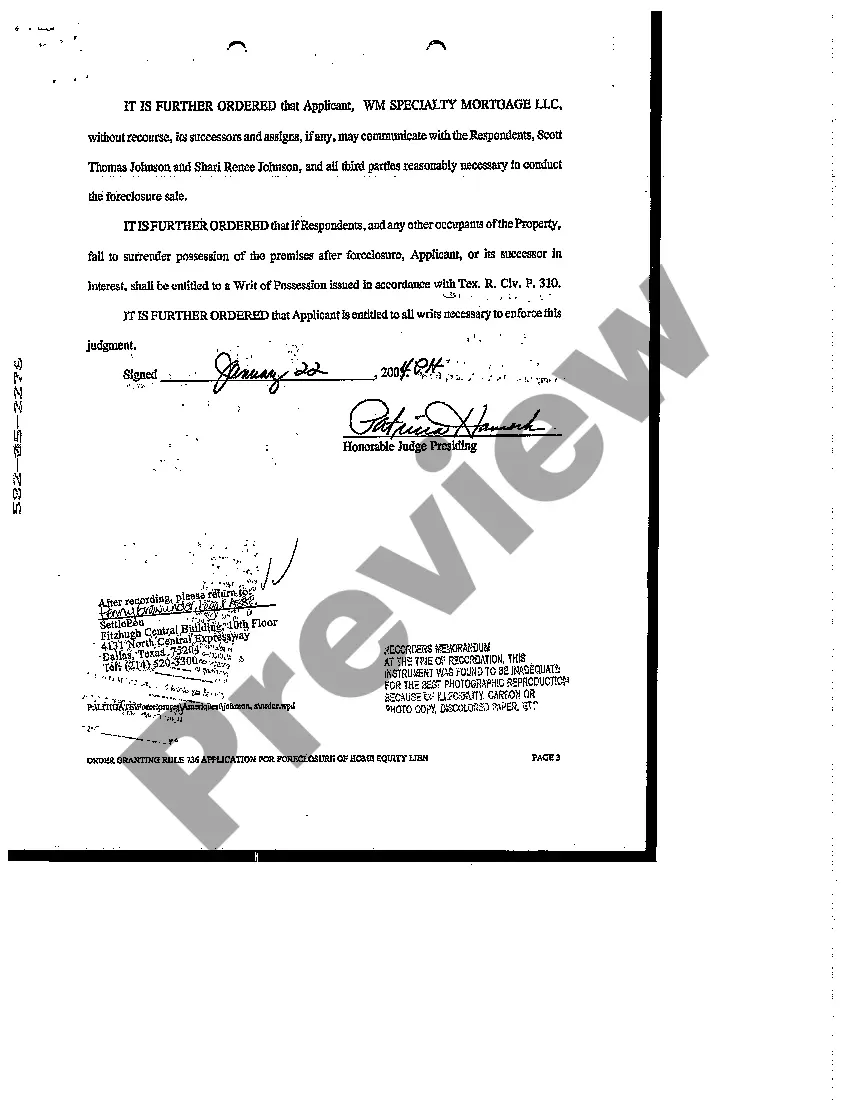

Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process in which a creditor seeks permission from the court to foreclose on a property that is subject to a home equity lien. This procedure is initiated when the borrower fails to meet their financial obligations, leading the lender to enforce their rights. In Harris County, Texas, there are different types of Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien. These can include: 1. Defaulted Home Equity Loan Foreclosure: This type involves the lender pursuing foreclosure on a property due to the borrower defaulting on their home equity loan payments. 2. Home Equity Line of Credit (HELOT) Foreclosure: In this case, the lender seeks to foreclose on a property when the borrower fails to meet the repayment terms and conditions of their home equity line of credit. 3. Second Mortgage Home Equity Foreclosure: When a homeowner has taken out a second mortgage using the equity in their property and subsequently defaults on their payments, the lender can file for foreclosure. 4. Judicial Foreclosure Process: While not explicitly related to a specific type of home equity lien, the judicial foreclosure process refers to cases where the foreclosure must go through the court system, allowing both parties the opportunity to present their arguments and evidence. It is essential to understand that each type of Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien follows a specific legal process and must comply with Texas state laws and regulations. The lender must file a formal application with the Harris County court, which provides detailed information about the borrower's default, the outstanding amounts owed, and the steps taken to try and resolve the situation before seeking foreclosure. The court carefully reviews the application and supporting evidence. If the court finds sufficient grounds for foreclosure and determines that the lender has followed all required procedures, they may grant the Order, allowing the lender to proceed with the foreclosure process. Overall, Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal mechanism that ensures lenders have a fair opportunity to recover overdue debts related to home equity loans or lines of credit. It is crucial for both borrowers and lenders to understand the specific rules and regulations governing foreclosure proceedings in Harris County, Texas.

Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process in which a creditor seeks permission from the court to foreclose on a property that is subject to a home equity lien. This procedure is initiated when the borrower fails to meet their financial obligations, leading the lender to enforce their rights. In Harris County, Texas, there are different types of Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien. These can include: 1. Defaulted Home Equity Loan Foreclosure: This type involves the lender pursuing foreclosure on a property due to the borrower defaulting on their home equity loan payments. 2. Home Equity Line of Credit (HELOT) Foreclosure: In this case, the lender seeks to foreclose on a property when the borrower fails to meet the repayment terms and conditions of their home equity line of credit. 3. Second Mortgage Home Equity Foreclosure: When a homeowner has taken out a second mortgage using the equity in their property and subsequently defaults on their payments, the lender can file for foreclosure. 4. Judicial Foreclosure Process: While not explicitly related to a specific type of home equity lien, the judicial foreclosure process refers to cases where the foreclosure must go through the court system, allowing both parties the opportunity to present their arguments and evidence. It is essential to understand that each type of Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien follows a specific legal process and must comply with Texas state laws and regulations. The lender must file a formal application with the Harris County court, which provides detailed information about the borrower's default, the outstanding amounts owed, and the steps taken to try and resolve the situation before seeking foreclosure. The court carefully reviews the application and supporting evidence. If the court finds sufficient grounds for foreclosure and determines that the lender has followed all required procedures, they may grant the Order, allowing the lender to proceed with the foreclosure process. Overall, Harris Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal mechanism that ensures lenders have a fair opportunity to recover overdue debts related to home equity loans or lines of credit. It is crucial for both borrowers and lenders to understand the specific rules and regulations governing foreclosure proceedings in Harris County, Texas.