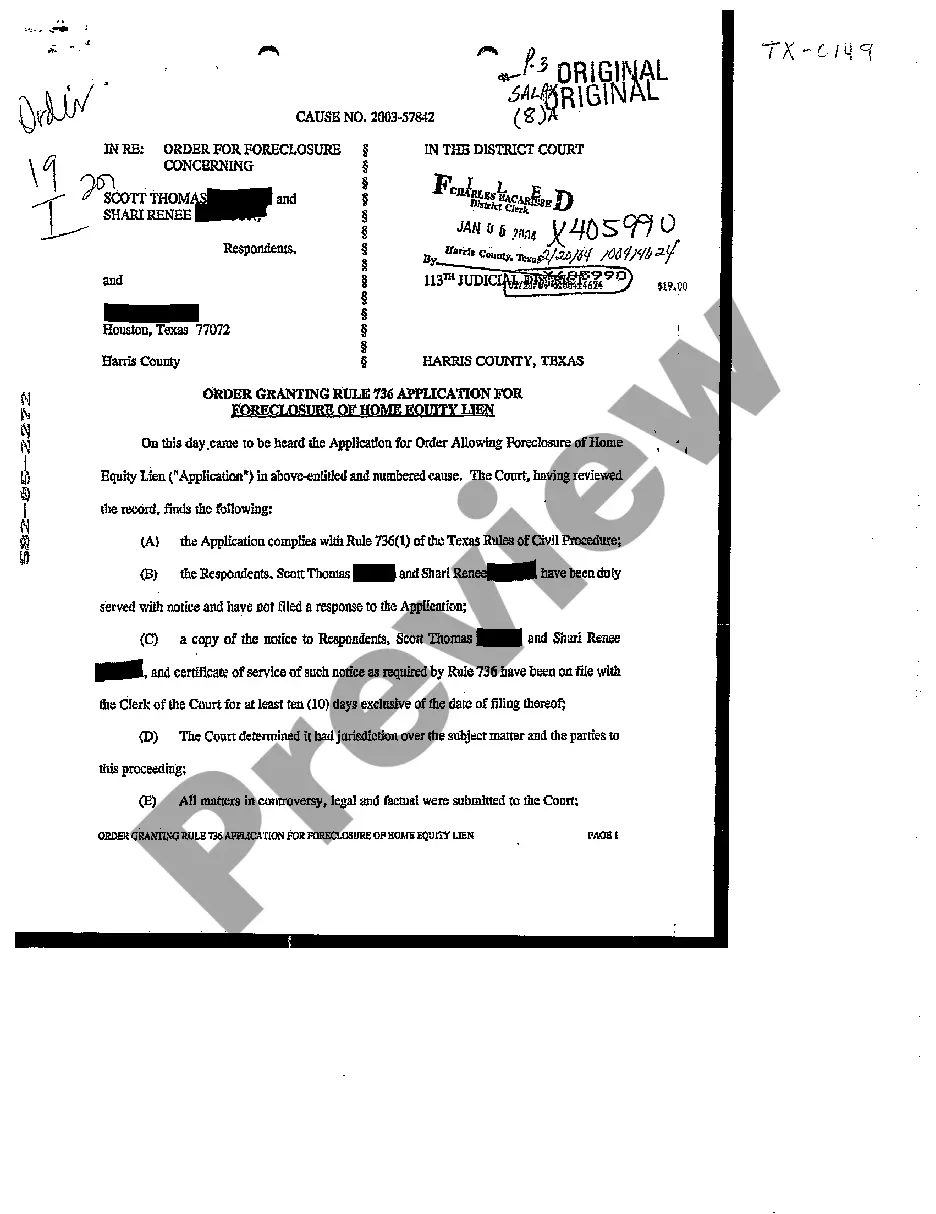

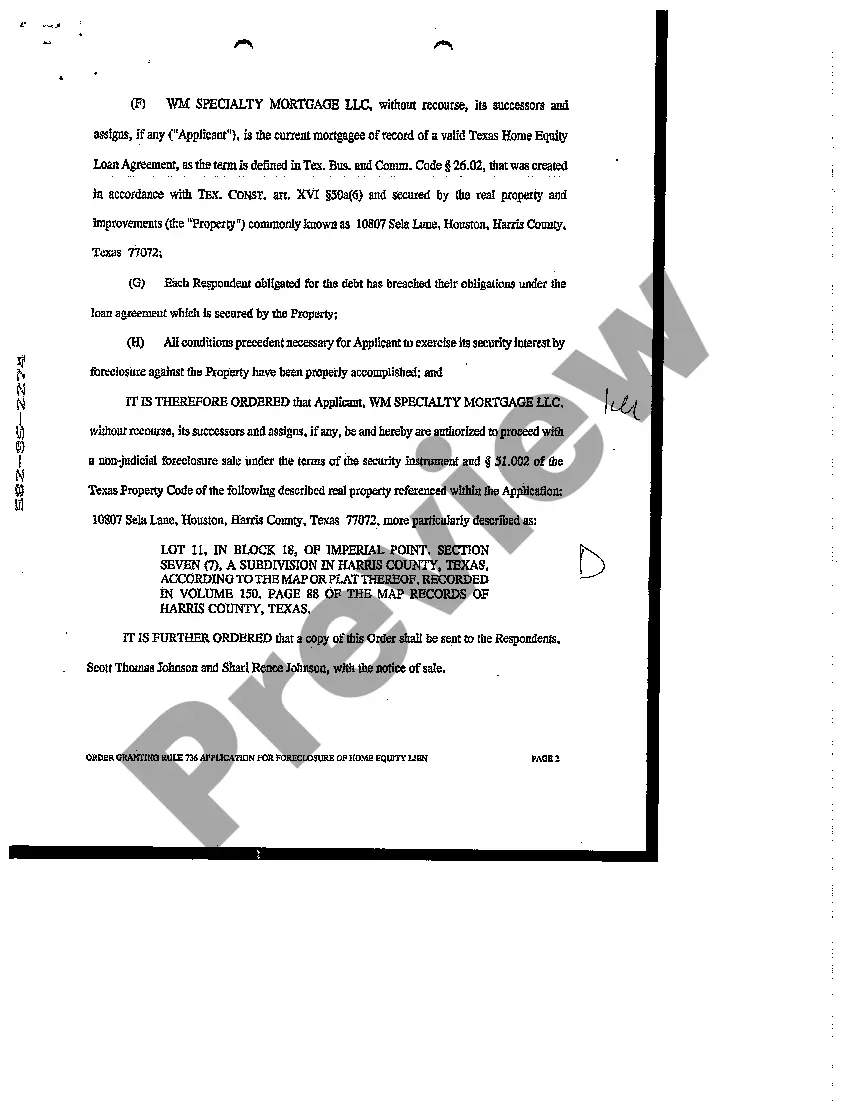

McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process that allows a lender to seek foreclosure on a property in McAllen, Texas when the borrower has defaulted on their home equity loan. This article aims to provide a detailed description of this process, explaining its purpose, procedure, and potential consequences. In McAllen, Texas, when a homeowner fails to make timely payments on their home equity loan, the lender may choose to initiate foreclosure proceedings. To do so, the lender files an application for foreclosure of the home equity lien under Rule 736 of the Texas Rules of Civil Procedure. This rule outlines the requirements and steps involved in obtaining an order from the court to foreclose on the property. The purpose of the McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is to provide a legal mechanism for lenders to recover their loaned funds by selling the property in question. By obtaining a court order, the lender establishes their right to foreclose and conduct a public sale of the property. The application process starts with the lender filing a petition with the court, stating the reasons for seeking foreclosure and providing evidence of the borrower's default on the home equity loan. The court reviews the application, ensuring it complies with all legal requirements and that the borrower has been properly notified of the proceedings. Once the court determines the application is valid, it may grant the order allowing the lender to proceed with foreclosure. Different types of McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien may include variations in the circumstances leading to default, such as non-payment of monthly installments, failure to maintain required insurance coverage, or breaching terms and conditions specified in the home equity loan agreement. However, the overall process and purpose of seeking foreclosure remain the same. It is important for homeowners in McAllen, Texas to be aware of the potential consequences of a Rule 736 foreclosure. If the lender successfully completes the foreclosure process, the property will be sold at a public auction. If the auction fails to cover the outstanding loan amount, the borrower may still be held responsible for the remaining debt. Additionally, a foreclosure can harm an individual's credit score and make it challenging to secure future loans or mortgages. In conclusion, the McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal procedure that enables lenders to seek foreclosure when a homeowner defaults on their home equity loan. This process involves filing an application with the court, meeting specific legal requirements, and obtaining a court order to proceed with the foreclosure. Homeowners facing the possibility of foreclosure should seek legal advice and explore potential alternatives to protect their rights and financial well-being.

McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

State:

Texas

City:

McAllen

Control #:

TX-C149

Format:

PDF

Instant download

This form is available by subscription

Description

Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process that allows a lender to seek foreclosure on a property in McAllen, Texas when the borrower has defaulted on their home equity loan. This article aims to provide a detailed description of this process, explaining its purpose, procedure, and potential consequences. In McAllen, Texas, when a homeowner fails to make timely payments on their home equity loan, the lender may choose to initiate foreclosure proceedings. To do so, the lender files an application for foreclosure of the home equity lien under Rule 736 of the Texas Rules of Civil Procedure. This rule outlines the requirements and steps involved in obtaining an order from the court to foreclose on the property. The purpose of the McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is to provide a legal mechanism for lenders to recover their loaned funds by selling the property in question. By obtaining a court order, the lender establishes their right to foreclose and conduct a public sale of the property. The application process starts with the lender filing a petition with the court, stating the reasons for seeking foreclosure and providing evidence of the borrower's default on the home equity loan. The court reviews the application, ensuring it complies with all legal requirements and that the borrower has been properly notified of the proceedings. Once the court determines the application is valid, it may grant the order allowing the lender to proceed with foreclosure. Different types of McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien may include variations in the circumstances leading to default, such as non-payment of monthly installments, failure to maintain required insurance coverage, or breaching terms and conditions specified in the home equity loan agreement. However, the overall process and purpose of seeking foreclosure remain the same. It is important for homeowners in McAllen, Texas to be aware of the potential consequences of a Rule 736 foreclosure. If the lender successfully completes the foreclosure process, the property will be sold at a public auction. If the auction fails to cover the outstanding loan amount, the borrower may still be held responsible for the remaining debt. Additionally, a foreclosure can harm an individual's credit score and make it challenging to secure future loans or mortgages. In conclusion, the McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal procedure that enables lenders to seek foreclosure when a homeowner defaults on their home equity loan. This process involves filing an application with the court, meeting specific legal requirements, and obtaining a court order to proceed with the foreclosure. Homeowners facing the possibility of foreclosure should seek legal advice and explore potential alternatives to protect their rights and financial well-being.

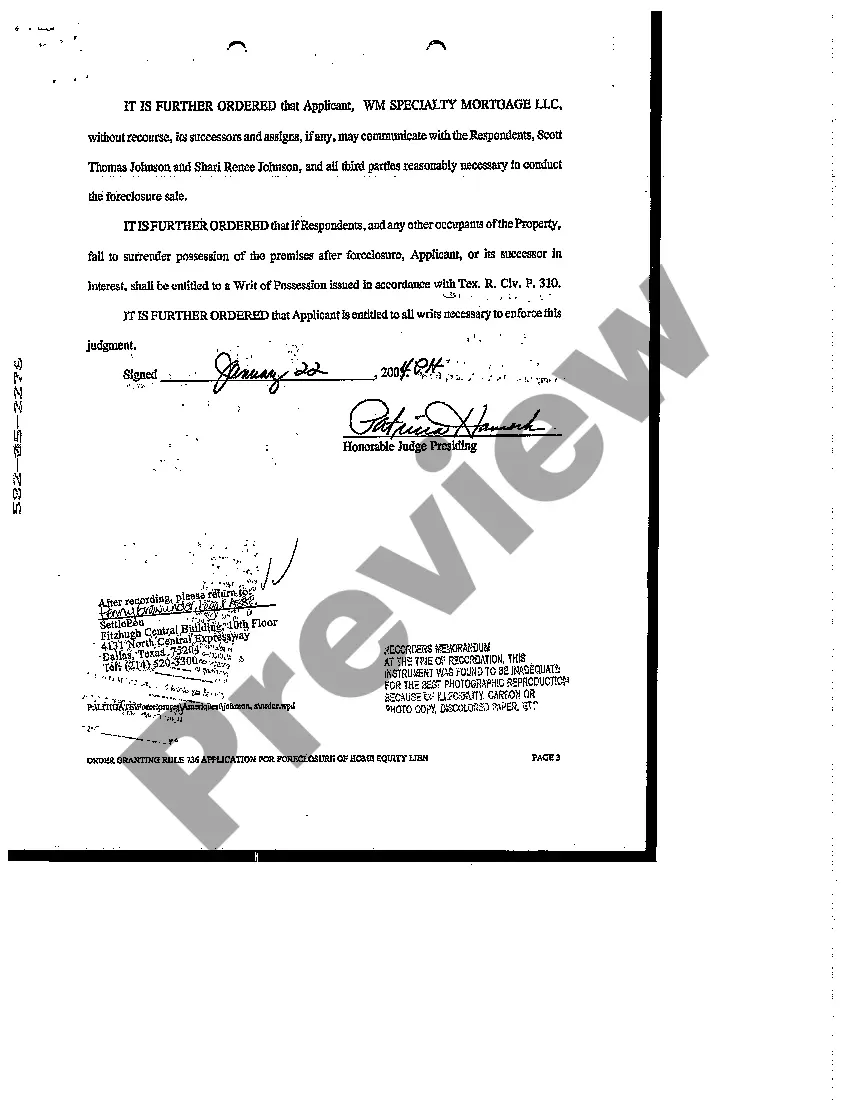

Free preview

How to fill out McAllen Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

If you’ve already utilized our service before, log in to your account and download the McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your McAllen Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!