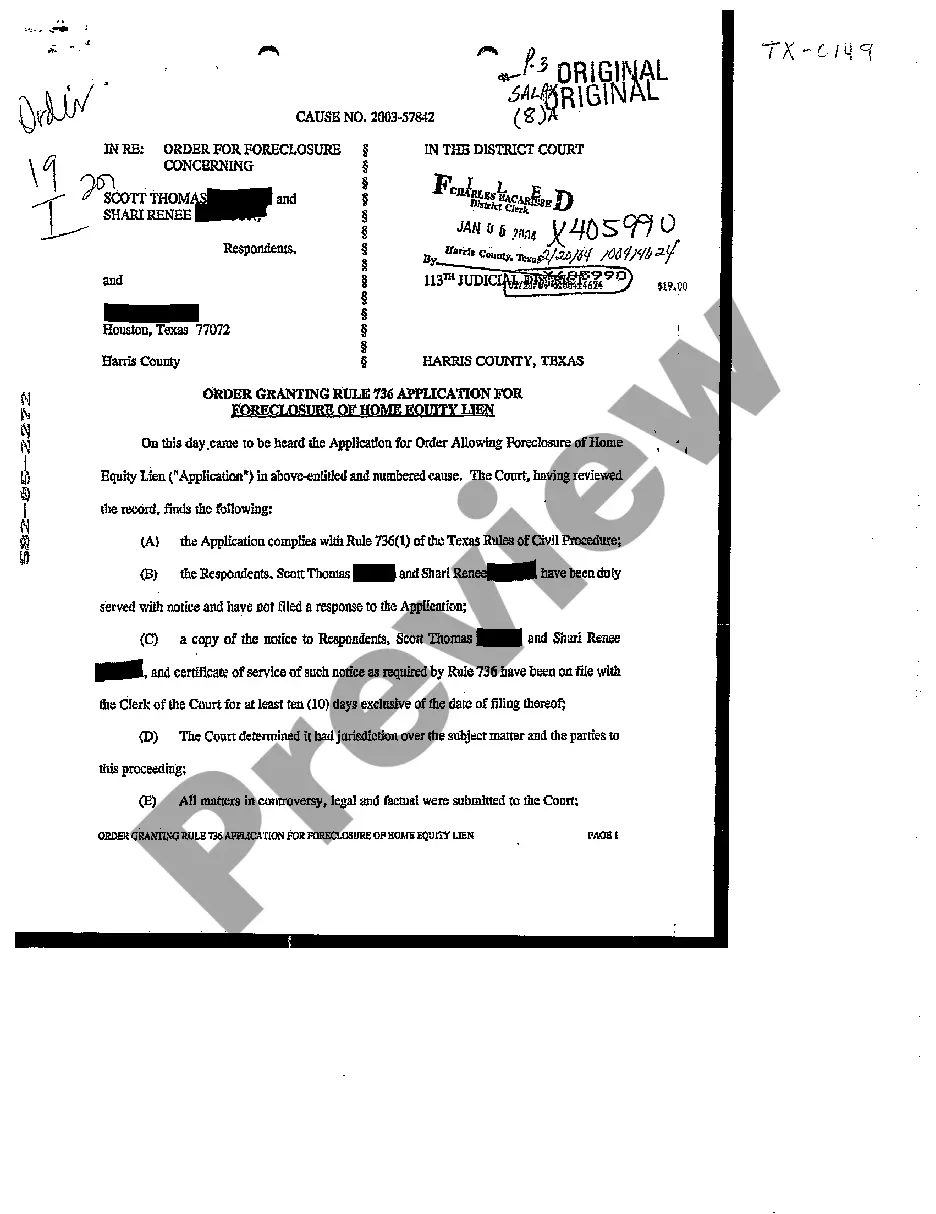

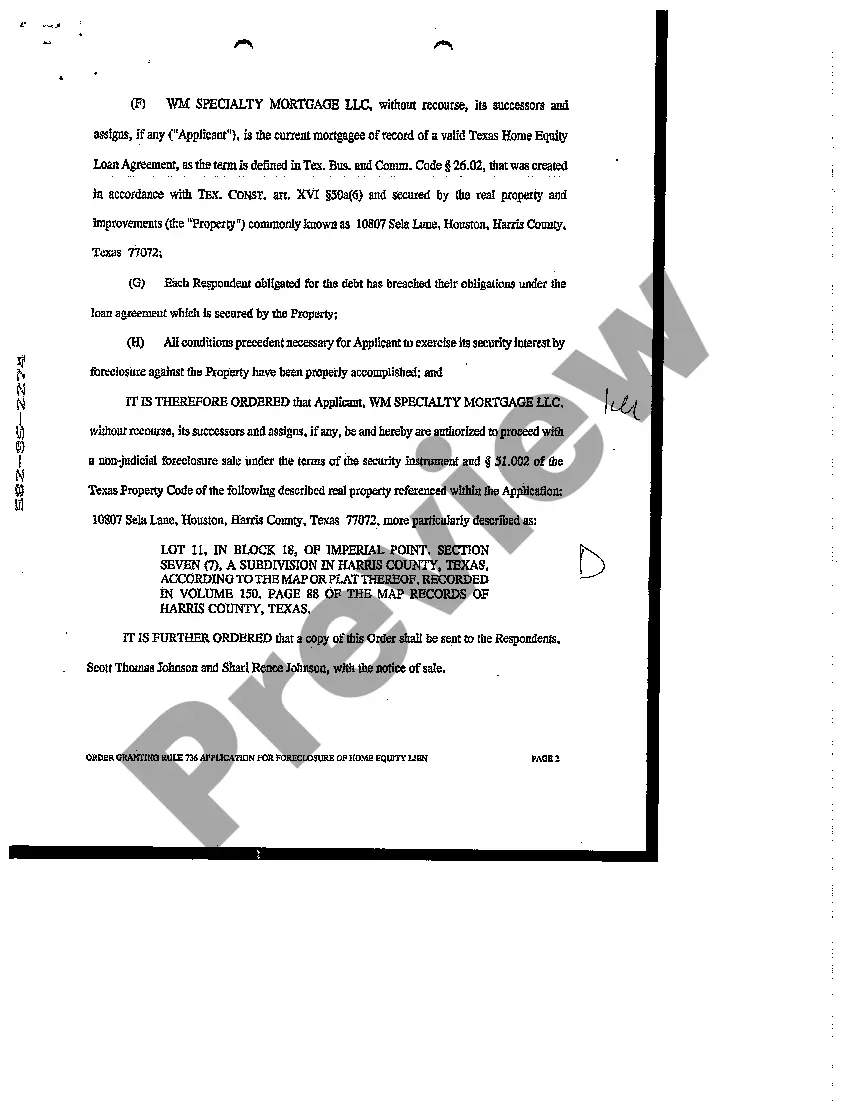

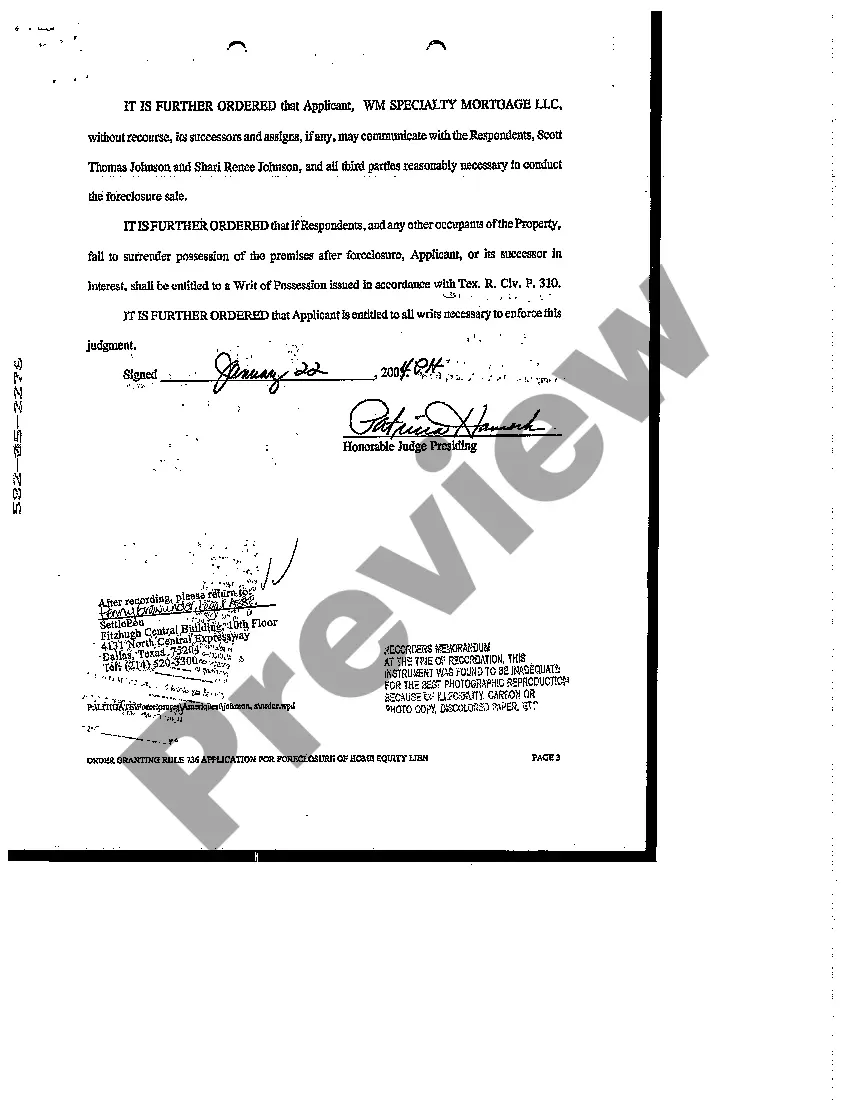

Title: Understanding Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien Keywords: Tarrant Texas, Order Granting Rule 736, Foreclosure, Home Equity Lien Introduction: In Tarrant Texas, an Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process that allows a lender to foreclose on a property when the borrower fails to repay their home equity loan in accordance with the terms and conditions. This detailed description will explore the intricacies of this process, outlining its purpose, requirements, and potential implications. Types of Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien: 1. Residential Property Foreclosure: A Rule 736 Application for Foreclosure of Home Equity Lien can be filed by a lender against a residential property owner who has defaulted on their home equity loan payments. This type of foreclosure aims to recover the outstanding debt by selling the property. 2. Commercial Property Foreclosure: Similar to residential properties, lenders also have the right to file a Rule 736 Application for Foreclosure of Home Equity Lien against commercial property owners who have failed to meet their home equity loan obligations. The lender seeks to sell the commercial property to recoup the unpaid loan amount. Requirements for Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien: 1. Default on Home Equity Loan: Before filing an application for foreclosure, the lender must establish that the borrower has defaulted on their home equity loan payments, violating the terms and conditions agreed upon in the loan agreement. 2. Written Notice Requirement: It is essential for the lender to have provided a written notice to the borrower, informing them of their default and giving them a specified time to cure the default. This notice must comply with the necessary legal requirements to ensure fairness in the process. 3. Court Approval: In Tarrant Texas, a Rule 736 Application for Foreclosure of Home Equity Lien must be granted by the court. The lender's application should include all relevant documentation and evidence, demonstrating the default and the legal basis for foreclosure. Implications of Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien: 1. Property Auction: If the court approves the foreclosure application, the property may be sold through a public auction to the highest bidder. The sale proceeds are then used to satisfy the debt owed by the borrower, including any associated legal costs. 2. Eviction: In the event of foreclosure, the borrower may face eviction from the property. This process typically occurs after the property is sold and ownership is transferred to the new buyer. Conclusion: A Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien enables lenders to initiate the foreclosure process when a borrower has defaulted on their home equity loan payments. Whether on residential or commercial properties, this legal process allows the lender to recover the outstanding debt by selling the property. It is crucial for borrowers to understand their obligations and seek legal advice if facing potential foreclosure.

Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien

Description

How to fill out Tarrant Texas Order Granting Rule 736 Application For Foreclosure Of Home Equity Lien?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person with no legal education to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a massive library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien in minutes employing our trusted service. In case you are already a subscriber, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are a novice to our platform, make sure to follow these steps prior to obtaining the Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien:

- Be sure the form you have chosen is specific to your location because the regulations of one state or area do not work for another state or area.

- Preview the form and go through a brief description (if provided) of scenarios the paper can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Select the payment gateway and proceed to download the Tarrant Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien once the payment is done.

You’re all set! Now you can go ahead and print the form or fill it out online. In case you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.