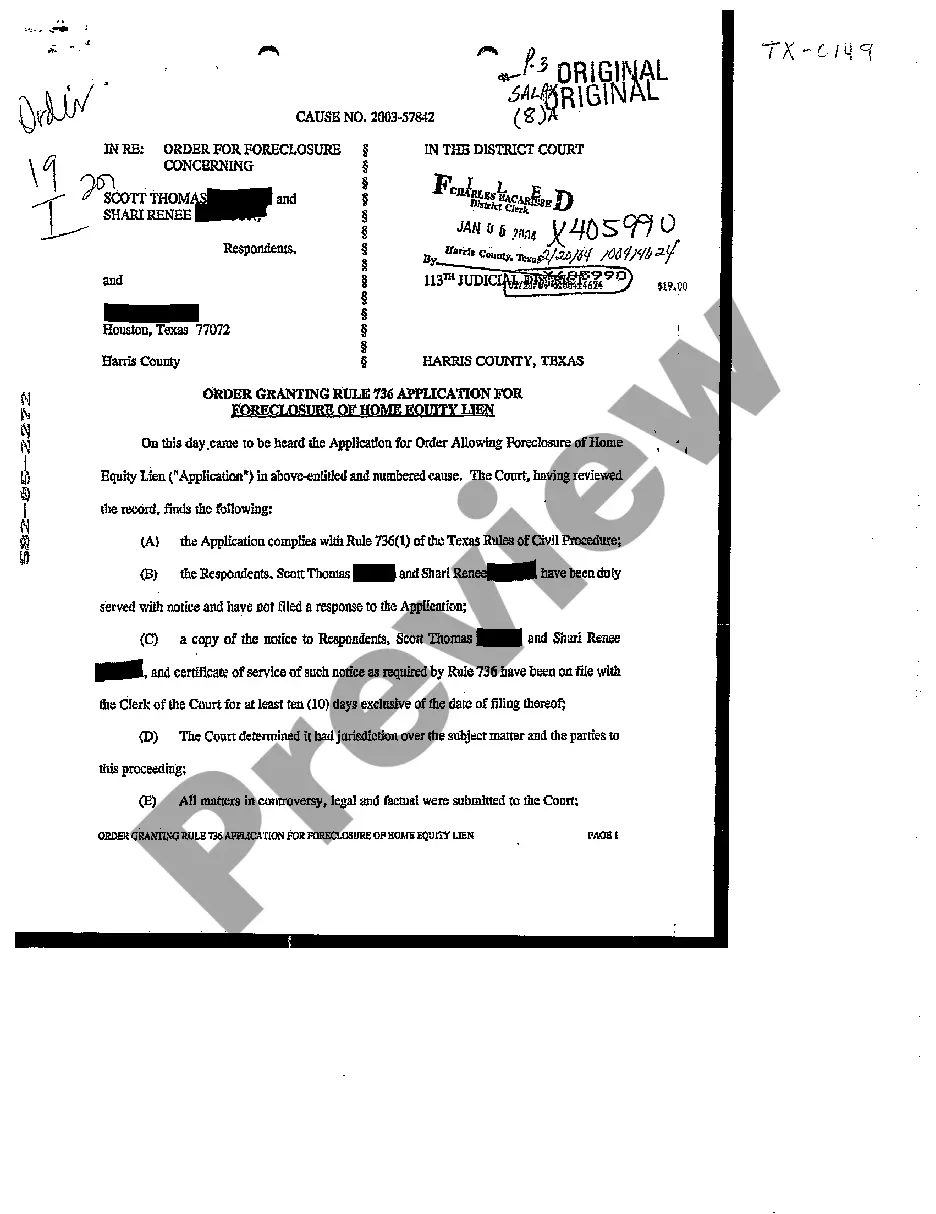

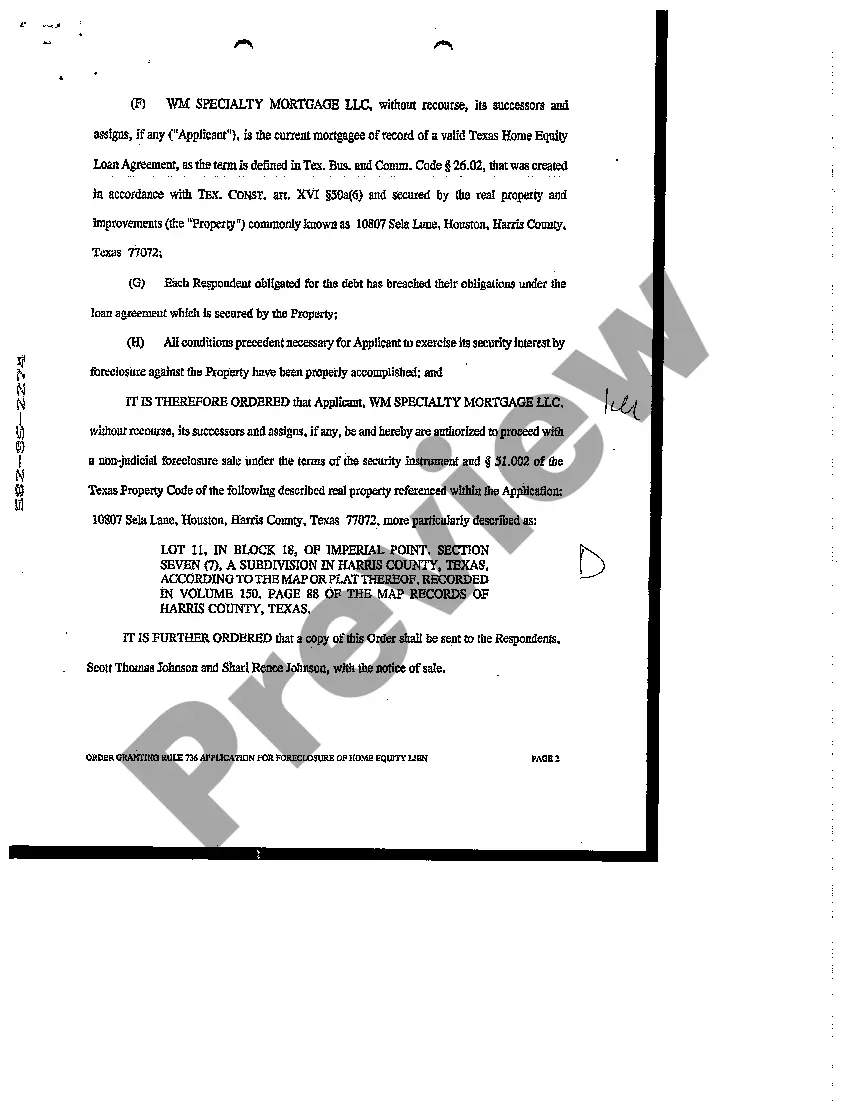

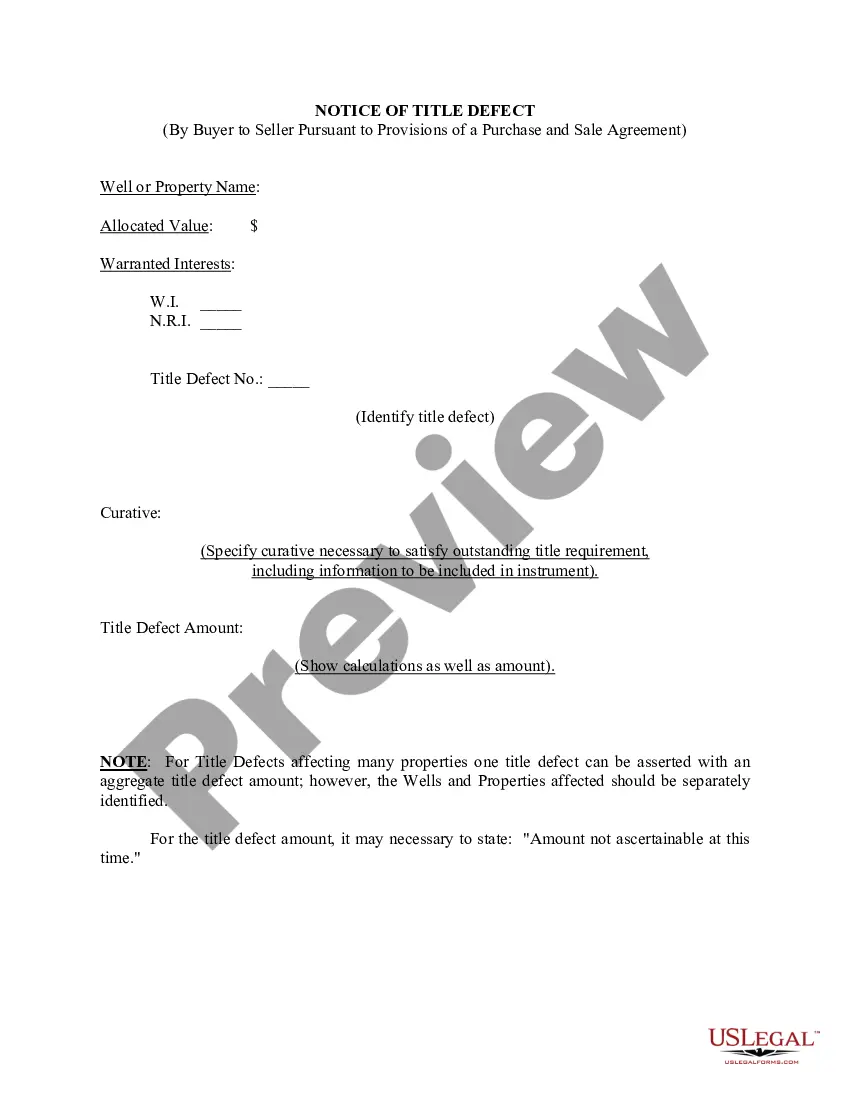

Title: Understanding the McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien Keywords: McKinney Texas, Rule 736, application, foreclosure, home equity lien Introduction: The McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien allows lenders to initiate foreclosure proceedings on properties in McKinney, Texas, where a borrower has defaulted on their home equity lien. This legal process grants lenders the right to foreclose on the property and sell it to recover the outstanding debt. Let's explore the key aspects of this application and its different types. 1. What is Rule 736? Rule 736, governed by the Texas Rules of Civil Procedures, sets forth the specific guidelines and procedures for the foreclosure of a home equity lien. It ensures a fair and transparent process for both lenders and homeowners in McKinney, Texas. 2. Understanding the Application Process: To start the foreclosure process, lenders must file an application under Rule 736 with the respective court in McKinney, Texas. This application contains pertinent details, such as the borrower's name, property address, loan information, default amount, and other necessary documentation. 3. Grounds for Foreclosure: The application for foreclosure of a home equity lien is typically based on the borrower's failure to make timely payments, violating the terms of the loan agreement, or defaulting on the home equity lending agreement. Lenders must provide sufficient evidence to support their claim and establish the homeowner's liability. 4. Different Types of Rule 736 Applications: a) Standard Rule 736 Application: This type of application applies to regular foreclosure proceedings when a borrower defaults on their home equity loan and lenders seek to recover the outstanding debt through the sale of the property. b) Acceleration of Debt Application: In some cases, lenders may choose to accelerate the outstanding debt, meaning they demand the entire loan balance in one lump sum. This application is filed when the borrower fails to repay the accelerated amount within the stipulated time frame. c) Dismissal of Foreclosure Application: Sometimes, homeowners in McKinney, Texas can dispute the foreclosure application based on specific grounds, such as errors in the application or irregularities in the foreclosure process. This application is filed to request the court to dismiss the foreclosure proceedings. Conclusion: The McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien enables lenders to protect their interests when borrowers default on their home equity loans. It ensures a lawful and well-regulated process that respects the rights of both parties involved. By understanding the different types of Rule 736 applications, homeowners and lenders in McKinney, Texas can navigate the foreclosure process more effectively.

McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

Description

How to fill out McKinney Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

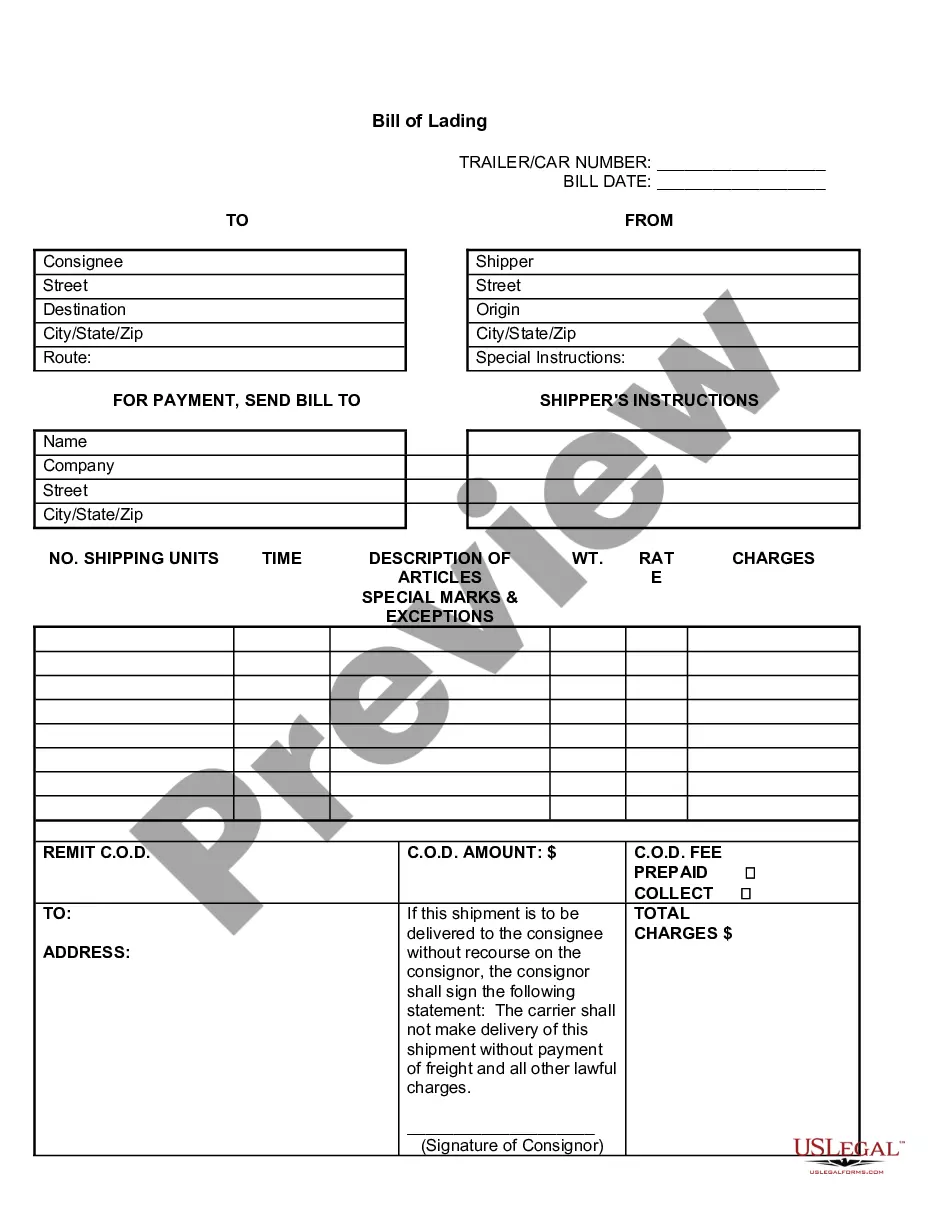

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

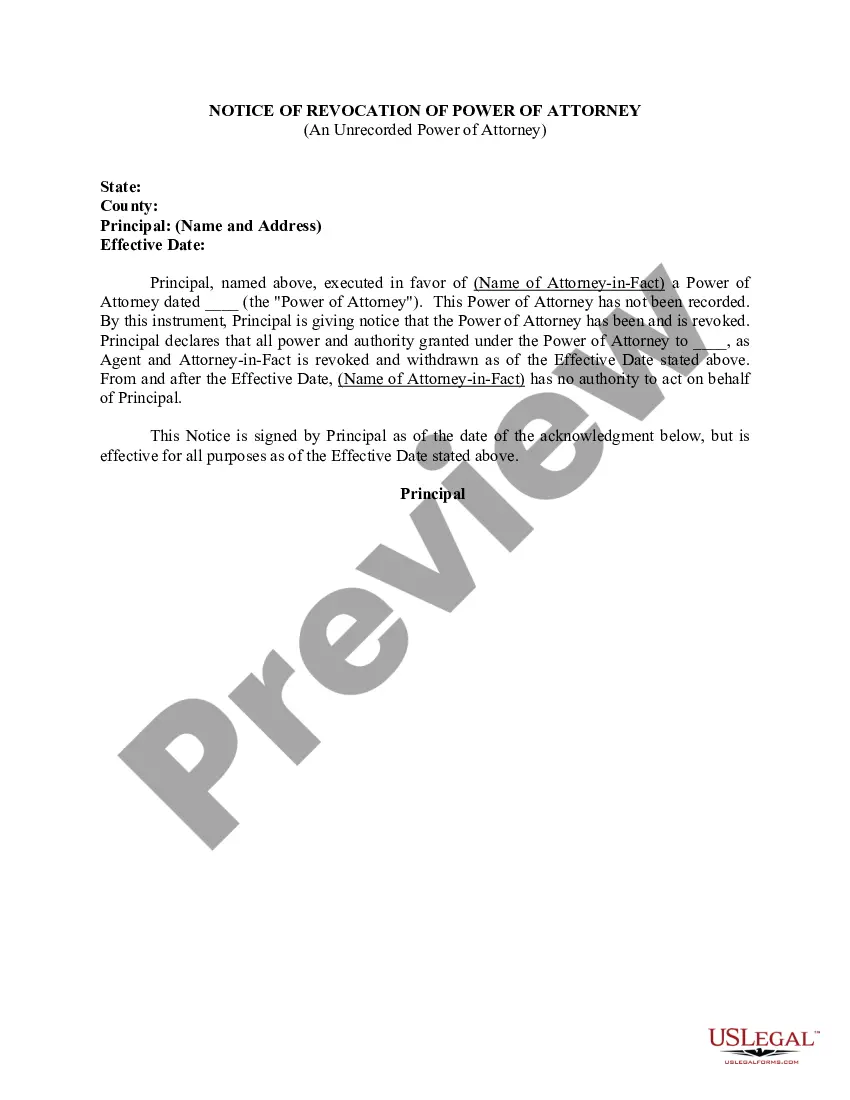

US Legal Forms is an online collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the McKinney Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!